Private outdoor space is the number one feature buyers are looking for this year. Rising prices are the top concern, reflecting America’s hot housing market, with price growth hitting double digits every month this year.

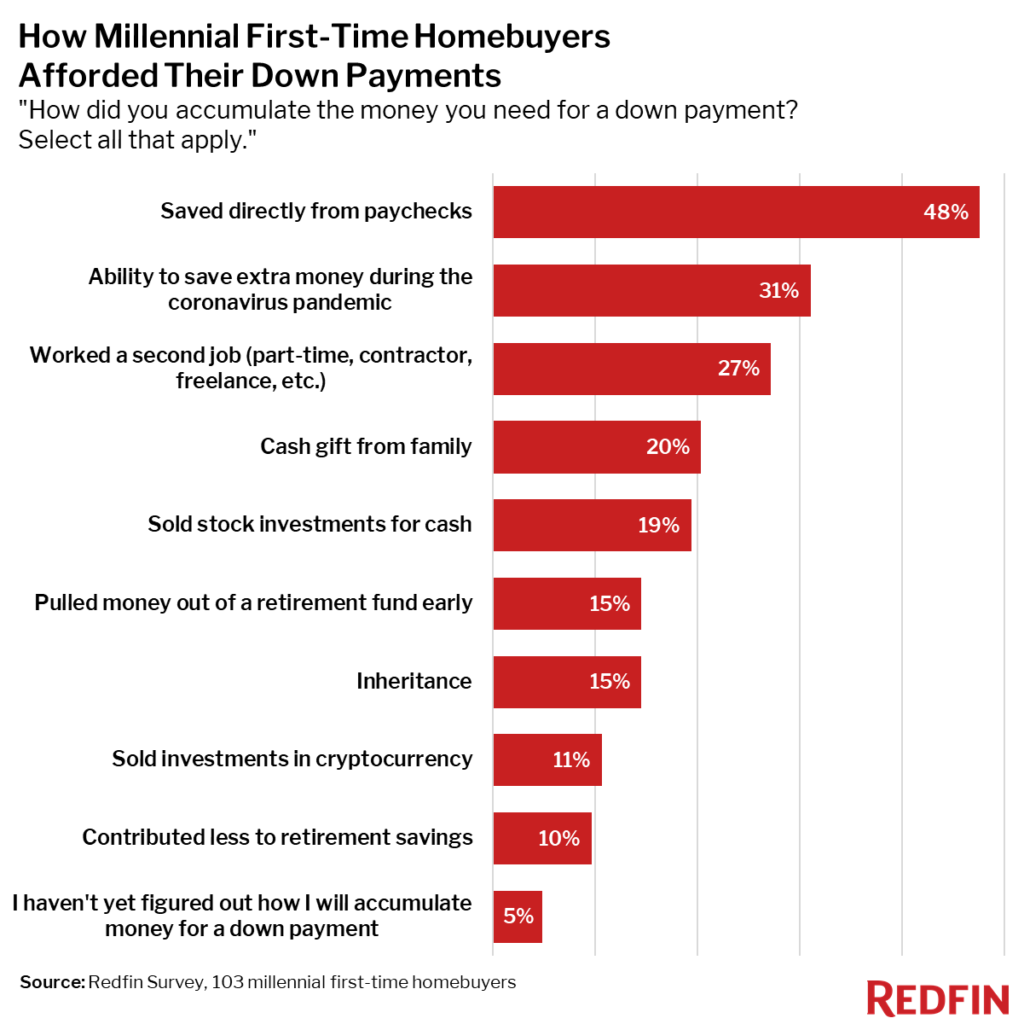

For nearly one-third (31%) of millennial first-time homebuyers we recently surveyed, the ability to save extra money during the coronavirus pandemic helped them accumulate the money needed for a down payment.

That’s according to a March Redfin survey of more than 1,500 Americans who plan to buy or sell a home in the next 12 months, with just over 100 responses from millennial first-time homebuyers to the question about down payments. This report doesn’t compare responses from the first quarter of 2021 to similar questions in past surveys. We added pandemic-specific responses to questions in the Q1 2021 survey, so the results aren’t directly comparable to those of past surveys.

Forty-eight percent of millennial first-time buyers who took this survey saved money directly from paychecks for their down payment on a home, the most commonly cited method. It’s followed by the ability to save extra money during the coronavirus pandemic (31%), working a second job (27%), cash gifts from family (20%), and selling stock investments (19%).

While many workers were furloughed or laid off due to the pandemic, people who held onto their jobs have been able to save more money than usual over the last year as they spent less on things like eating out, travel and in-person events. The U.S. personal savings rate soared to 33.7% in April 2020, up from a pre-pandemic rate of 7.2% in December 2019. It has remained at an elevated level, clocking in at 27.6% in March. That’s according to the Federal Reserve Bank of St. Louis and the U.S. Bureau of Economic Analysis, which track the percentage of personal disposable income saved by Americans in any given month.

The rest of this report presents other key findings from the survey. Note that the down-payment responses reported above are focused on millennials, while the remainder of the findings in this report are not broken into any specific age group.

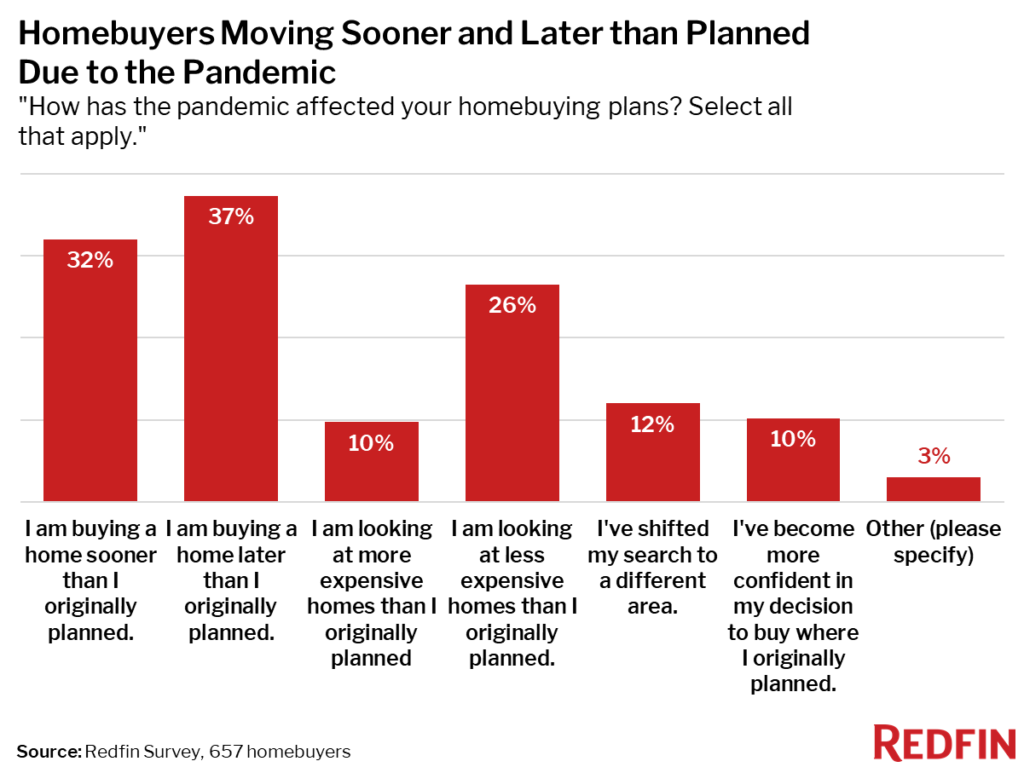

The pandemic effect: One-third of homebuyers are buying sooner than expected; another one-third are buying later

Thirty-seven percent of homebuyer respondents are purchasing a home later than originally planned because of the pandemic and 32% are buying a home sooner than originally planned.

There are many reasons why the pandemic is encouraging some people to race toward buying a home and others to pump the brakes. As mentioned above, the popularity of remote work is fueling demand for spacious homes, and it’s also motivating people to move to entirely different areas. But rising prices and a home-supply shortage are among the factors causing would-be buyers to pause their home search.

“Roughly half of my clients are people moving to the Central Valley from the Bay Area because they want to live in a bigger home for less money, and a lot of them only need to commute into the city once or twice a week, if that,” said Steven Majourau, a Redfin agent in Stockton, Tracy and other parts of California’s Central Valley. “They’re selling a large condo or townhouse for close to $1 million—or a small single-family home for more than $1 million—in San Francisco, San Jose or the East Bay and buying a large house here in the Central Valley for around $700,000.”

“Another part of my client base is first-time buyers, both locals and people from the Bay Area, who have accelerated their purchase plans and refocused their search here instead of San Francisco or Silicon Valley,” Majourau continued. “Now they’re able to get everything they want in a home at an affordable price.”

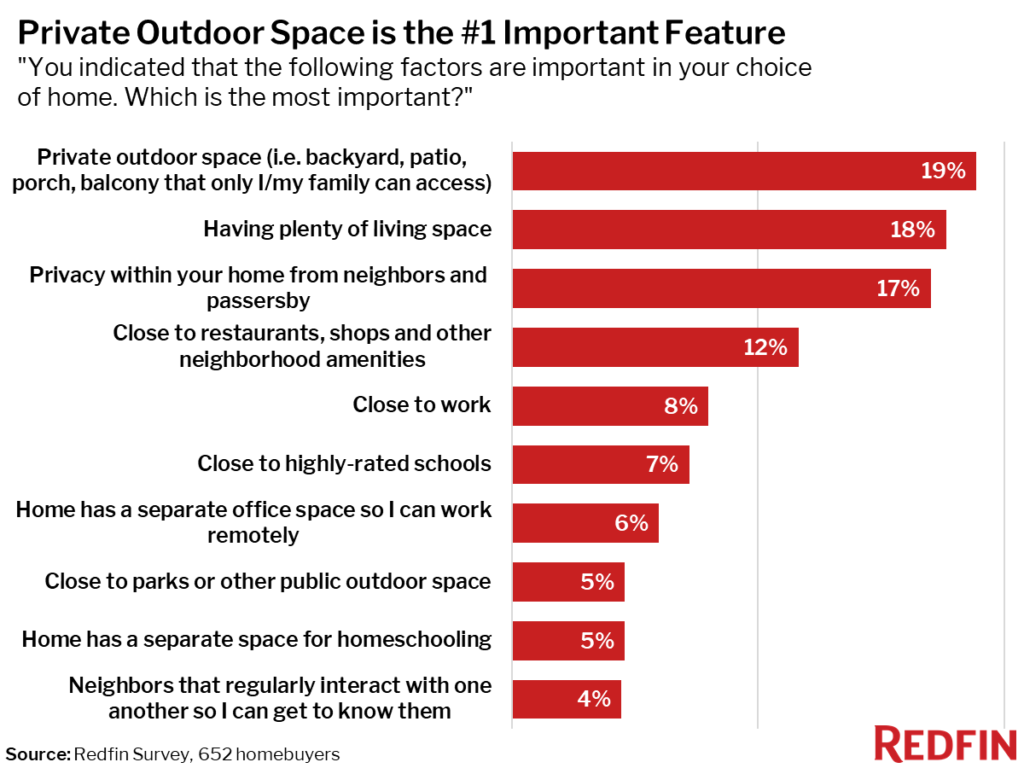

Homebuyer preferences: Private outdoor space and plenty of living space

Nineteen percent of homebuyers said private outdoor space is the most important feature in their choice of home, the most common response.

It’s followed closely by the desire for plenty of living space (18%) and privacy within the home from neighbors or passersby (17%).

Eight percent of respondents said proximity to work was the most important factor in their home choice, and 7% cited proximity to highly rated schools. Meanwhile, 6% of respondents said a separate office was the most important factor and 5% said a separate space for homeschooling was the most important factor.

“What homebuyers really want this year is a single-family home with their own outdoor space. They want to sit on the porch, grill, enjoy the sunshine and watch their kids play in the yard,” said Salt Lake City Redfin agent Chad Snow. “The other important thing is extra space inside the house, whether it’s an extra bedroom or an office. Because so many people plan to continue working remotely, a common thought process is ‘As long as I have enough space in my home and a nice yard, living close to work doesn’t matter so much.’”

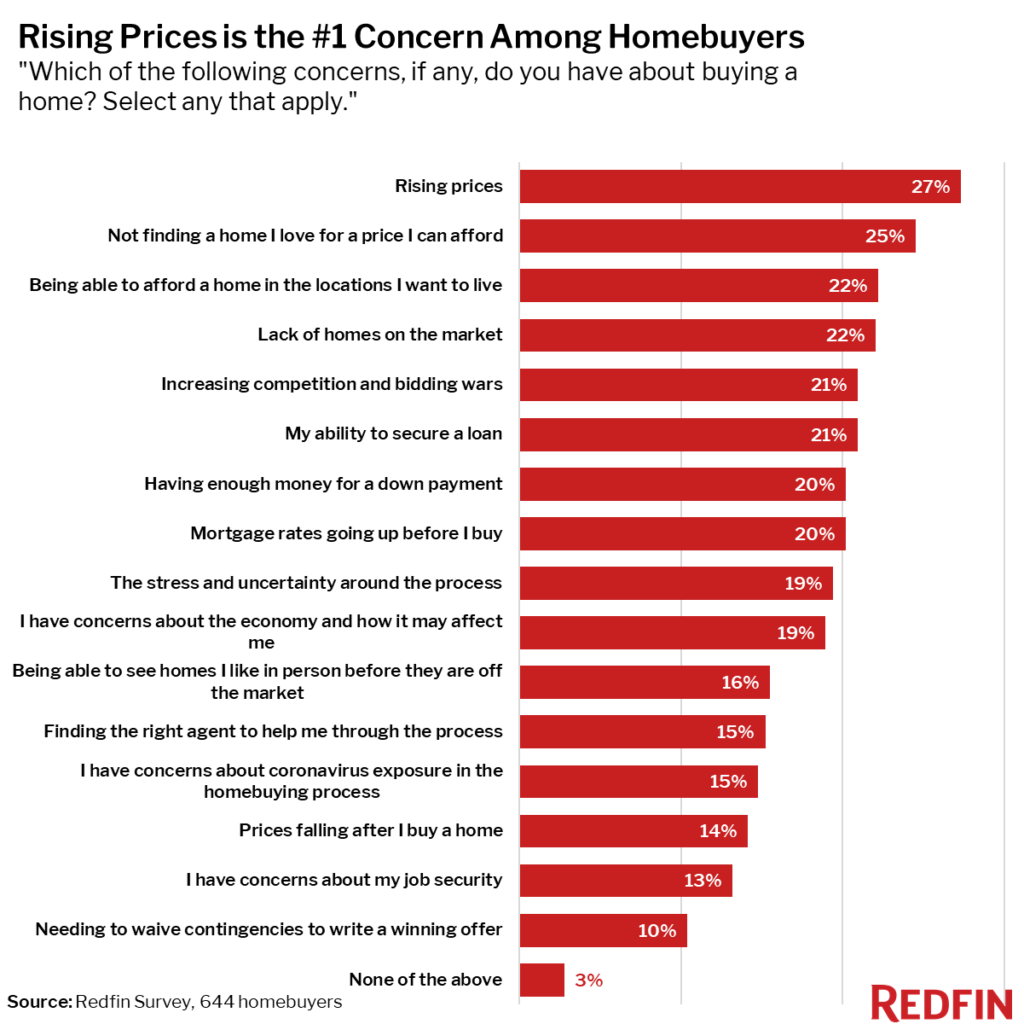

Homebuyer concerns: Rising prices and other financial considerations top the list

Although homebuyers are searching for space, they’re also worried about prices going up.

Rising home prices were the top concern among house hunters, with 27% of homebuyer respondents who plan to buy in the next year citing it as a worry. It’s followed by concerns about being able to find a home they love at a price they can afford, with 25% of respondents selecting that option. Home prices were up 22% year over year in April, reaching a record high of $357,000 (the year-over-year increase is somewhat inflated because price growth was low last April as pandemic-driven lockdowns nearly ground the housing market to a halt).

Homebuyers are also concerned about other financial issues, with roughly 20% of respondents selecting each of the following concerns: Mortgage rates going up, ability to secure a loan and not having enough money for a down payment and concerns about the economy.

“After months of home prices rising dramatically, buyers are well aware that homes are more expensive now than they were a year ago or six months ago,” said Redfin Chief Economist Daryl Fairweather. “Even though people are prioritizing things like space and privacy in their home search, rising prices mean a lot of buyers will need to make compromises to avoid going beyond their financial comfort zone. A buyer who was hoping for a single-family home may need to settle for a condo, and someone who was hoping for a separate home office may have to get creative and carve out part of the living room for a desk.”

United States

United States Canada

Canada