Want to curate the report according to your business needs

Report Description + Table of Content + Company Profiles

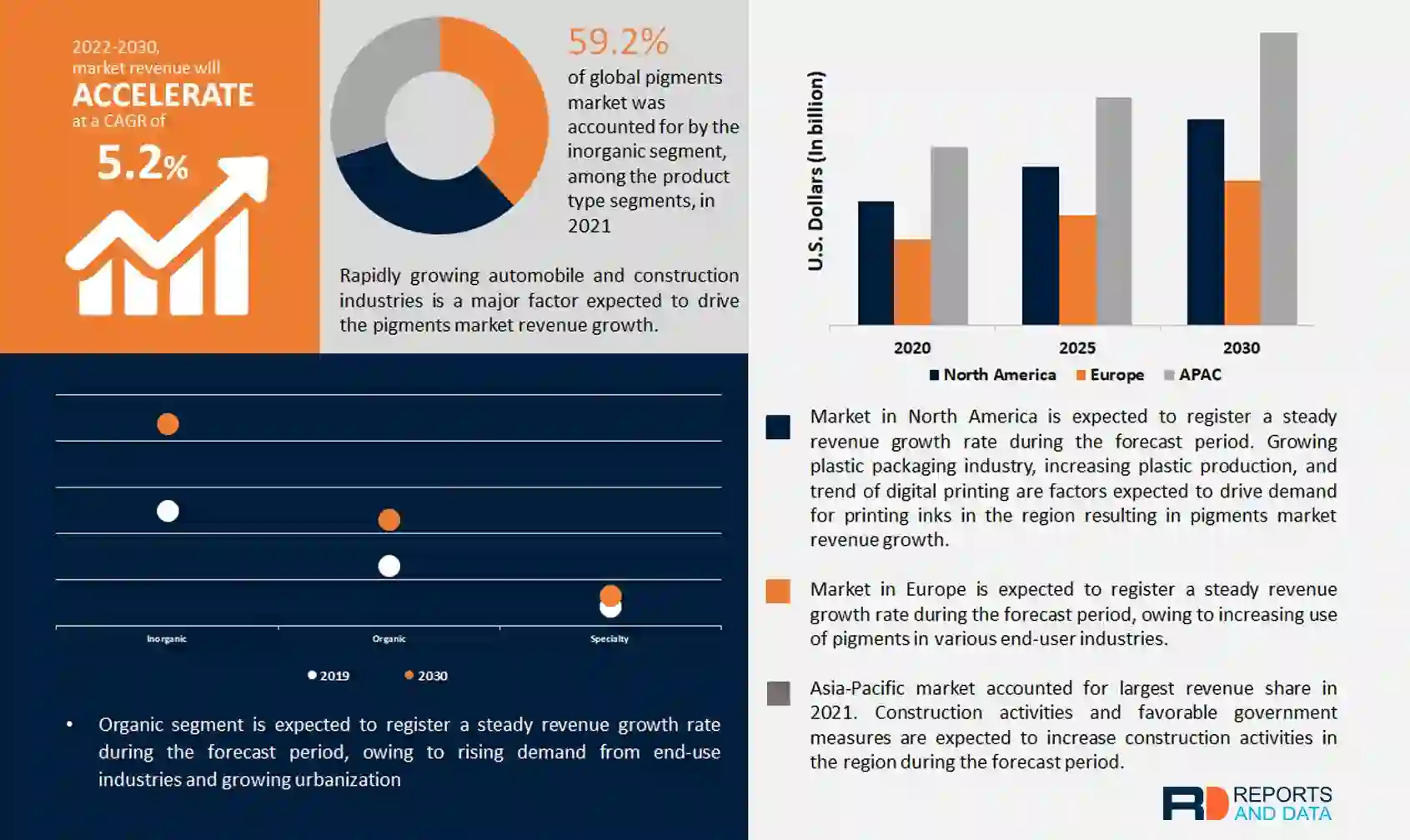

The global pigments market size was USD 23.13 Billion in 2021, and is expected to register a revenue CAGR of 5.2% during the forecast period. Growing automobile and construction industry is a major factor expected to drive the market revenue growth. In the construction industry, pigments are used to add lasting color to a number of building materials used in architecture and infrastructure projects. Architects and designers use colored Cement as a tool to incorporate an element of innovation, differentiation, and exclusivity into their projects. Therefore, continuous upturn in construction spending is driving expansion of the pigments market revenue share globally. According to a report by European Parliament on 17 February 2020, more than 40% of buildings in Europe are built before 1960 and 90% before 1990; consuming more amount of energy compared to the new ones. Hence, renovation activities of these buildings over the forecast years is expected to drive revenue growth of the market.

Moreover, in the automotive industry, pigments used as automobile paints and coatings are applied to interior as well as exterior of both the vehicles. There is a change in customer preference towards attractive textures followed by improved aesthetic appearances for vehicles. Therefore, increasing use of pigments in various automotive applications is expected to drive market revenue growth over the forecast period. According to the International Organization of Motor Vehicle Manufacturers, in the first nine months of 2021, global automotive manufacturing increased by about 10%, reaching 57.26 million vehicles, up from 52.15 million units in the same period of 2020. In the first half of 2021, car sales rose by about 29% over the same period in 2020, hitting 44.40 million units, hence driving the market revenue growth during the forecast period.

Growing concerns regarding pollution have increased efforts to use recyclable packaging. These paints are non-toxic and safe and are an obvious choice for consumers concerned with environment conservation and protection and therefore is expected to drive revenue growth of the market. Another factor driving the industry is increasing purchasing power of consumers and their changing lifestyles. Their interest in innovative and quality products is expected to drive the market revenue growth. With rapid urbanization, competition among the major players is also increasing. This has resulted in availability of a variety of products in the market, which is further expected to drive pigments market revenue growth during the forecast period. However, factors such as limited availability of raw materials and stringent government regulations are limiting the market revenue growth.

The market is expected to grow consistently over the forecast period attributed to the rising demand for beautiful designs in plastic packaging. Owing to enhanced rivalry, product uniqueness is becoming more important, resulting in a greater emphasis on aesthetics in plastic packaging. Furthermore, organic pigments are in high demand owing to rise in requirement to make items appealing to buyers. Organic pigments' strong coloring intensity allows for customized colors and a broad range of color hues, which helps to improve product appeal and aesthetics. Moreover, strict laws governing use of Printing Inks in food packaging are driving demand for environmentally safe organic pigments. Food packaging safety has become a global problem, and there is rising awareness among concerned communities regarding potential for package color to transfer into food. Organic pigments of good grade are color and viscosity stable. During the forecast period, rising demand for Food and Drug Administration (FDA)-approved pigments such as yellow, green, and other Colorants is expected to drive the market revenue growth. The Food, Drug, and Cosmetic (FD&C) Act, initiated by FDA, limits the use of non-certified color pigments in Medical Devices and surgical tools that are in contact with the human body for an extended period of time. Pigments listed under Title 21 of the Code of Federal Regulations (CFR) Parts 73 & 74; Subpart D are certified by the FDA as safe for use in such medical devices.

Producing organic pigments, particularly synthetic organic pigments, is costlier. Synthetic pigments require a lot of chemical processing, which raises the cost per unit. Emergence of high price end-products is stemming from rising raw material costs combined with rising costs involved with creating and shipping organic pigments. Furthermore, regulations laid down by governing bodies of various countries are expected to restrict revenue growth of pigments market during the forecast period. For instance, according to FDA on 2 March 2022, in regulatory requirements, organic color pigments are classified under Drug and Cosmetics Lake Colors (D&C Lake Colors), Food Drug and Cosmetics Lake Colors (FD&C Lake Colors), Non-D&C and FD&C Pigments, and EEC Lake Colors. Pigment manufacturers in India must abide by the FD&C color guidelines to create cosmetics color solutions for the U.S. market. EEC lake colors are prepared in accordance with the directive by the European Economic Community (EEC) for pigment colors used in cosmetics for the European markets. All these stringencies in regulations are restricting pigments market revenue growth.

The pigments market is expected to grow steadily during the next few years, owing to the expanding construction and automotive industries. Increased demand for organic pigments is expected to influence market revenue growth. Population increase, combined with rising per capita income, has driven paint and coatings demand in the building and construction, automotive, and consumer goods industries. As a result, there is increased demand for pigments in the paint and coatings industry. However, reduced demand and productivity are affecting pigments market revenue in the present COVID-19 situation. The main obstacles include combination of shutdown's effects on distribution of fixed costs, labor constraints, especially contract workers, working capital issues, and ultimately, a drop in local and export demand. Pigment manufacturing is a somewhat labor-intensive business, particularly in India, and labor scarcity has hampered the use of human workers. Pigments are often utilized in automotive paint applications.

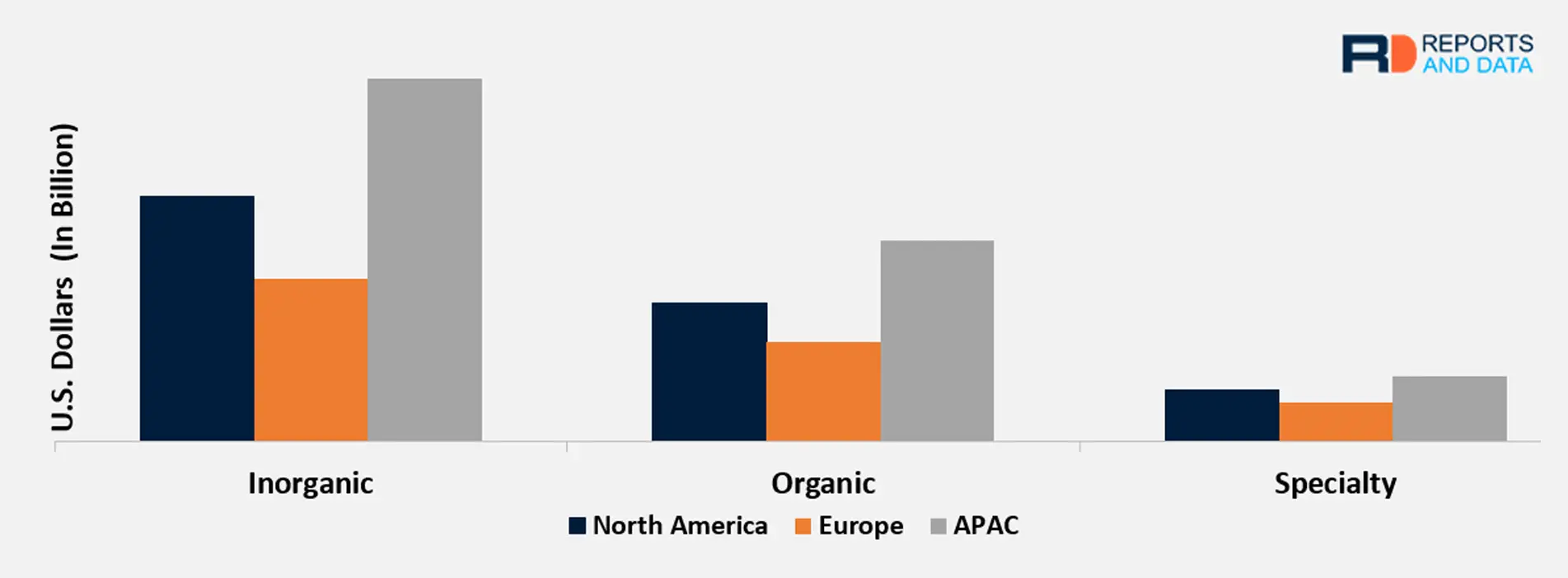

Based on product type, the pigments market is segmented into inorganic, organic, and specialty. Inorganic segment accounted for the largest revenue share in 2021, owing to its composition and low cost. Inorganic pigments are usually opaque and more insoluble than organic pigments owing to their composition. Revenue growth of the segment in case of inorganic pigments can be attributed to rising involvement of inorganic pigments in multiple inorganic applications. Furthermore, there is a continuous rise in demand from construction, automotive, and plastic industries for inorganic pigmentations owing to properties such as high light scattering power, a high degree of hiding power, and good tinting strength, among others. In addition to it, market players are focusing on expansion of production capacity in order to cater to the inorganic pigments demand. For example, on 31 March 2021, LANXESS AG expanded its Colortherm yellow pigment range for heat-resistant high-performance Plastics. They are comprised of iron oxide and Zinc Oxide and are particularly intended for cost-effective coloring in the 220°C to 260°C temperature range.

The organic segment is expected to register a steady revenue growth rate during the forecast period. Increasing construction activities and rising infrastructure spending are expected to drive demand for paints & coatings, thereby driving the market revenue growth. Furthermore, rising demand for high-quality organic pigments in the packaging, automotive, and building & construction sectors is also expected to drive revenue growth in market during the forecast period. Additionally, the flourishing textile and automobile industry, especially in emerging economies such as India and China, is significantly driving revenue growth of the segment.

Based on application, the pigments market is segmented into Paints and Coatings, Printing Inks, textiles, Plastics, leather, construction materials, automotive sector, and others. Paints and coatings segment accounted for largest revenue share in 2021. The paint & coating industry uses specialty pigment to manufacture paint for application in different industries. Over the forecast period, various developments in the paints and coatings industry are expected to drive revenue growth of pigment market. For example, on 29 November 2021, Asian Paints announced intentions to invest USD 127 million in its Gujarat factory in India in the next two to three years to increase paints manufacturing capacity from 130,000 kiloliters to 250,000 kilotons. PPG Industries Inc. invested USD 13 million in its paints and coatings unit in China on 13 May 2021. The capacity is expected to be increased by over 8,000 metric tons per year as a result of this development.

Automotive segment is expected to register a steady revenue growth rate during the forecast period. Automobile paints & coatings serve the purpose of delivering a superior aesthetic appearance, protecting components, and underlying metal from harsh environmental conditions, avoiding corrosion, and improving durability. Apart from this, for automobile restoration, these coatings are employed in auto body shops and repair facilities. For example, in July 2021, DCL acquired Sun Chemical's Goose Creek, South Carolina, manufacturing facility. For the most demanding applications, such as automotive, Industrial Coatings, and customized plastics, it would give specialty pigment families the greatest performance, including high chromaticity, durability, heat stability, and transparency.

Based on regional analysis, pigments market in Asia-Pacific accounted for the largest revenue share in 2021. With availability of a cheap labor force, the textile industry in China and India is rapidly expanding, increasing demand for pigments. China has a 40% stake in the global textile market, followed by India, which has a 5% share. According to the Ministry of Sector and Information Technology (MIIT), China's textile industry increased rapidly in the first nine months of 2021, with earnings of USD 26.80 billion (about 171.1 billion yuan), a 31.7% rise year-on-year (YoY). Furthermore, the National Bureau of Statistics of China mentioned that about 7.9 million metric tons of Plastic items were produced in December 2021, compared to 7.3 million metric tons in November 2021. As a result of rising demand from various end-use sectors such as paint & coatings, textiles, and plastics, demand for pigment market revenue is expected to rise over the forecast period.

Market in North America is expected to register a steady revenue growth rate during the forecast period. The U.S. is considered a highly mature market for pigments. High demand in the region is owing to developing automotive and construction industry. Rise in production of plastics for packaging and growing trend of Digital printing are factors expected to drive pigment market revenue growth in the region. Ford Motors, General Motors, and Fiat Chrysler Automobiles are among the world's largest vehicle manufacturers in North America. During the forecast period, the regional market is expected to be driven by presence of these ‘big three’ firms in the region, as well as technological developments in the automobile industry. Furthermore, increased construction activity in North America is expected to drive pigment demand over the forecast period. According to the U.S. Census Bureau, total value of public construction in July 2019 was USD 324,055 million, an increase of almost 6% from last year.

Market in Europe is expected to register a moderate revenue growth rate during the forecast period. In the forecast period, the Europe pigments market is expected to be driven by increased demand for eco-friendly paints and coatings as a result of rising environmental awareness. Furthermore, the region's growing automotive OEM and refinish industries are expected to drive product demand for decorating paints and coatings. In addition, technological advancements in food processing, together with rising demand for functional foods, are expected to drive market expansion in Germany.

Competitive landscape of the global pigments market is fragmented with several key players operating on global and regional levels. Key players are engaged in product development and strategic alliances to expand their respective product portfolios and gain a robust footing in the global market. Some of the major companies included in the global market report are BASF SE, ECKART GMBH, Clariant AG, Ferro Corporation, DIC Corporation, Heubach GmbH, Trust Chem Co. Ltd., Toyocolor Co. Ltd., Colorfix, Huntsman International LLC, Kebotix, Inc., and Sudarshan Chemical Industries Ltd.

Initiatives taken by market players are driving revenue growth of the market, for instance:

On 03 January 2022, Clariant, which is a Swiss multinational specialty chemicals company completed the sale of its pigment business to Heubach group and SK capital partners in a deal valued at up to USD 951.27 million. Moreover, Clariant retained a 20% stake in the new company.

On 31 July 2021, DCL acquired Sun Chemical's Goose Creek, South Carolina, manufacturing facility. For the most demanding applications, such as automotive, industrial coatings, and customized plastics, it would give specialty pigment families the greatest performance, including high chromaticity, durability, heat stability, and transparency.

On 30 June 2021, DIC Corporation, which is a Japanese chemical company completed the acquisition of BASF’s global pigments business known as BASF Colors & Effects. DIC acquired BASF’s patents, technologies, manufacturing assets, supply chain, and customer service capabilities.

This report offers historical data and forecasts revenue growth at a global, regional, and country level, and provides analysis of the market trends in each of the sub-segments from 2019 to 2030. For this study, Reports and Data have segmented the pigments market based on product type, application, and region:

| PARAMETERS | DETAILS |

| The market size value in 2021 | USD 23.13 Billion |

| CAGR (2021 - 2030) | 5.2% |

| The Revenue forecast in 2030 |

USD 36.36 Billion |

| Base year for estimation | 2021 |

| Historical data | 2019-2020 |

| Forecast period | 2022-2030 |

| Quantitative units |

|

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | By Product Type Outlook, Application Outlook, Regional Outlook |

| By Product Type Outlook |

|

| By Application Outlook |

|

| Regional scope | North America; Europe; Asia Pacific; Latin America ; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; France; BENELUX; China; India; Japan; South Korea; Brazil; Saudi Arabia; UAE; Turkey |

| Key companies profiled | BASF SE, ECKART GMBH, Clariant AG, Ferro Corporation, DIC Corporation, Heubach GmbH, Trust Chem Co. Ltd., Toyocolor Co. Ltd., Colorfix, Huntsman International LLC, Kebotix, Inc., and Sudarshan Chemical Industries Ltd. |

| Customization scope | 10 hrs of free customization and expert consultation |

Facing issues finding the exact research to meet your business needs? Let us help you! One of our Research Executives will help you locate the research study that will answer your concerns. Speak to Analyst Request for Customization

Request a FREE Sample here to understand what more we have to offer over competition…

upto20% OFF

upto20% OFF

Want to curate the report according to your business needs

Report Description + Table of Content + Company Profiles