2021 U.S. RETAIL SALES DATA FOR THE PLANT-BASED FOODS INDUSTRY

In 2021, plant-based foods built on a record 2020 and charted impressive growth.

As the only U.S. trade association representing the plant-based foods industry, the Plant Based Foods Association is committed to conducting in-depth research to better understand how the growth of plant-based foods is transforming the marketplace.

Our most recent data set, analyzed and categorized by the Plant Based Foods Association and The Good Food Institute, from SPINS data, shows that U.S. retail sales of plant-based foods continue to increase, growing 6.2% in 2021 over a record year of growth in 2020 and bringing the total plant-based market value to an all-time high of $7.4 billion.

The growth of the plant-based category is particularly significant in the face of ongoing challenges presented by the pandemic and disruptions in the supply network. The resilience of plant-based foods illustrates strong consumer interest in foods that align with their values, meeting expectations for sustainability and social justice, and speaks to the nimble nature of plant-based food companies that navigated supply challenges and displayed unwavering commitment to creating innovative, delicious food for all occasions.

Looking at retail sales data from 2021, in conjunction with four-year trends, emphasizes the staying power of this cutting-edge, rapidly-growing industry. With ever-increasing plant-based meat, dairy, and egg options available to more and more consumers on retail shelves and online, and the permanence of the ongoing plant-based market shift, comes major opportunities to diversify our food system and build a secure, sustainable future.

TOTAL GROWTH OF PLANT-BASED FOODS

$7.4 billion

in dollar sales

6%

one-year growth

54%

three-year growth

Consumers purchased more plant-based foods than ever in 2020, setting a high bar for growth in 2021. The sustained growth in plant-based food sales this past year illustrates strong consumer commitment to purchasing foods that taste great and align with their values and are better for personal health, the planet, workers in the supply network, and animals.

Plant-based food retail sales grew three times faster than total food retail sales

Growth of plant-based foods continues to outpace total food sales, and in the case of certain products like milk and creamers, have become the growth drivers of their overall categories. As we begin to see the results of continued innovation and increased space and assortment on grocery shelves, we expect to see plant-based foods driving growth in other categories, as well.

Plant-based category share is increasing

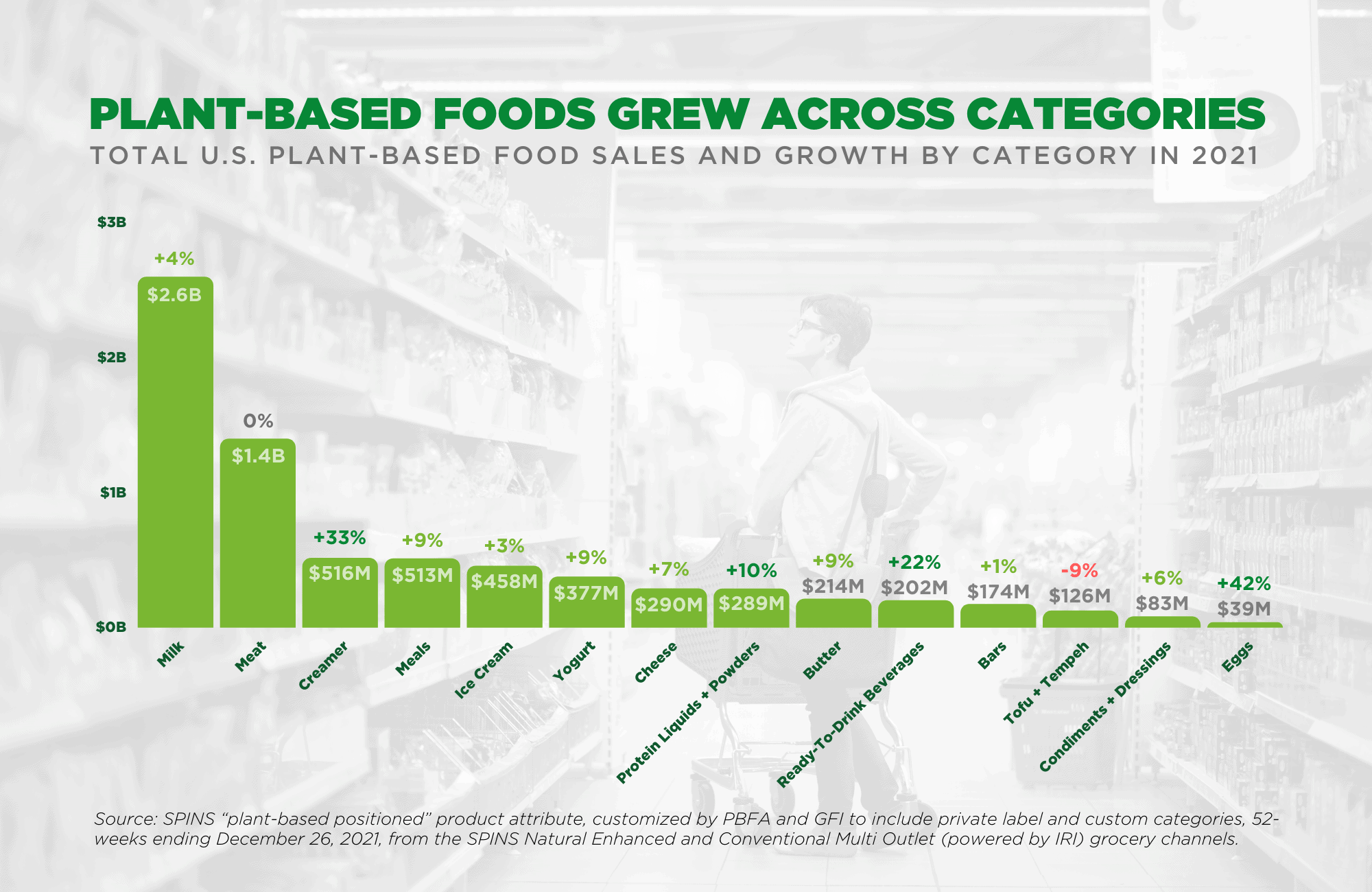

All categories of plant-based foods showed growth across the board, with the exception of meat, which was able to hold steady after record growth in 2020. These numbers illustrate sustained increases over recent years and demonstrate the incredible opportunities available for brands in every part of the store, and across online platforms.

The dollar share of plant-based foods continues to grow year over year, and the units of plant-based foods (individual products sold) are up compared to overall units of food. While inflation and rising food prices may lead consumers to shop less frequently and be more mindful of cost, plant-based foods are consistently making it into consumers’ shopping carts. This trend suggests that plant-based foods are no longer considered “nice to have,” but “must-have” items for consumers.

“The sustained rise in the market share of plant-based foods is remarkable, and makes it clear that this shift is here to stay. More and more consumers are turning to plant-based options that align with their values and desire to have a positive impact on personal and planetary health. The data shows that, despite the challenges of the past two years, retailers and foodservice providers are meeting consumers where they are by partnering with brands across the entire store to expand space, increase assortment, and make it easier than ever to find and purchase plant-based foods. The potential impact of these initiatives extends far beyond the store shelf: By taking consumer concerns to heart, the industry is actively embracing its role as a key driver of change that moves us closer to a secure and sustainable food system.”

More consumers are trying plant-based foods—and coming back for more

Sixty-two percent or 79 million U.S. households are now buying plant-based products. This is an increase from 61% (77 million in 2020). Increased repeat rates in plant-based foods across numerous record-breaking years illustrate strong consumer commitment and interest—the percentage of consumers purchasing multiple times within the plant-based category grew from 78% in 2020 to 79% in 2021.

Millennials and Gen Z, which together comprise 47% of the population and will continue to grow in their spending power, demonstrate particularly high demand for plant-based foods.

Plant-based foods now exist across 30 categories in grocery stores, which speaks to consumers’ desire for plant-based options for all occasions, including snacking, baking, and cooking—especially evident in the emergence and rapid growth of butter, eggs, and cooking sauces.

“PBFA recognizes that healthy and sustainable plant-based foods are not always readily available to consumers everywhere, which is why increasing accessibility of these foods to people of all backgrounds and geographies must be a top priority for the industry in the months and years ahead. Retailers and foodservice operators are seeking insights to inform the expansion of their plant-based food offerings and leverage the dollar opportunity that plant-based foods provide. We see this as an incredible opportunity to build collaborative partnerships between plant-based food companies, retailers, and foodservice operators to address potential gaps and identify opportunities to increase the visibility and availability of plant-based options everywhere, from grocery shelves to school lunches and beyond. ”

PLANT-BASED MILK

As the largest category in the plant-based market, plant-based milk continues to benefit from product innovation and expanded merchandising space and assortment. Plant-based milk is now the growth engine for the entire milk category, generating an absolute dollar sales increase in 2021: For context, plant-based milk contributed $105 million in growth, while animal-based milk’s decline equated to a loss of $264 million in the overall milk category.

Plant-based milk is also seeing considerable growth in category share—now soundly occupying 16% of all retail milk dollar sales in conventional channels and 40% in the Natural Enhanced Channel, which represents over 50 retailers and approximately 2,000 natural retail stores.

In terms of dollar sales, plant-based milk grew 4% in 2021 and now represents a $2.6 billion category. Over the past three years, plant-based milk grew a remarkable 33% and now serves as the innovation leader in the milk category due to priority for sustainability, key advancements in ingredient diversification, new product development, and increased nutritional profiles.

Almond milk is leading the way, accounting for 59% of the total category, and oat milk growth has become the second-largest segment, growing more than 44 times in the past three years and now making up 17% of category sales, up from only 0.5% in 2018.

Key Contributors to Plant-Based Milk Growth

Ingredient Innovation: Companies producing plant-based milks are setting a high bar for innovation and sustainable ingredient sourcing, working with new and functional ingredients to appeal to varying consumer interests. Oat milk has grown significantly in the past two years alone and milk companies are innovating products that harness sesame seeds, flax, hemp seeds, upcycled barley, pea protein, cassava root, potato starch, mushrooms, bananas, and a wide variety of nuts including cashews, coconuts, macadamia nuts, pili, pistachio, pecan, walnut, and hazelnuts. The process for making plant-based milks is capable of liquifying nutrients from a wide array of plant sources, so the number of varieties and blends of plant-based milks is virtually limitless.

Integrated and expanded merchandising: Milk is the perfect illustration of the power of merchandising plant-based foods next to their conventional counterparts. Retailers are leaning into plant-based milk and at most retailers dedicating up to 33% of shelf space, and up to 50% in the natural channel, to these options. PBFA research on the importance of integrated merchandising strategies continues to influence industry practices.

Pricing: Average retail price for plant-based milk declined in 2% 2021, while units increased 3%, further demonstrating the strength and sustained growth of plant-based milk.

PLANT-BASED MEAT

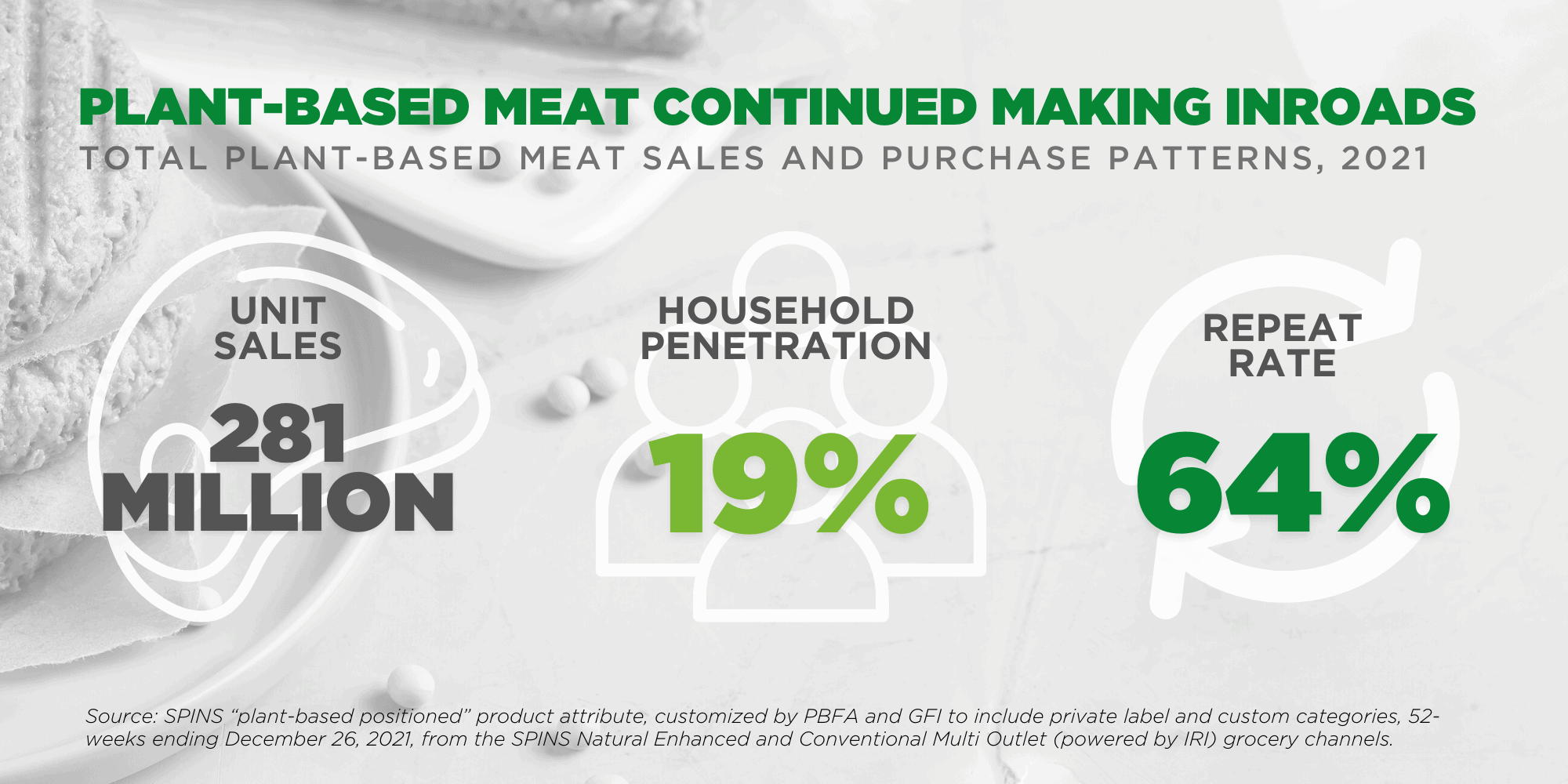

After record growth in years prior, 2021 plant-based meat dollar sales remained steady and achieved a repeat year of $1.4 billion in sales. In the past three years, plant-based meat sales have skyrocketed, growing by 74%.

The unit comparison is even more striking: While conventional meat unit sales have grown 9% in the past three years, plant-based meat unit sales have outpaced that by more than six times, growing 51% during the same period. In 2021, plant-based meat’s share was 2.7% of retail packaged meat dollar sales, or 1.4% of the total meat category (including random weight meat), and plant-based meat’s share of meat in the natural channel is now 14%.

Consumer demand rose last year: 19% of households purchased plant-based meat in 2021—up from 18% in 2020—and on top of that, an impressive 64% of those buyers purchased it multiple times throughout the year.

Category Innovation

Plant-based burgers continue to lead the plant-based meat category as the top-selling product type. At the same time, the industry is responding to consumer desire for more variety within the meat category. The fastest-growing plant-based meat product types in 2021 were plant-based meatballs, chicken nuggets, tenders, and cutlets, and deli slices. In fact, plant-based chicken was a growth leader in 2021 as more products that match the taste, texture, and appearance of animal-based chicken hit retail shelves.

Foodservice is also experiencing growth according to Technomic, with one-third of Millennial and Gen Z restaurant diners are seeking out vegetarian/vegan entrées as a first choice on menus, and 27% of older adults are also doing so. Plant-based meats are featured in nearly every major chain from plant-based burgers in Burger King and McDonald’s to plant-based pepperoni at Little Caesars and Pizza Hut, plant-based chorizo at Chipotle, plant-based fried chicken at KFC and Panda Express, and many more.

There remains a significant ongoing opportunity for plant-based seafood, which grew 14% to $14 million but accounts for just 1% of the plant-based meat market, compared to conventional seafood composing a fifth of total meat and seafood sales.

In the past few years, the food industry has seen multiple supply chain disruptions and broad volatility. Notably, after an overstimulated 2020, the unit sales of almost every single animal-based category experienced negative growth in 2021, as did a couple of select plant-based categories to a lesser extent. Conventional meat dollar sales increased three times faster than its unit sales over the past three years—demonstrating significant inflation—indicating that apparent growth is driven by higher unit prices. And IRI’s inflation index shows that in March 2022, U.S. retail conventional meat price per unit was up 13% compared to March 2021, while plant-based meat price per unit was down 2%. With the rapid scale-up of the plant-based industry, plant-based products may soon be able to compete with animal products on price, further stimulating consumer demand.

Key Insights on Plant-Based Meat

Importance of price: Cost remains one the biggest considerations for consumers. With high inflation rates, unit sales of plant-based meat were slightly down and animal-based meat were down by a significant percent. As the 2022 Power of Meat report from the Food Industry Association (FMI) indicates, high prices of animal-based meats led consumers to shop for meat less frequently and prioritize purchasing on promotion.

Diversification of products: While plant-based burgers are still a consumer favorite, the plant-based meat category is responding to consumer demand for more variety and innovation. Plant-based meatballs grew by 12% in 2021, followed by plant-based chicken varieties like nuggets, tenders, and cutlets, which grew by 9%—doubling in size in the past three years—and deli slices, which grew by 8%. This illustrates consumer desire to have options for a variety of meal occasions and when compared to the conventional meat category, there is a $16 billion opportunity in plant-based meats alone. As remaining categories increase in share, this equates to an exponential dollar growth opportunity.

Consumers expect better: The continued growth of plant-based meats shines a spotlight on the fact that consumers are looking for foods that are better for people, planet, and animals. News headlines underscoring the poor treatment of workers in industrial animal agricultural processing facilities are registering with consumers and an increased focus on social responsibility is gaining traction. Plant-based foods are uniquely positioned to meet these values-aligned desires: More consumers are trying plant-based meats and becoming repeat buyers. This trend is particularly important for Millennial and Gen Z consumers, who now compose 47% of the population and will continue to grow in their spending power.

Integrating merchandising shows significant benefits: Making plant-based meats easy for all consumers to find in retail stores is a top area for growth in this category. PBFA research found that when plant-based meats are merchandised alongside their conventional counterparts, sales increased 23% and consumers were impressed by the variety of options. These findings are also important to consider for e-commerce merchandising as we move into an omnichannel marketplace where shoppers are purchasing more foods online with sales increasing 47% in 2021. The industry is building out an ecommerce infrastructure at breakneck speed to meet consumer demand and making it easier to find plant-based foods online is a key focus area for PBFA.

PLANT-BASED DAIRY: Butter, Cheese, Yogurt, Creamer, Ice Cream

The success of plant-based milk has laid the groundwork for major growth of other plant-based dairy products, which reached $2.1 billion in total sales in 2021. Across the store, plant-based dairy dollar sales are growing faster than those of many conventional animal products.

We’re seeing significant growth and variety in plant-based creamers, yogurts, and cheeses alike. In terms of market share, plant-based creamer is the second-largest behind milk, followed by ice cream, yogurt, cheese, and butter.

Key Insights on Plant-Based Dairy

Ingredient Innovation: Particularly striking in the dairy categories is the inclusion of functional ingredients like mushrooms in creamers, or nuts and cashews in cheese, and watermelon seeds in cottage cheese, which are able to be incorporated while maintaining a smooth, delicious taste. Plant-based foods appeal to a broad base of consumers, with over 60% of households purchasing plant-based foods for many different reasons. These consumers may be motivated by heath, sustainability, and/or animal welfare, but what is also increasingly clear is that they simply like plant-based dairy for their taste and the ability to add variety to their diets.

Making it easier for shoppers to find plant-based dairy: As with plant-based milk, other plant-based dairy foods are merchandised next to their animal-based counterparts, making it easy to find. Retailers are making great strides toward implementing clear signage within each section so shoppers can more easily distinguish between plant-based and animal-based.

Exciting developments in price parity: Scale is critical to achieve price parity. We are beginning to see more evidence of lower prices with a corresponding increase in unit sales, demonstrating the success of competitive pricing:

Plant-based creamers average retail price declined 6%, while units grew 25%

Plant-based cheese average retail price declined 2%, while unit sales grew 6%

Plant-based butter average retail price declined 2%, while units sales grew 12%

PLANT-BASED EGGS

The plant-based egg category also grew rapidly in 2021, with a 42% increase in dollar sales. The larger growth trend is even more astounding: In the past three years, plant-based egg dollar sales have grown more than 1,000%.

With conventional egg dollar sales declining by 4% in 2021 and plant-based eggs now comprising nearly 0.6% share of the total egg market–compared to a 0.05% share three years ago–plant-based eggs are now a growth driver of the category. Notably, the percentage of households purchasing plant-based eggs grew by 50% in the last year.

METHODOLOGY

Point-of-sale data:

To size the U.S. retail market for plant-based foods, GFI and PBFA commissioned retail sales data from the market research firm SPINS. The firm built the dataset by first pulling in all products with the SPINS “plant-based positioned” product attribute. The dataset was further edited by adding plant-based private label categories and subcategories, and refining the plant-based eggs category. Inherently plant-based foods, such as chickpeas and kale, are not included. Due to the nature of these categories, the retail data presented in this report may not align with standard SPINS categories. SPINS obtained the data over the 52-week, 104-week, 156-week, and 208-week periods ending December 26, 2021, from the SPINS Natural Enhanced and Conventional Multi Outlet (powered by IRI) grocery channels. SPINS defines these channels as follows:

Conventional Multi Outlet (MULO): More than 111,000 retail locations spanning grocery, drug, mass, dollar, military, and club.

Natural Enhanced: Almost 2,000 full-format stores with $2 million+ in annual sales and 40 percent or more of UPC coded sales from natural/organic/specialty products. This is not 111,000 retail locations (MULO) and “almost 2,000” (from 1,800 above).