Key takeaways for the 4-week period ending August 2:

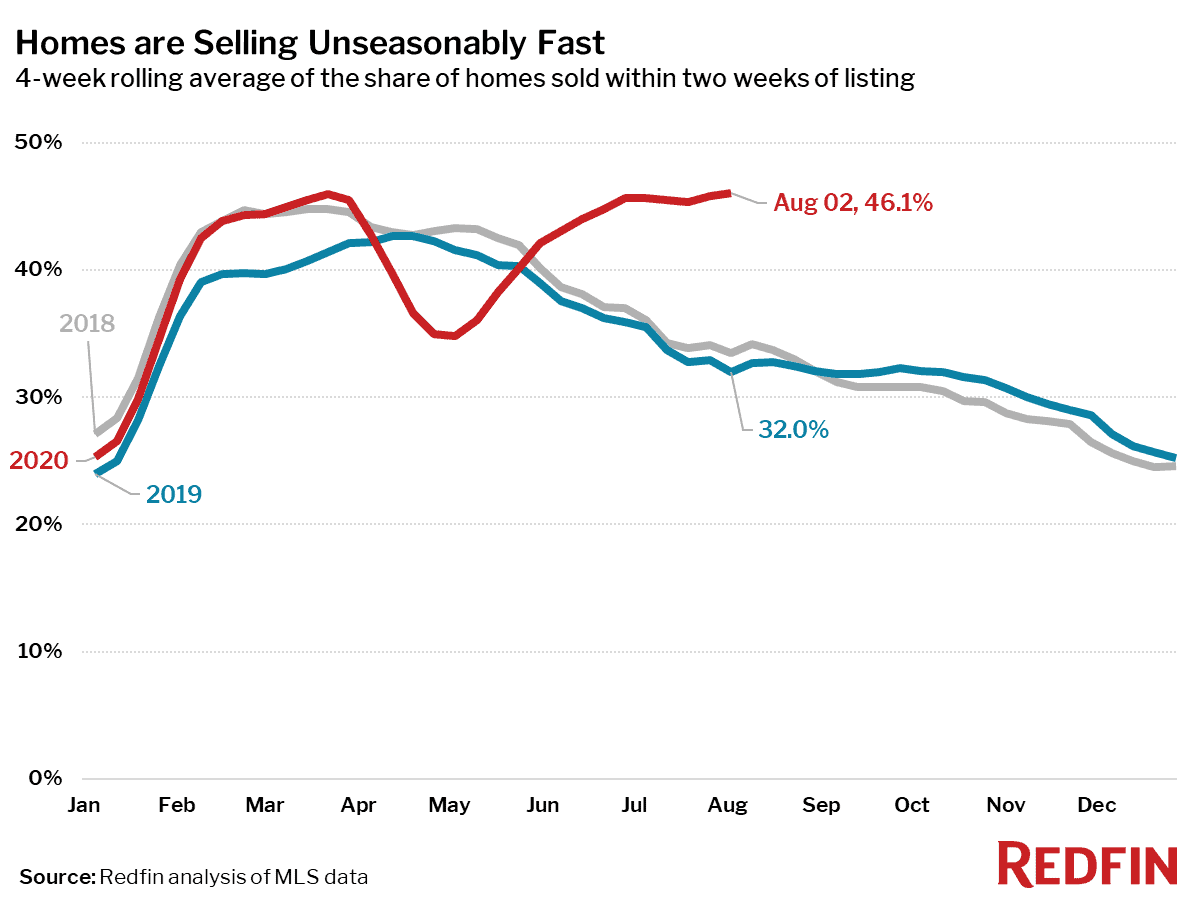

- A record-high share of homes are selling fast: 46% of homes sold within the first two weeks on the market, the highest level since at least 2012 (as far back as our data on this measure goes).

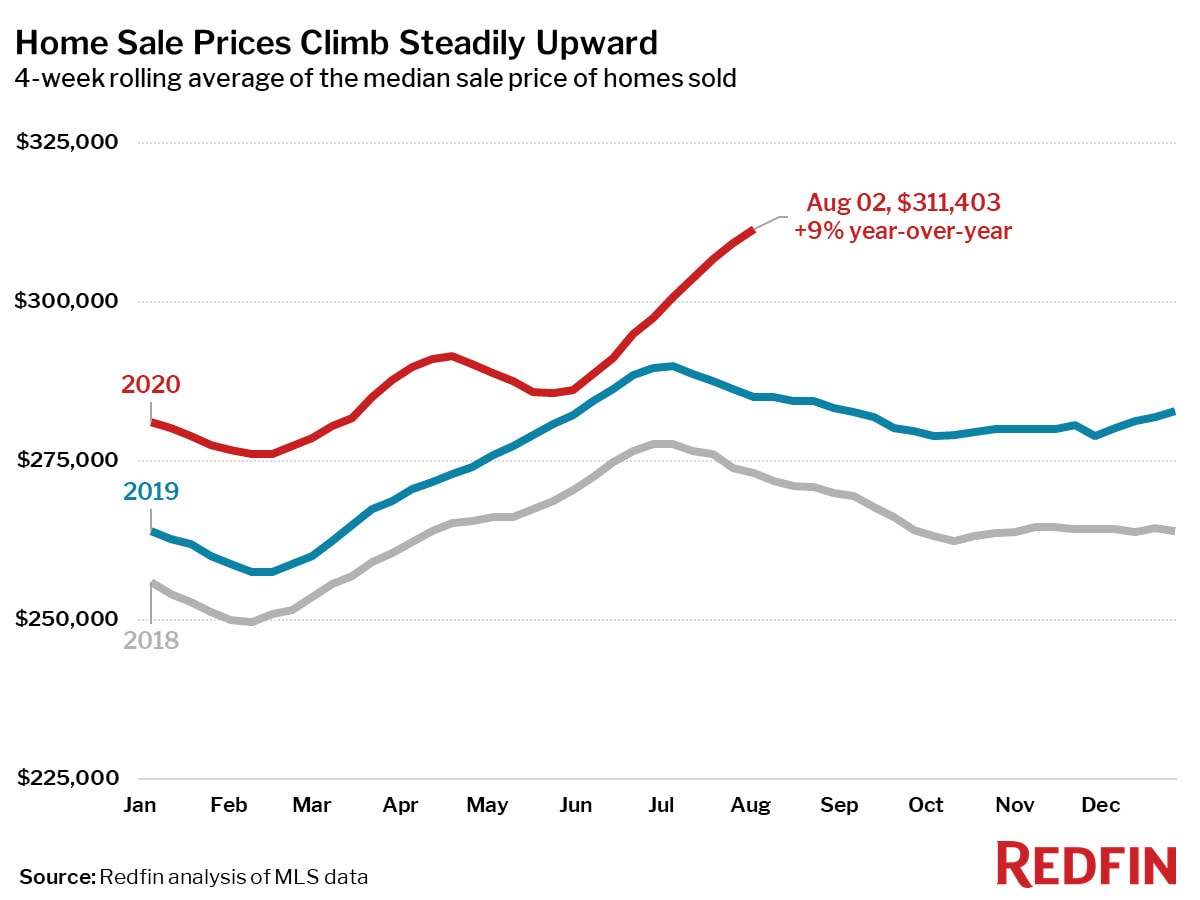

- Home sale prices were up 9% year over year to another new all-time high of over $311,000. “The combination of ultra low inventory, very high buyer demand, and super duper low interest rates is a very successful formula for sellers, not so great for buyers,” said Brian Morales, a Redfin agent in Orange County, California.

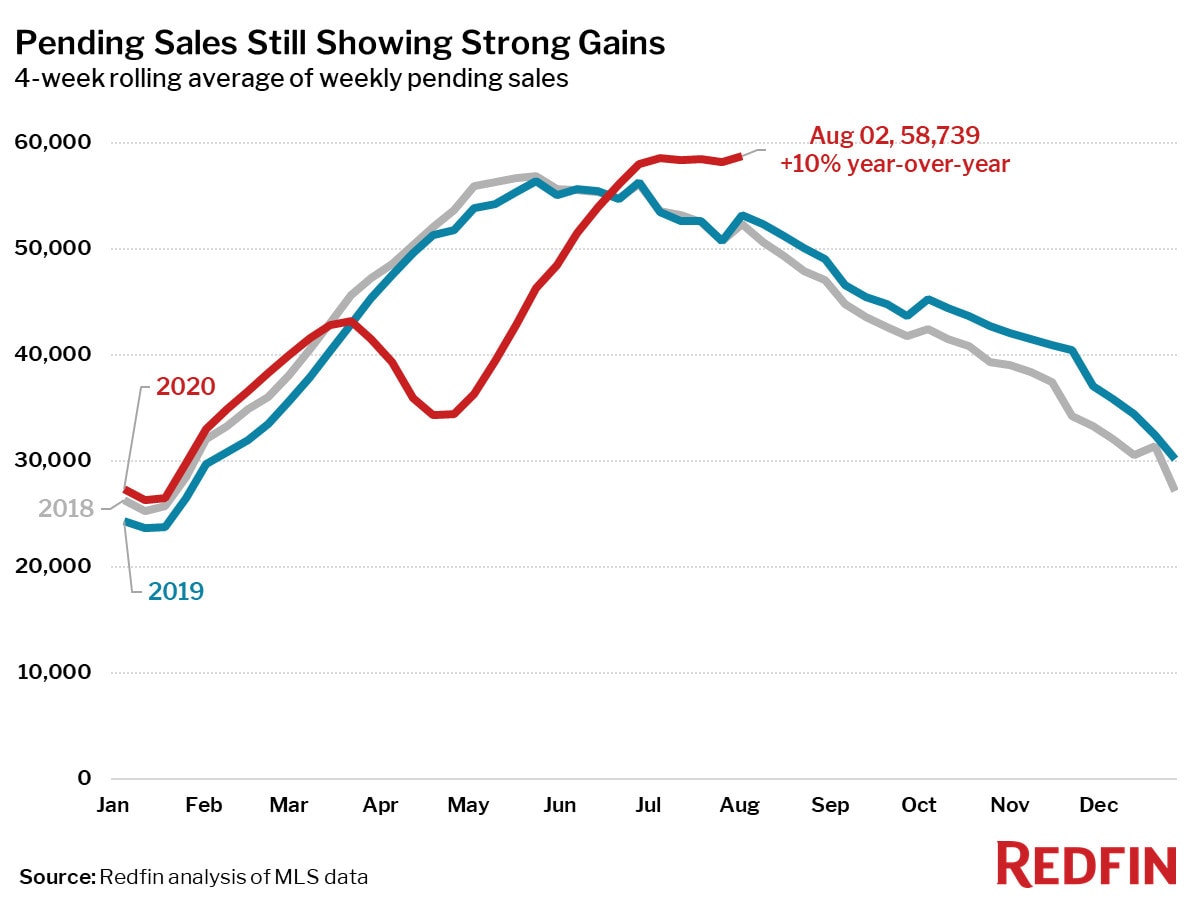

- Pending home sales were up 10% year over year and have plateaued over the last month, up just 0.2% from the four-week period ending July 5. Sales declined an average of 1.4% over the same period the last two years.

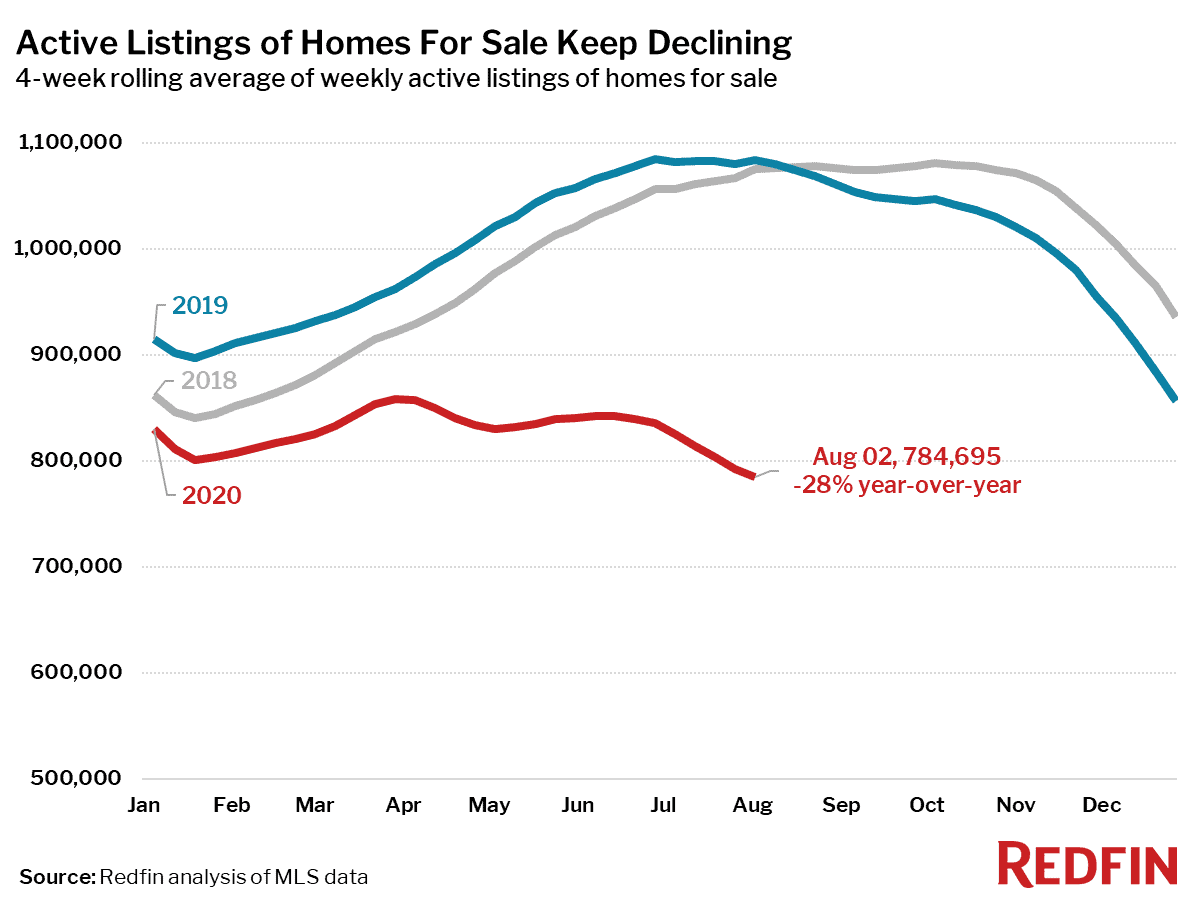

- The supply of homes for sale continued to fall; year over year, new listings were down 2.7% and active inventory of homes for sale was down 28%.

Buying a home in July felt like finding toilet paper in April

Trying to buy a home today is starting to feel similar to searching for hand sanitizer or toilet paper in the early days of the coronavirus pandemic—everything is flying off the shelves faster than it can be restocked.

Of homes that went under contract during the four week period ending August 2, 46% found a buyer within two weeks of hitting the market—the highest level we’ve seen since at least 2012 (as far back as our data is available). During the same period last year, 32% of homes found a buyer within two weeks.

The average sale-to-list price ratio remained at its record high of 99%–meaning homes are selling closer than ever to their list price–up from 98.5% during the same period last year. Homes actively listed for sale during the four weeks ending August 2 had been on the market (age of inventory) for 49 days, the lowest level on record. In other words, the typical home for sale was listed around mid-June. Homes typically take longer to sell after June as the spring homebuying season winds down; last year, the age of inventory increased 6.5 days between early June and early August. But this year, the age of inventory fell at a record pace, down 18 days over the same period.

Prices keep climbing to new highs

The median price of homes that sold during the four-week period ending August 2 was up 9% year over year, and hit a new all-time high of $311,403.

During just the last week of the period, the median home sale price hit $316,614, up 11% from a year earlier. Home price gains over the past month have been unseasonably strong. Last year home prices fell 1.7% from the first week of July to the first week of August, but this year price increased 3.5% over the same timeframe.

“Hands down, interest rates are the major driving factor in home prices right now,” said Orange County Redfin agent Brian Morales. “Affordability with interest rates below 3% is key. The combination of ultra low inventory, very high buyer demand, and super duper low interest rates is a very successful formula for sellers, not so great for buyers.”

Demand is unseasonably strong

The seasonally adjusted Redfin Homebuyer Demand Index was up 29% from pre-pandemic levels in January and February. Pending home sales were up 10% compared to a year earlier, even though they only increased 0.2% between the four-week periods ending July 5 and August 2. During this same time in 2018 and 2019 pending sales declined an average of 1.4%.

“Normally this time of year the market would be slowing down,” said Redfin chief economist Daryl Fairweather. “But given that mortgage rates keep falling to new lows, and more people are just now getting clarity on how often they can work remotely and whether their kids will be going back to school this year, we are likely to see an unseasonably busy fall and even winter.”

Supply keeps on slipping away

The lack of homes for sale means homebuyers are finding that if they want to win a bidding war they have to make aggressive offers. “I helped one of my buyers win a home by putting in an offer with an escalation clause (which automatically increases the offer price up to a predetermined maximum relative to the next-highest bid) just a few hours after it hit the market,” said Cleveland Redfin agent Danielle Parent. “This was ‘the’ house for my buyers—the one they really wanted. We went 4% over list price and beat the next-highest offer by $100.”

The number of new listings is still down 2.7% from 2019 for the four-week period ending August 2, and active inventory of homes for sale was down 28%, falling to the lowest point since the National Association of Realtors and the government began tracking this data in 1999.

“We should have had a delayed flood of new listings from March and April when the shutdown ended, but they never came,” said Austin-based Redfin listing agent Carmen Petersen. “For home owners who are thinking of selling and buying something else, it’s a daunting prospect because of how difficult the market is right now for buyers. Another reason potential home sellers may be reluctant is because they aren’t comfortable having buyers coming into their house while they’re living there—most of the houses that we’re seeing on the market are vacant.”

Interest rates will likely continue to prop up homebuyer demand in a uncertain economy

With the Federal Reserve planning even more actions aimed at stimulating the economy, interest rates are likely to remain low for years, continuing to prop up demand from homebuyers for the foreseeable future, but the long term health of the overall economy is the wildcard.

“Even though housing has strengthened throughout the pandemic, the U.S. economy is still in a precarious place and at risk of getting worse,” continued Fairweather. “If it does get worse, that could eventually hurt the housing market, and even record-low mortgage rates couldn’t help that.”

United States

United States Canada

Canada