The global food safety testing market size was valued at $18.7 billion in 2021, and is projected to reach $37.5 billion by 2031, growing at a CAGR of 7.2% from 2021 to 2031.

As part of food safety testing, pathogenic organisms, chemicals, and other dangerous pollutants are inspected in food products. The three primary types of food contaminants that are normally the focus of food safety testing market are pathogens, chemicals, and genetically modified organisms (GMOs).

Despite being the final stage of the food manufacturing chain, testing food products is regarded as the most crucial step. Food product testing is essential to ensure that the food is safe for consumption and to ensure that it is free of physical, chemical, and biological dangers. Metals, infections, cleaning products, additives, preservatives, pesticides, adulterants, and other substances are a few examples of food contamination that could be dangerous. Food product testing refers to the process of scientifically analyzing food and its components to learn more about the structure, composition, and physicochemical qualities of the food in the food safety testing market.

For all food enterprises, food testing has become essential after the pandemic due to surge in health consciousness among consumers across the globe. In some locations, the FSSAI even requires it as a requirement as part of the license application process. Food testing helps maintain product quality, assure its safety, and identify any products' potential health advantages or concerns. Operators of food businesses are responsible for ensuring that they carry out food quality monitoring in order to adhere to food rules and to safeguard the public's health.

Falsification and adulteration done for financial benefit are two of the major serious fraudulent practices in the food industry that impac the food safety testing market. Eating contaminated food, which may also contain radioactive and dangerous compounds, causes foodborne illness. This condition could possibly be lethal. Some of the most common methods used in food fraud include recycling animal leftovers, selling goods after their "use by" dates, and using risky food handling techniques. The leading food safety organizations that have been identifying and minimizing such deliberate actions are the Food Standards Agency, the European Food Safety Authority, the Food Safety and Standards Authority of India, and the Canadian Food Inspection Agency. To track the distribution of fake goods, the European Food Safety Authority, for instance, has developed food supply traceability systems to avoid such dishonest actions. The Rapid Alert System for Food and Feed (RASFF), one of the EU's proposed action IT tools, instantly warns member states and enables them to halt the sale of goods. The US Department of Agriculture is in charge of marketing, the US EPA is in charge of sport and recreational fishing, the FDA is in charge of fish safety, and the NOAA is in charge of ocean fisheries. These organizations track products to prevent frauds that cheat fishermen and end consumers. The adoption of such strict legislation to combat food fraud is expected to drive global food safety testing market demand.

Owing to the existence of numerous reputable manufacturers and providers, the market for food safety testing in the U.S. is extremely competitive. Moreover, there has been a substantial amount of food safety testing market consolidation recently and this trend is anticipated to continue, given the increased acceptability of food safety testing and technical developments. Food producers have faced fierce rivalry as the global food market has grown. For example, adding formalin to fish and meat products as a preservative helps to keep the product fresh and hence increases its shelf life. However, deliberately tampering with food causes health risks and has an effect on clients, companies, and the economy.

To increase earnings, the quality of the food is purposefully degraded. Food adulteration involves inadvertent contamination during growing, harvesting, handling, transporting, & distributing of food, in addition to intentional addition or substitution of ingredients. Food that has been altered poses a hazard to life since it is poisonous and deficient in essential nutrients, both of which have a negative impact on health. The majority of contaminated food products are found in the U.S., Latin America, India, and China. The contaminated food products include milk-based products, seafood, and honey. Authorities in food safety make sure that both domestic and foreign food products are wholesome and safe for human consumption.

It is difficult to measure and identify food fraud since it happens frequently in the global food and beverage business. There are many food traceability and safety procedures in place to safeguard the food authenticity. However, as the food fraud business continues to grow and diversify, the present methods of food detection for ensuring food safety are anticipated to confront substantial difficulties. The COVID-19 pandemic increased consumer demand for food products as a result of panic buying among consumers. As a result, panic buying, rushed industry audits, and ongoing pressure on the food industry have exposed more vulnerabilities in an already complicated system.

In addition, due to the increased consumer awareness of food safety in the post-pandemic period, the demand for food safety testing in the food safety testing market is anticipated to increase quickly in the coming years. Furthermore, consumer spending on food safety testing is expected to rise as active players in the food business introduce new, cutting-edge techniques to the market with an effort to guarantee customer safety and security. In light of this, the market for food safety testing is anticipated to have a significant growth during the food safety testing market forecast period.

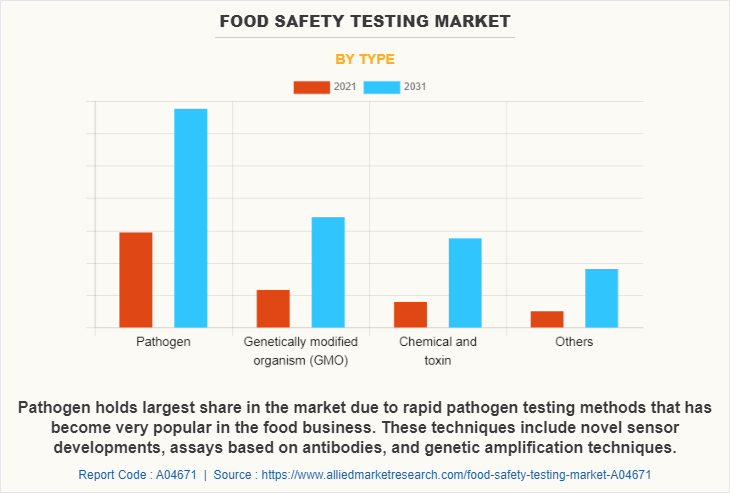

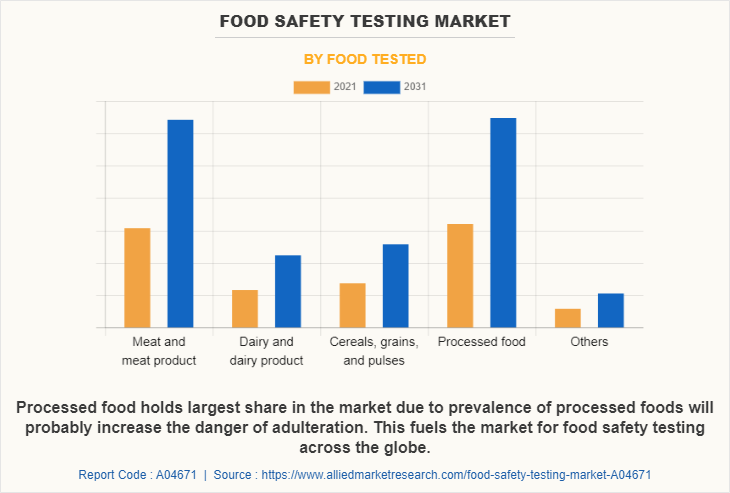

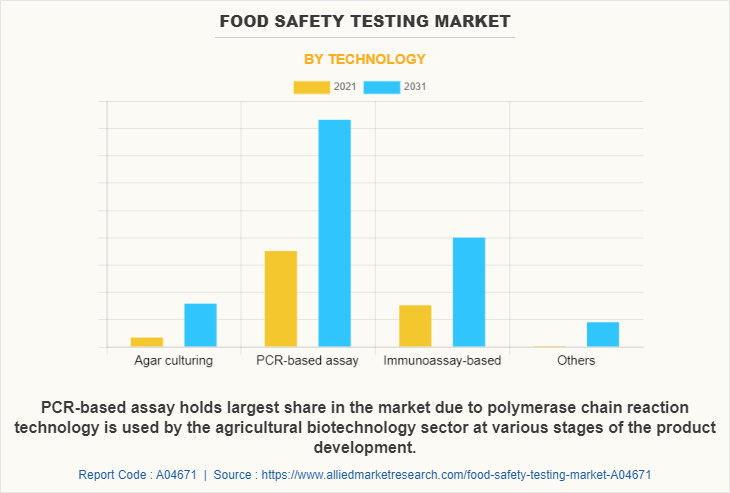

The food safety testing industry is segmented on the basis of type, food-tested, technology, and region. By type, the market is categorized into pathogen, genetically modified organism (GMO), chemical & toxin, and others. On the basis of food-tested, the food safety testing market is fragmented into meat & meat product, dairy & dairy product, cereals, grains, pulses, processed food, and others. As per the technology, the market is divided into agar culturing, PCR-based assay, immunoassay-based, and others. Region-wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, Switzerland, and the rest of Europe), Asia-Pacific (China, India, Japan, South Korea, Australia, and the rest of Asia-Pacific), and LAMEA (Brazil, South Africa, UAE, Saudi Arabia Argentina and the rest of LAMEA).

By type, pathogen had the largest food safety testing market share in 2021 with a CAGR of 7.1%. Moreover, In the food industry, rapid pathogen testing techniques have grown highly popular. These methods include new advancements in sensors, assays based on antibodies, and methods for genetic amplification. Enrichment is a traditional plating technique with limitations, such as taking days to produce results as opposed to more modern rapid approaches, which produce results in just a few hours. Genetic amplification methods such as PCR and nucleic acid sequence-based amplification have dramatically shortened assay times while maintaining a high level of specificity and sensitivity (NASBA). These methods can distinguish between closely related species where most antibody testing cannot. These amplification approaches are, however, only used at the moment as a screening method before applying standard culture techniques. As a result, pathogen testing is a popular choice among firms in the food safety testing market.

By food tested, processed food had the largest food safety testing market size in 2021 i.e., $6,430.4 million in 2021, and is expected to reach $12,990 million by 2031, growing at a CAGR of 7.3% during the forecast period. The shelf life, flavor, and aroma of processed foods are frequently increased by adding a variety of additives. However, to enhance the food product, the food producers routinely include a number of food additives that are harmful to health and are outlawed by the FDA. Compounds called food additives are added to food to improve its flavor, color, and shelf life. Food additives are employed in the production of food to change the flavor and consistency. Numerous chemicals are mixed with processed food to produce it in the proper form. The health of the consumer may be gradually impacted by these chemicals, depending on how frequently they are included in the customer's daily diet. To prevent dried fruits from rotting by bacteria and turning brown, sulfite is additionally added to them. However, sulphites may cause allergic reactions or hives. As a result, the risk of adulteration is expected to undoubtedly increase as processed foods become more common. This stimulates the global food safety testing market.

By technology, PCR-based assay segment had the largest food safety testing market share in 2021 and is expected to have the largest market share during the forecast period. as real-time polymerase chain reaction is a quick and affordable quantitative technique that helps in detecting both intentional and unintentional food adulterations brought on by biological contaminants by quantifying the amount of certain DNA-segments present in samples. In addition, the agricultural biotechnology industry employs polymerase chain reaction technology at many stages of the product development process. The method is generally used to determine whether or not there is genetically modified material in a product sample or to estimate the amount of genetically modified material present in a product. The method is generally used to determine whether or not there is genetically modified material in a product sample or it is used to estimate the amount of genetically modified material present in a product. Food diversity, quantity, and mobility are all changing quickly, which makes food analysis even more necessary to ensure food quality and safety. In addition, food safety technology can identify a wide range of products, including meat & meat products. It also identifies plants that are consumed as food ingredients, genetically modified organisms, food-borne viruses or bacteria, and allergens, in highly processed food and even at low concentrations. Polymerase chain reaction testing is hence more popular, hence likely to propel the food safety testing market growth.

By region, North America held the largest share in 2021 i.e., $6,830.4 million in 2021, and is expected to reach $13,339.2 million by 2031 at a CAGR of 6.9% in the forecast period, due to the enormous demand from the U.S., which dominates the market for food safety testing. Players in the food safety testing market has wide presence in the North American market by delivering specialized product lines and higher-quality food safety testing services, while utilizing cutting-edge marketing and manufacturing strategies. The region's market for food safety testing is anticipated to expand as a result of rise in disposable income in Canada. According to MDPI, there are an estimated 9.4 million cases and 1351 fatalities from foodborne illnesses in the U.S. per year. In addition, Mississippi still faces a public health burden from foodborne infections (MS). According to the Mississippi State Department of Health, the three most common foodborne infections in Mississippi are salmonellosis, campylobacteriosis, and shigellosis (MSDH). Mississippi is also one of the top agricultural states, with significant rates of obesity and associated health disparities. As a result, the number of companies offering food safety testing in the North American region is projected to grow.

The food safety testing industry is being driven by factors such as rapid growth in infrastructural development as well as various advancements in developing countries. The major players operating in global Food safety testing are SGS SA, Eurofins Scientific, Intertek Group PLC, Bureau Veritas SA, ALS Limited, TÜV SÜD, AsureQuality Ltd, DNV GL, Bio-Rad Laboratories, and Thermo Fisher Scientific, Inc.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the food safety testing market analysis from 2021 to 2031 to identify the prevailing food safety testing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the food safety testing market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global food safety testing market trends, key players, market segments, application areas, and market growth strategies.

Food Safety Testing Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 37.5 billion |

| Growth Rate | CAGR of 7.2% |

| Forecast period | 2021 - 2031 |

| Report Pages | 171 |

| By Type |

|

| By Technology |

|

| By Food Tested |

|

| By Region |

|

| Key Market Players | AsureQuality Ltd, TUV SUD AG, Bio-Rad Laboratories, SGS SA, Intertek Group plc, Bureau Veritas SA, DNV AS, Thermo Fisher Scientific, Inc., Eurofins Scientific, ALS Limited |

Analyst Review

According to the top CXOs, North America is projected to witness the largest share during the forecast period owing to the growing cases of food-borne diseases in the region. The major emerging markets include the U.S., the UK, Germany, and France. The population summed up with a significant demand, rise in disposable income, huge investment, and enhanced food safety testing are important factors that propel the growth of food safety testing techniques in emerging markets. Furthermore, Asia-Pacific is the leading destination for agriculture, and it is the highest revenue generator in the food and beverage industry. Therefore, the growing consumption rate of food is expected to fuel the growth of the Food safety testing market in emerging nations. Many new market players are expected to enter the Food safety testing market during the forecast period, attracted by profitable growth and high-profit margins.

Moreover, the adulteration of imported tea with iron filings in the nineteenth century is only one example of how food fraud has long been a big worry for the food sector. The market is now predicted to be dominated by meat adulteration, fish species substitution, the use of chemicals such as formalin in meat and fish products. As it is challenging to identify food fraud, sophisticated analytical procedures must be developed. These techniques include molecular biology, isotopic analysis, and a variety of traditional physical, chemical, and biological approaches. Economically motivated adulteration (EMA) has rapidly increased in the market, which is a major health threat for consumers. Meat and processed food product segments are anticipated to witness the highest growth rate during the forecast period.

The U.S. is expected to witness significant growth on account of increase in processed food production and a surge in food safety concerns among consumers. Furthermore, supportive government policies regarding food testing in the country coupled with foreign investments in the food & beverage industry are expected to boost the market for food safety testing during the forecast period.

By food tested, processed food holds the largest share of the market. In addition, multiple additives are often added to processed food to increase shelf life, flavor, and scent. This fuels the market for food safety testing across the globe.

North America is the largest regional market for Food Safety Market. The prevalence of improper usage of pesticide in developing countries such as India and China are expected to contribute to the growth of the food safety testing market.

Rise in economically motivated adulteration (EMA) owing to high competition among food producers is one of the drivers of the food safety testing market. Food producers have witnessed high competition over the years owing to growth in the global food industry.

The major players operating in the global Food safety testing are SGS SA, Eurofins Scientific, Intertek Group PLC, Bureau Veritas SA, ALS Limited, TÜV SÜD, AsureQuality Ltd, DNV GL, Bio-Rad Laboratories and Thermo Fisher Scientific, Inc.

The global food safety testing market size was valued at $18,713.3 million in 2021, and is projected to reach $37,469.8 million by 2031, registering a CAGR of 7.2%. the use of rapid test kits shields the business from unintentional food product adulteration, which is anticipated to present prospects for market advancement.

By type, pathogen were the highest revenue contributor in 2021 with a CAGR of 7.1%. In addition, quick pathogen testing methods have become very common in the food business. New developments in sensors, tests based on antibodies, and techniques for genetic amplification are a few of these techniques.

In the post-pandemic period, the demand for food safety testing is expected to retain its growth. The innovations of the engaged stakeholders in the market will help to enhanced food testing technology, which will help gain consumer attention and will help the market grow. Furthermore, the increase in online penetration will further lead to market proliferation.

China and U.S. have enormous market in the Food safety testing market. This is attributed to the huge number of players in the region offering wide range of products at lucrative prices as well as purchasing power of population in this countries contributing in the growth.

Loading Table Of Content...

Loading Research Methodology...