Frozen Food Market: Current Scenario and Forecast (2020-2026)

$3500 – $6860

Emphasis on Product Category (Ready to Eat, Ready to Drink, Ready to Cook), Product Type (Frozen Meat Products, Frozen Fish/Seafood, Frozen Ready Meals, Frozen Bakery Products, Frozen Pizza, Frozen Potato Products, Others), Distribution Channel (Hypermarkets/Supermarkets, Independent Retailers, Convenience Store, Others (Specialist Retailers, Online)) and Region/Country

Detailed Analysis of COVID-19 Impact on the Frozen Food Market

| Published: | Mar-2020 |

|---|---|

| Pages: | 154 |

| Table: | 66 |

| Figure: | 128 |

| Report ID: | UMCG20173 |

| Geography: |

Report Description

Global Frozen Food Market was valued at US$ 232.42 billion in 2019 and is anticipated to reach US$ 320.06 billion by 2026 displaying an elevated CAGR of 4.6% over the forecast period (2020-2026). Frozen Foods have increasingly become an integral part of daily diets among people. Busy lifestyles and increasing working population have driven the food manufacturing industry to produce new products in the form of frozen foods to meet the surging demand for ready to eat food items. Rising demand for convenience and Ready-to-Eat (RTE) food products is a major growth driving factor for the global frozen foods market. The longer shelf life of frozen foods without decay is also boosting its demand across the globe. In addition, the easy availability of these foods in different types has also catalyzed the demand further. The rising population coupled with increasing disposable income levels, especially in the emerging regions such as the Asia Pacific, has impacted positively on the overall product demand. To add on, cold chain infrastructure also plays a pivotal role in driving the frozen food market, as it helps to transport products at both the domestic and international levels. The global demand for fresh and processed fruits & vegetables has tremendously surged, as the consumption habits of the urban population have changed dramatically.

This demand is fulfilled using cold chain logistics to maintain the temperature and quality of frozen food products. The rise in the export and import of frozen food has spurred accredited to the strong global cold chain services available in developed economies. According to the International Association of Refrigerated Warehouses (IARW), a core partner of the Global Cold Chain Alliance (GCCA), it has been estimated that the global capacity of refrigerated warehouses increased to 616 million cubic meters (m3) in 2018, from 552 million cubic meters (m3) in 2014.

US Retail Sales of Frozen Foods, By Product Category (US$ Million, 2019)

Furthermore, in 2018, almost 25% of the population bought food and groceries from online retail channels. With the growing penetration of the internet and smartphone usage, retail grocery shopping is emerging as one of the platforms for companies to showcase and sell their frozen food products. The frozen food products market mainly consists of fruits and vegetables, dairy products, bakery products, meat and seafood products, and convenience food and ready meals, as well as other products. Developed countries such as the US, Germany, France, and Japan dominate the frozen food market owing to the high purchasing power of consumers. While the convenience foods and ready meals segment hold the largest market share; attributed to hectic work schedules of people, globally, resulting in increased global consumption of frozen foods.

“Amongst Product Category, Ready-to-Eat food segment dominated the market in 2019, accounting for 42.9% share in terms of value”

Based on the product category, the global frozen food market is fragmented into ready to eat, ready to cook and ready to drink frozen foods. The popularity of ready to eat meals has witnessed a rapid rise accredited to immense convenience and ease offered coupled with increasing working women population, increasing disposable income and changing lifestyles. The segment is anticipated to generate revenue of US$ 138.52 billion by 2026.

“Frozen Ready Meals dominated the product type segment of the frozen foods market in 2019, followed by Frozen Fish/Seafood”

Based on product type, the global frozen food market is bifurcated into Frozen Meat, Frozen Fish/Seafood, Frozen Ready Meals, Frozen Bakery, Frozen Pizza, Frozen Potato and others. Growing inclination towards frozen ready meals, increasing health awareness and surging spend on health and wellbeing has catalyzed the growth of the market. The segment generated revenue of US$ 54.05 billion in 2019. The Frozen Bakery Products segment is anticipated to register the highest CAGR growth of 5.1% during the forecast period 2020-2026.

“Frozen Foods are majorly sold through Supermarket/Hypermarket, followed by Independent Retailers”

Based on the distribution channel, the global frozen food market is bifurcated into supermarket/hypermarkets, Independent Retailers, Convenience Store and other channels such as specialist retailers and online modes. Preference for supermarkets/ hypermarkets with respect to ease of availability over conventional distribution channels for buying frozen foods has risen tremendously due to cost-effectiveness and better convenience. The segment is expected to generate revenue of US$ 226.26 billion by 2026 through the sales of frozen food products.

“Europe was the largest market for the frozen food industry in 2019, accounting for 38.5% share”

For a deep-dive analysis of the frozen food industry, detailed country-level analysis was conducted for major region/country including Americas (US, Canada, Rest of North America), Europe (Germany, UK, France, Italy, Spain, Rest of Europe), Asia-Pacific (China, Japan, India, South Korea) and Rest of the world. It has been observed that most of the European countries prefer domestically produce products. Increasing government initiative and support to boost the domestic production of frozen food products such as meat and poultry product is further expected to boost the market for frozen food in the near future globally. Moreover, changing lifestyles, increasing the women population in the corporate world and growing demand for vegan frozen food constitute to be the additional factors attributed to an increase in demand for frozen food products over the forecast period in the region. Asia-Pacific is expected to generate revenue of US$ 81.74 billion by 2026.

Competitive Landscape-Top 10 Market Players

Nestle SA, Ajinomoto, Goya Foods, ConAgra Foods, General Mills, Heinz Company, Tyson Foods, Unilever PLC, Maple Leaf Foods, Nomad Foods, Mc Can Foods Ltd, Dr. Oetker are some of the prominent players operating in the frozen foods industry. Several M&A’s along with partnerships have been undertaken by these players to facilitate costumers with hi-tech and innovative products in the frozen food domain.

Reasons to buy:

- Current and future market size from 2020 to 2026 in terms of value (US$)

- Combined analysis of deep-dive secondary research and input from primary research through Key Opinion Leaders of the industry

- Country-level details of the overall consumption of Frozen Foods

- A quick review of overall industry performance at a glance

- In-depth analysis of key industry players

- A detailed analysis of regulatory framework, drivers, restraints, key trends and opportunities prevailing in the industry

- Examination of industry attractiveness with the help of Porter’s Five Forces analysis and start ups

- The study comprehensively covers the market across different segments and sub-segments of the market

- Regions/Countries Covered: Americas (US, Canada, Rest of North America), Europe (Germany, UK, France, Italy, Spain, Rest of Europe), Asia-Pacific (China, Japan, India, South Korea) and Rest of the world

Customization Options:

UMI understands that you may have your own business need, hence we also provide fully customized solutions to clients. The Global Frozen Foods market can be customized to the country level or any other market segment.

You can also purchase parts of this report. Do you want to check out a section wise

price list?

Research Methodology

Analyzing the historical market, estimation of the current market and forecasting the future market for Frozen Food products were the three major steps undertaken to create and analyze the consumption trend of frozen food around the world. Exhaustive secondary research was conducted to collect the historical market numbers to estimate the current market size. Secondly, to validate these insights, numerous findings and assumptions were taken into consideration. Moreover, exhaustive primary interviews were conducted with industry experts across the value chain of the frozen food sector. Post assumption and validation of market numbers through primary interviews, the bottom-up approach was employed to forecast the complete market size of the Frozen Foods industry. Thereafter, market breakdown and data triangulation methods were applied to estimate and analyze the market size of segments and sub-segments the industry pertains to. Detailed methodology is explained below:

Seek More Details About Research Methodology

Analysis of Historical Market Size

Step 1: In-Depth Study of Secondary Sources:

Detail secondary study was conducted to obtain the historical market size of Frozen Foods market through company internal sources such as annual report & financial statements, performance presentations, press releases, etc., and external sources including journals, news & articles, government publications, competitor publications, sector reports, third-party database and other credible publications. For economic data collection, sources such as Trading Economics, Trade Map, World Bank, IMF, FAO among others were used.

Step 2: Market Segmentation:

After obtaining the historical market size of the Frozen Foods market, a detailed secondary analysis was conducted to gather historical market insights and share for different segments & sub-segments for major regions/countries across the world. Major segments included in the report are product category, product type, and distribution channel. Further analysis is also conducted for different countries to analyze the overall consumption of frozen supplements in that particular country.

Step 3: Factor Analysis:

After acquiring the historical market size of different segments and sub-segments, detailed factor analysis was conducted to estimate the current market size of Frozen Foods market. Factor analysis was conducted using dependent and independent variables such as increased demand for healthy foods, increasing awareness for a healthy diet, changing lifestyles and increased demand for longer shelf life products. The demand and supply-side scenario were also thoroughly studied by considering top partnerships, merger and acquisition, business expansion, product launches and analyzing the list of start-ups in the Frozen Food sector across the globe.

Current Market Size Estimate & Forecast

Current Market Sizing: Based on actionable insights from the above 3 steps, we arrive at the current market size, key players in the Frozen Foods market along with their market shares for the base year. All the required percentage shares split, and market breakdowns were determined using the above-mentioned secondary approach and were verified through primary interviews.

Estimation & Forecasting: For market estimation and forecast, weight was assigned to different factors including drivers & trends, restraints, and opportunities available for the stakeholders. After analyzing these factors, relevant forecasting techniques i.e. Bottom-up approach was applied to arrive at the market forecast pertaining to 2026 for different segments and sub-segments across the major regions/countries globally. The research methodology adopted to estimate the market size encompasses:

- The industry’s market size, in terms of value (US$) and consumption rate of Frozen Foods across major regions

- All percentage shares, splits, and breakdowns of market segments and sub-segments

- Key players in the Frozen Foods market in terms of the services offered as well as market share. Also, the growth strategies adopted by these players to compete in the fast-growing market

Market Size and Share Validation

Primary Research: In-depth interviews were conducted with the Key Opinion Leaders (KOLs) including Top Level Executives (CXO/VPs, Sales Head, Marketing Head, Operational Head, and Regional Head, Country Head, etc.) across major regions. Primary research findings were summarized, and statistical analysis was performed to prove the stated hypothesis. Inputs from primary research were consolidated with secondary findings, hence turning information into actionable insights.

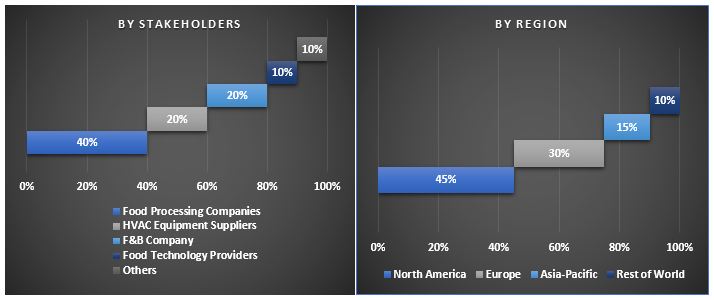

Split of Primary Participants in Different Regions

Market Engineering

Data triangulation technique was employed to complete the overall market estimation and to arrive at precise statistical numbers of each segment and sub-segment pertaining to the Frozen Foods market globally. Data was split into several segments & sub-segments post studying various parameters and trends in the areas of product category, product type, and distribution channel and region/country.

Main objective of the Frozen Foods Market Study

The current & future market trends of the frozen food market are pinpointed in the study. Investors can gain strategic insights to base their discretion for investments from the qualitative and quantitative analysis performed in the study. Current and future market trends would determine the overall attractiveness of the market at a regional level, providing a platform for the industrial participant to exploit the untapped market to benefit as a first-mover advantage. Other quantitative goals of the studies include:

- Analyze the current and forecast market size of the frozen food market in terms of value (US$). Also, analyze the current and forecast market size of different segments and sub-segments of the sector

- Segments in the study include product category, product type, distribution channel and region/country

- Analyze the value chain involved with the presence of various intermediaries, along with analyzing customer and competitor behaviors pertaining to the industry

- Define and analysis of the government regulations for frozen food products globally

- Detailed analysis of used case study of the Frozen Foods

- Analyze the current and forecast market size of the frozen food category across the globe. Major regions analyzed in the report include Americas (US, Canada, Rest of North America), Europe (Germany, UK, France, Italy, Spain, Rest of Europe), Asia-Pacific (China, Japan, India, South Korea) and Rest of the world

- Define and analyze the competitive landscape of the Frozen Foods industry and the growth strategies adopted by the market players to sustain in the fast-growing market