Latinx Americans are Driving U.S. Homeownership Gains, But Wide Gaps Remain

Latinx homeownership has made huge strides over the past decade. But this community remains underrepresented among homeowners, and faces unique challenges.

Latinx homeownership has made huge strides over the past decade. But this community remains underrepresented among homeowners, and faces unique challenges.

Latinx homeownership has made huge strides over the past decade, helping drive the overall U.S. homeownership rate up in recent years. But the data show that Latinx Americans are still somewhat under-represented among U.S. homeowners, and that this hugely diverse community faces a set of unique challenges in reaching full equality.

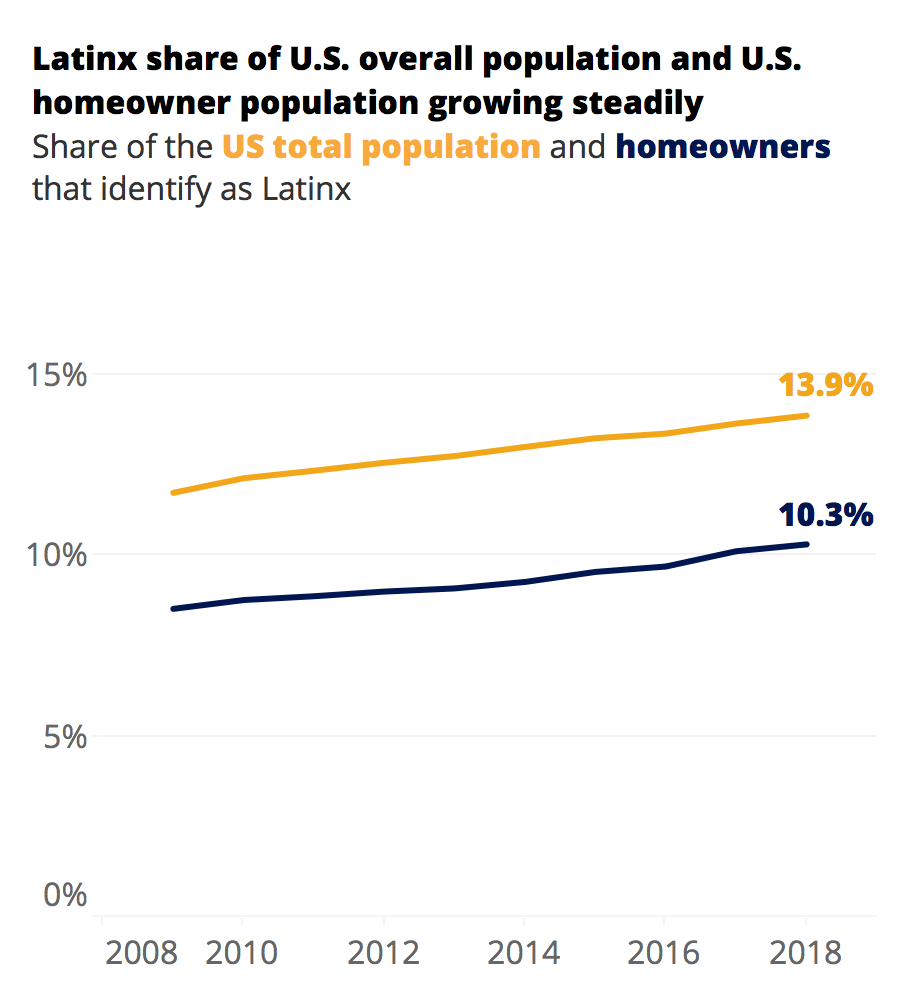

Latinx Americans accounted for more than 60% of new U.S. homeowner gains over the past decade, bringing the Latinx homeownership rate to 48.9% by Q1 2020, the highest level since 2008. Between 2009 and 2018, the percent of household decision makers that identified as Latinx rose from 11.8% to 13.9%, according to a Zillow analysis of American Community Survey data. Over the same period, the percent of all U.S. homeowners that identified as Latinx grew from 8.6% to 10.3%.

But while the 1.7 percentage-point gain among homeowners matches closely with the 2.1-point gain in overall population share, homeownership among Latinx Americans still hasn’t reached parity with those that do not identify as Latinx. And while the difference between the share of the overall population that is Latinx and the share of the homeowner population that is Latinx might seem small, the imbalance works the other way for white Americans. Whites make up 68% of U.S. household decision makers, but represent 76% of all U.S. homeowners. In Q1 2020, the homeownership rate among non-Latinx whites was 73.7%. For Latinx Americans, that number was almost 48.9% — a roughly 25 point gap.

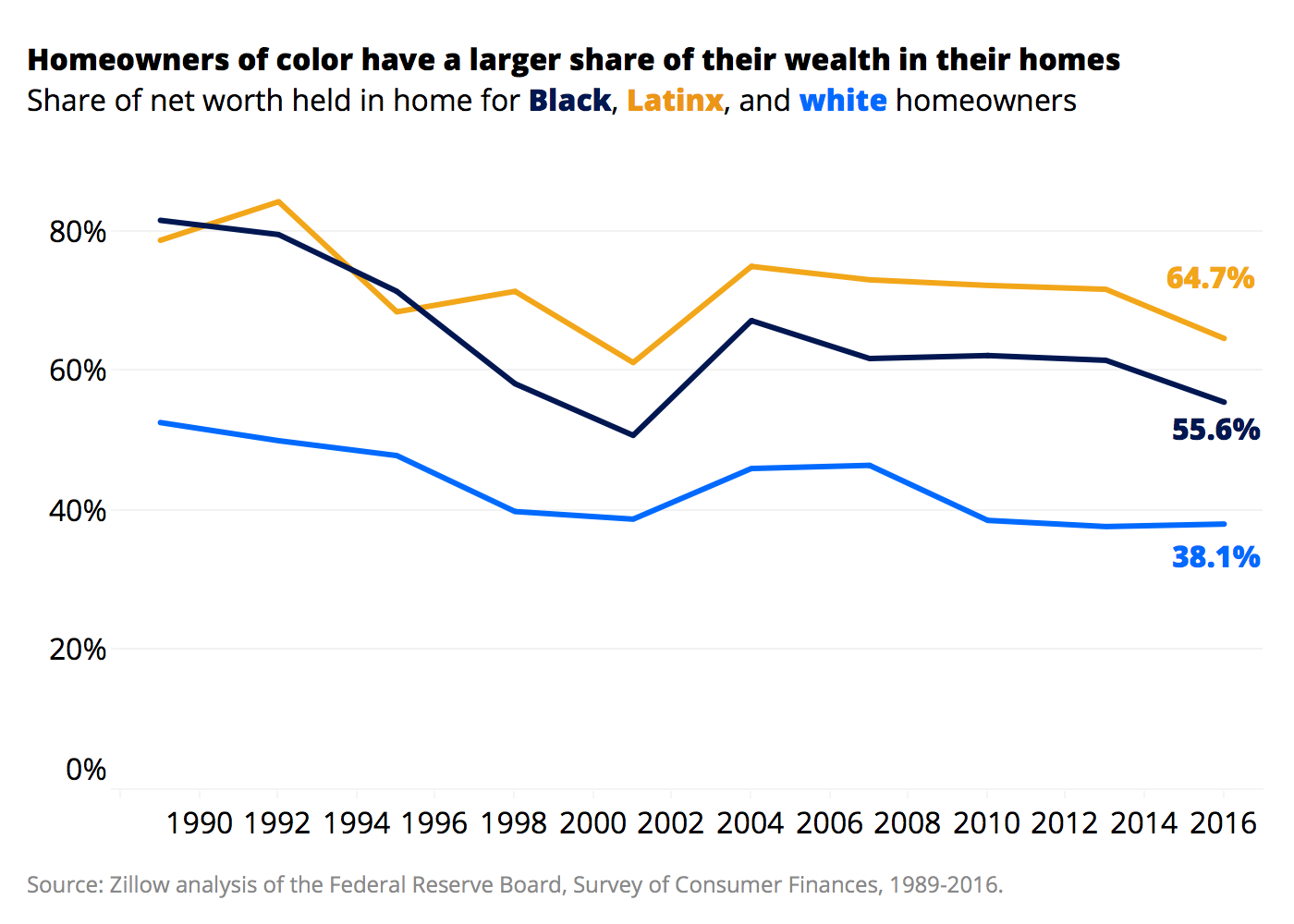

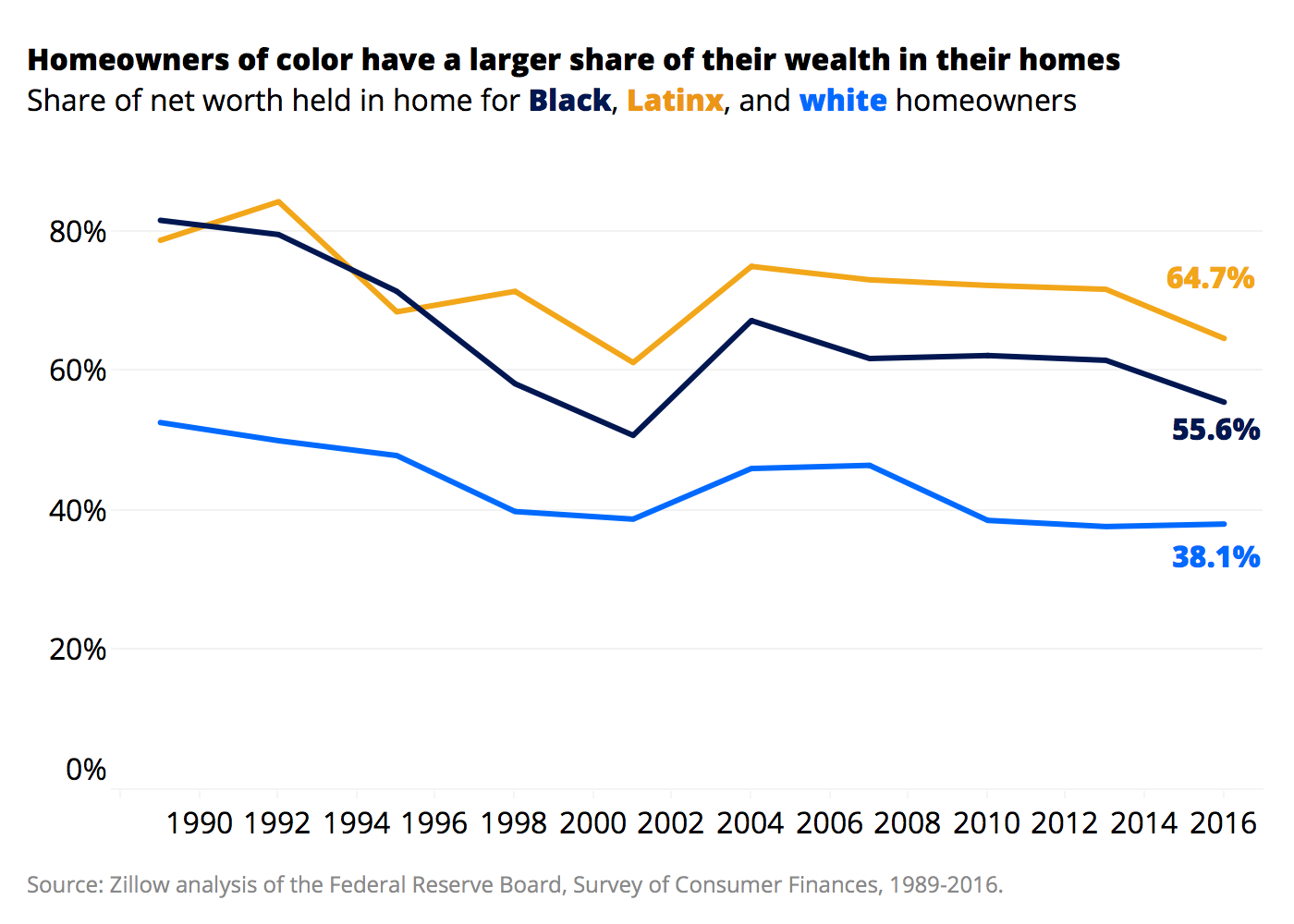

Recent gains in Latinx homeownership represent a significant turnaround in fortunes for the community after it was hit disproportionately hard during the Great Recession. Less than 10% of all U.S. homes are in largely Latinx communities, yet 19.4% of all homes foreclosed upon between 2007 and 2015 were in these neighborhoods. A disparity in household wealth was a major contributor to the unequal impact of the Great Recession and attendant foreclosure crisis on the Latinx community. In 2007, on the eve of the Great Recession, a home accounted for 73.1% of the typical Latinx homeowner’s total wealth — compared to 46.5% for the typical white homeowner.

Because their homes accounted for such a large share of their wealth, Latinx homeowners were more exposed to the foreclosure crisis as home values plummeted and unemployment rose. With fewer assets to draw on, it was harder for them to hold onto their homes if and when their homes fell into negative equity, if they lost a job and/or if they otherwise couldn’t make ends meet. By 2015, the Latinx homeownership rate was at its lowest level since 1998.

In 2018, the typical Latinx household earned about 75% of the typical white household, and the typical white household held more than eight times the amount of overall wealth. In recent years the wealth gap between white and Latinx households has narrowed somewhat, on the heels of very rapid gains in wealth by Latinx households, according to the Federal Reserve. Between 2016 and 2019, median wealth for the typical Latinx household rose 65%, compared to just 3% for white families. (Black family wealth rose 33% over the same period, and other families’ wealth rose by 8%). But this rapid pace of growth is deceiving: The typical white family’s wealth was $188,200 in 2019, compared to just $36,100 for the typical Latinx household. Put another way, even given the wide differences in growth rates, the white-Latinx wealth gap fell only modestly from $160,000 in 2016 to $152,100 in 2019.

Some of these disparities may also reflect the higher hurdles and challenges faced in the home buying process by Latinx buyers. Among home buyers of all races surveyed as part of the Zillow Consumer Housing Trends Report, Latinx buyers were most likely to say they were very concerned about qualifying for a mortgage (38% said they were, compared to 22% of white mortgage buyers). And a third of Latinx mortgage buyers (33%) reported being denied at least once for a mortgage before ultimately being approved, compared to 20% of white buyers.

Latinx home buyers also skew slightly younger (the median age of Latinx buyers is 39, compared to an overall median of 42), and a majority are purchasing their first home (56%, compared to 43% of buyers overall). Prior Zillow research shows that first-time buyers in general face greater financial hurdles because they don’t have access to equity from a previous home sale to help with a down payment, and almost always (80% of the time) finance their purchase with a mortgage (which, as noted above, is often a greater hurdle for Latinx buyers).

Some of the challenges for Latinx home buyers are also flowing through to other aspects of their lives: Latinx buyers are more likely to report that the cost of housing interrupted or delayed marriage (28% of Latinx buyers, versus 18% of buyers as a whole), having children (29% versus 19%), retirement (26% versus 19%) and moving in with a partner (31% versus 17%).

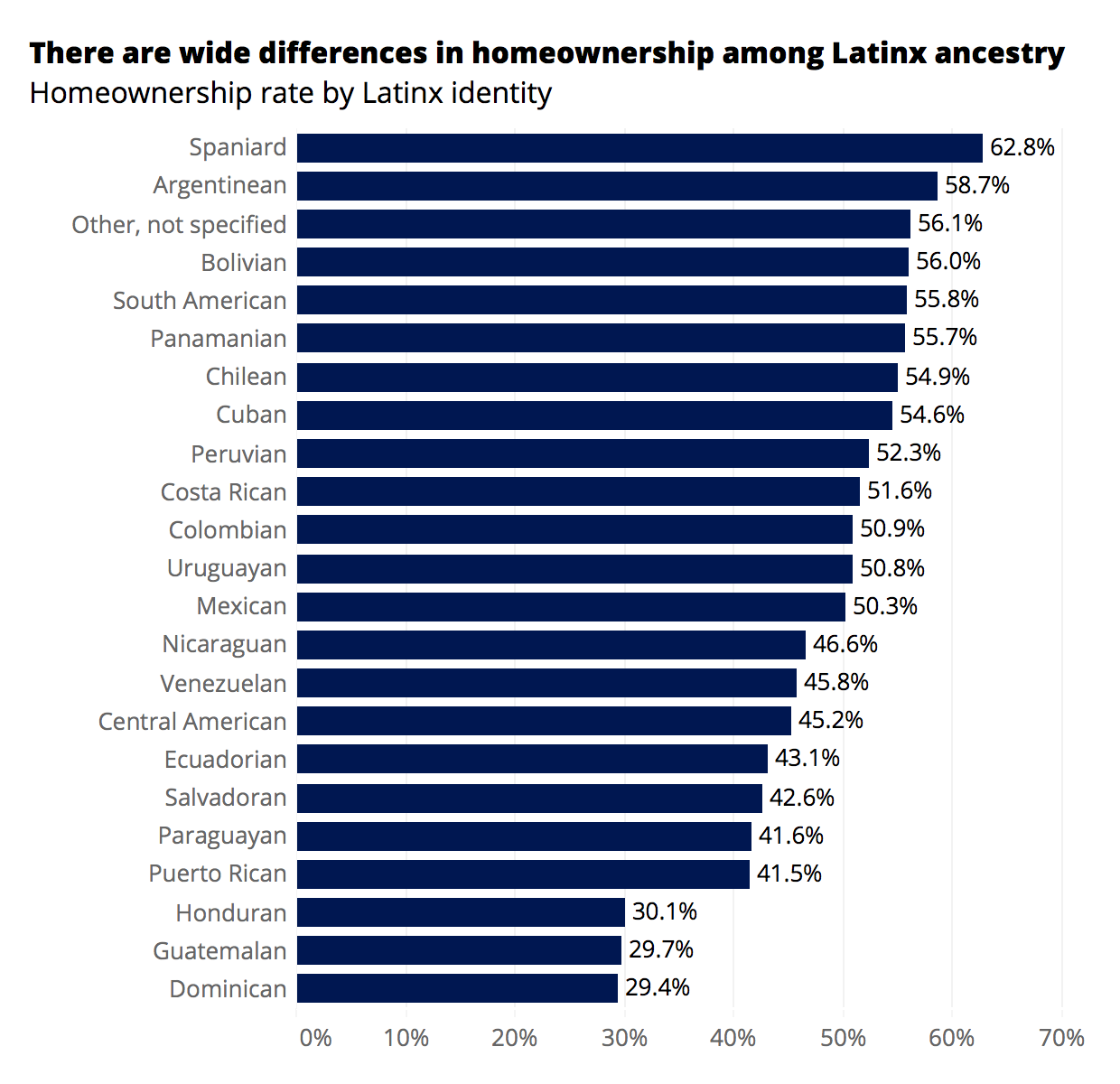

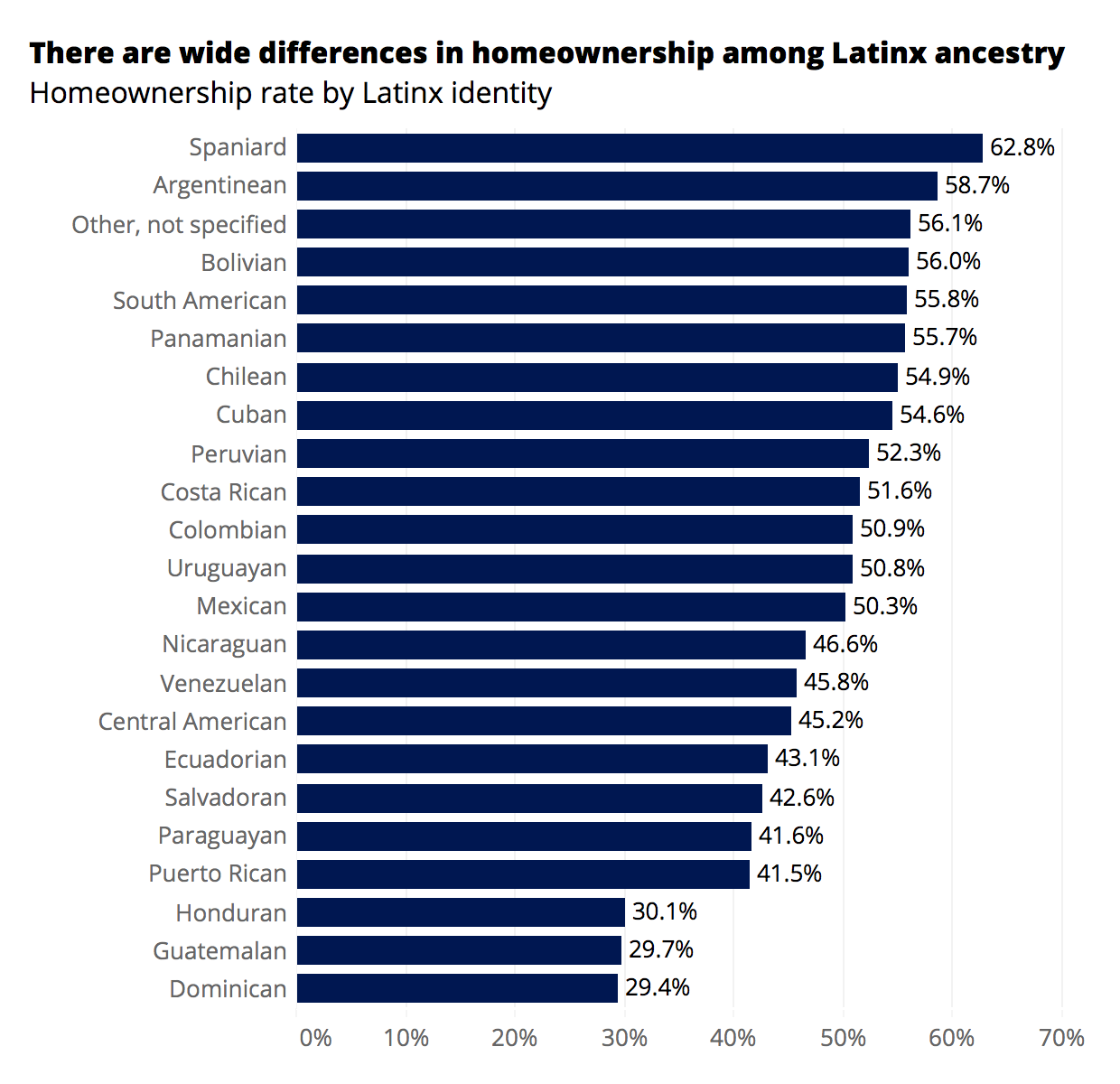

Latinx Americans are a massive and diverse group numbering more than 60 million. Between 2014 and 2018, Latinx Americans identified with more than 200 unique ancestries and spoke more than 100 distinct languages at home. That diversity is also evident in the often wide differences in homeownership within the community overall. For example, just 29% of Latinx household decision makers of Dominican descent own their home, compared to 63% of those reporting Spanish descent.

And many of the same variables that impact the likelihood of homeownership for the U.S. population as a whole also play a part among Latinx Americans. Age, U.S. citizenship, education, English proficiency and years lived in the U.S. all increase the likelihood of being a homeowner. On the flip side, residency in certain pricey markets and/or areas with low home inventory can serve to reduce the probability of homeownership.

Variables including country of origin, race, and years spent living in the US all correspond with household wealth: Newcomers to the United States and/or those coming with fewer means are less likely to have accumulated the wealth required to buy a home. This relationship between time in the US and wealth may in part explain the slightly lower homeownership rate among first generation Latinx Americans (46%) compared to second-generation and later Latinxs (50%).

As the share of the U.S. population that identifies as Latinx grows, the community will likely continue to wrestle with the homeownership inequities that affect the U.S. as a whole — and often may feel certain home buying challenges more acutely. At scale, these challenges represent roadblocks to a level housing market, while also revealing pain points that will need addressing in order to achieve true equality.