Why Blacks and Hispanics Rely On Their Homes for Their Wealth

White households are more than twice as wealthy as black and Hispanic households, and their more diversified portfolios mean that a smaller portion of whites’ wealth is tied up in their homes.

- Roughly half (51.2 percent) of the total wealth accumulated by the typical American homeowner is tied up in a primary residence.

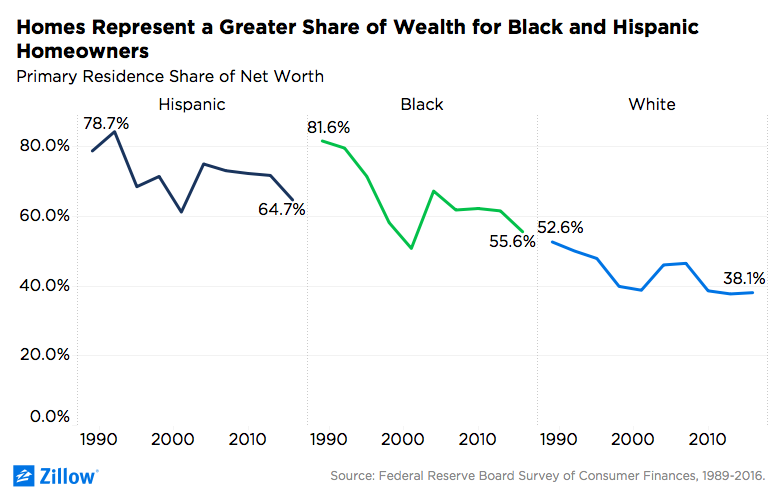

- The median white homeowner in 2016 had 38.1 percent of her net worth stored in her primary residence, compared to 64.7 percent among Hispanic homeowners and 55.6 percent among black homeowners.

White households are more than twice as wealthy as black and Hispanic households, and their more diversified portfolios mean that a smaller portion of whites’ wealth is tied up in their homes.

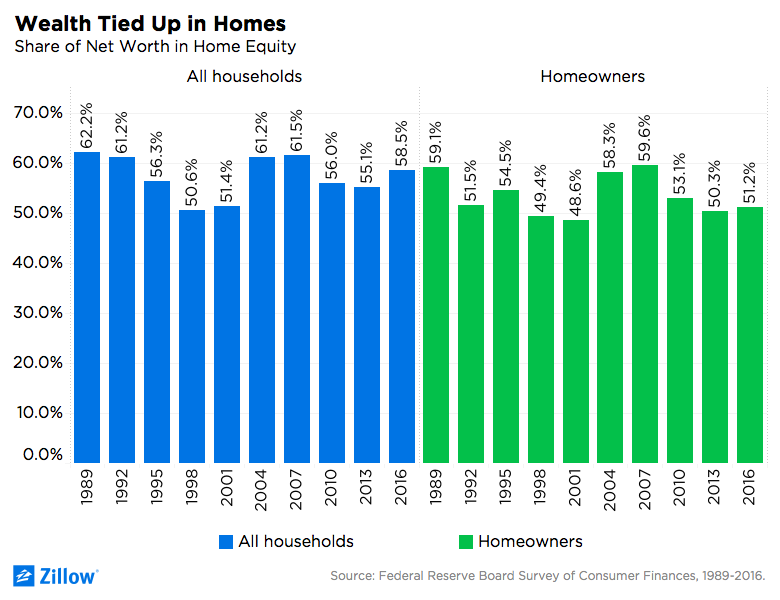

Just over half the total wealth accumulated by the typical American homeowner (51.2 percent) is tied up in their primary residence, according to newly released data from the Federal Reserve Board’s Survey of Consumer Finances. The share is up slightly from 2013 (50.3 percent), but well below the 59.6 percent reported in 2007 just after the housing bubble peaked.

Looking at all American households, including renters – who obviously have no wealth in a primary residence, because they don’t own one – the typical American household had 58.5 percent of its net worth in a primary residence, up from 55.1 percent in 2013. [1]

Less affluent homeowners have more of their net worth stored in primary residences. Homeowners with the least amount of total wealth (those in the lowest one-fifth of net worth) had 65 percent of their total wealth in home equity. The most affluent homeowners (those in the top fifth of net worth) have just 20 percent of their total wealth tied to their primary residence. Compared to 2013, homeowners in all wealth segments have seen their asset concentration in their primary residence increase.

Wealth in the United States is strongly correlated with race and ethnicity. The median white homeowner in 2016 had 38.1 percent of her net worth stored in her primary residence, compared to 64.7 percent among Hispanic homeowners and 55.6 percent among black homeowners. The homeownership rate among whites is higher, and white households also tend to own pricier homes. Whites also tend to have more diversified portfolios, so their primary residence is a smaller portion of their total net worth.

Overall, the net worth of the median white household is $272,000, 2.6 times the net worth of the median black household and 2.5 times the net worth of the median Hispanic household.

Expanding the universe to all households (renters and homeowners) shows that the median black and Hispanic household has no net worth in a primary residence – because the median black and Hispanic household rents. The median white household has almost a quarter (23.5 percent) of its net worth in a home.

[1] When including renters, the median amount of wealth held in a primary home shifts toward slightly less-wealthy households, because these households are less likely to hold other financial assets.