| Executive Summary

This report reviews public opinion on tax policy and the nation’s tax system in the years leading up to the passage of the TCJA, including underlying attitudes about who benefits from the tax system and the relationship of taxation to perceptions of deficits, government spending, and the overall economy. This report also looks at how the law is now viewed by the public and its potential impact in the upcoming midterm elections, including which messages about the law are most persuasive to Americans.

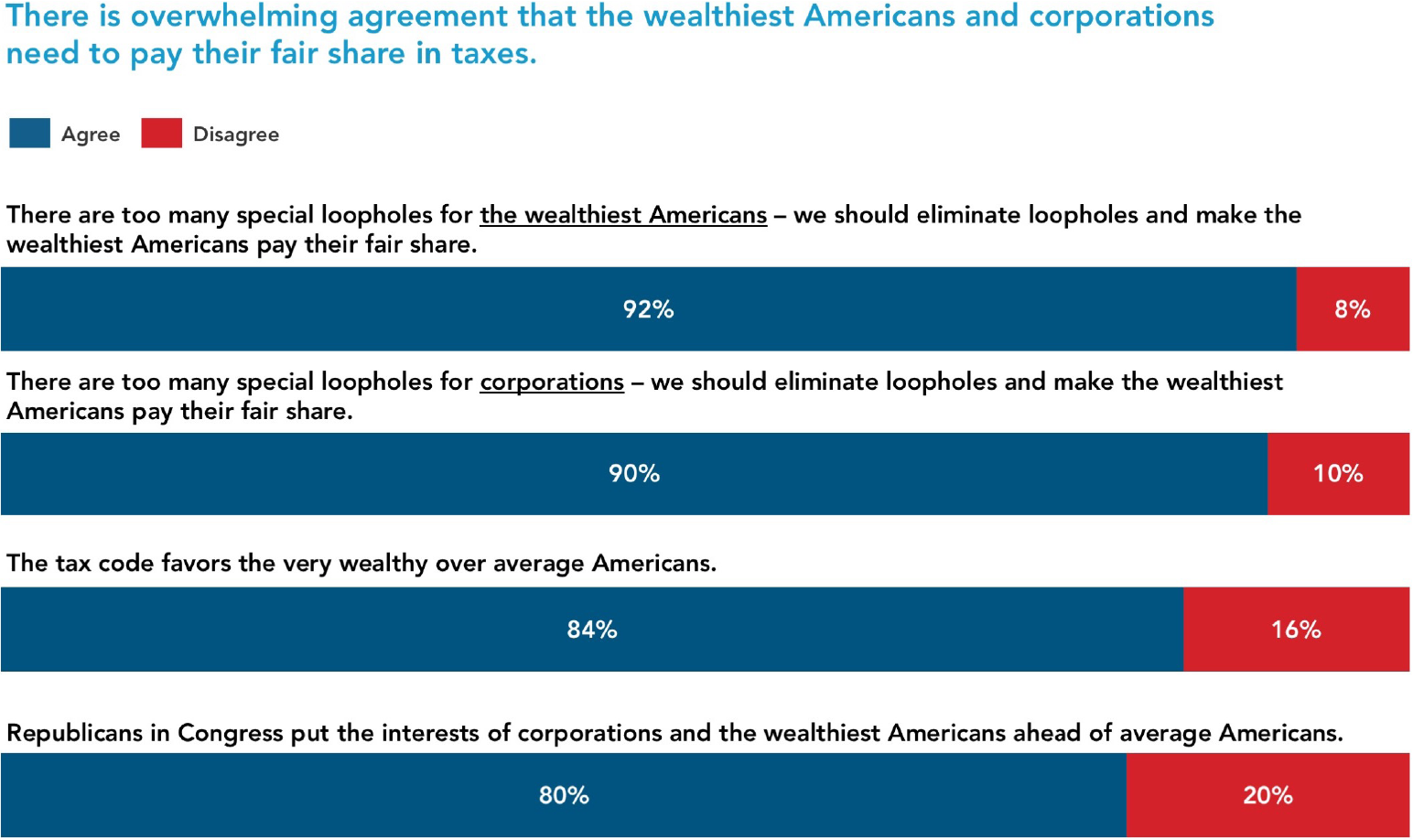

- Public opinion research over the past several years clearly demonstrates Americans believe that the tax system favors the wealthy and large corporations over everyone else. These are widely held beliefs across the political and ideological spectrums, even among Republicans and conservatives. Moreover, the public overwhelmingly rejects many conservative economic theories about the tax system.

- While there are competing views of the tax system and its impact on the economy, taxing the wealthy and corporations is seen as better for the economy than tax cuts for individuals or corporations.

- When it comes to taxes and government spending, Americans are supportive of cutting spending in theory, but are extremely concerned about potential cuts to popular public programs, and support raising taxes on the wealthy and corporations to enhance government programs that protect people and invest in the future.

- Now that it has been enacted, public opinion on the tax law is divided along partisan lines. Since passage of the law, the average level of support or approval among the public for the TCJA has hovered under 40 percent. The law has not become the lifeboat Republicans had hoped would buoy their approval ratings and electoral support in the midterm elections.

- Americans are convinced that the new law unfairly benefits the wealthiest individuals and largest corporations

at the expense of the middle class. The public also worries that the law will raise the deficit, resulting in deep cuts to valued public programs such as Medicare, Medicaid, Social Security, education, and infrastructure. - While the public is divided on the TCJA’s impact on the economy, opposition arguments to it strongly and consistently prevail over conservative defenses of the law.

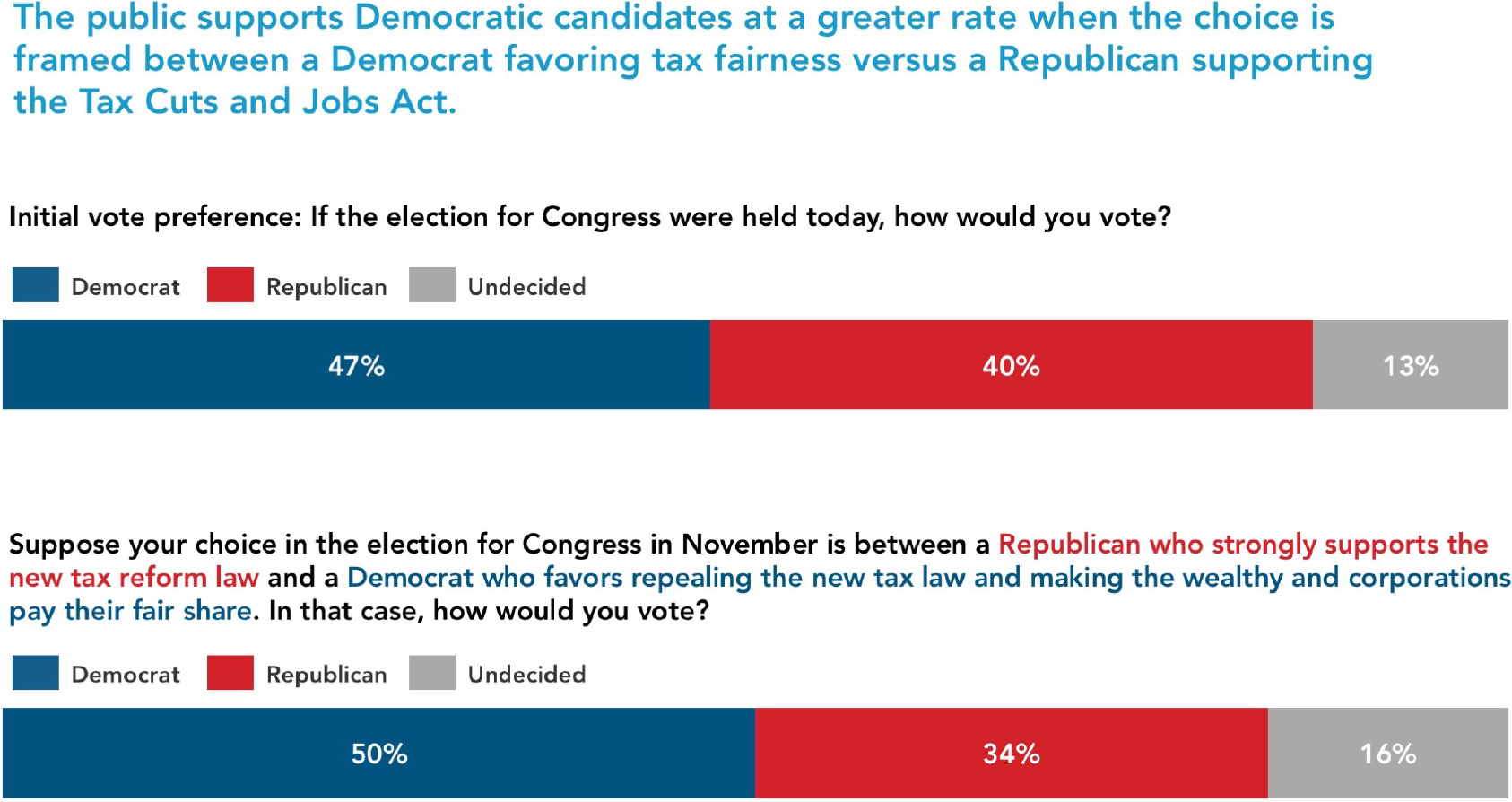

- Over the past year, as debate on this tax law continued, a number of polls revealed evidence that there is potential to actually increase electoral support for Democrats in next month’s elections.

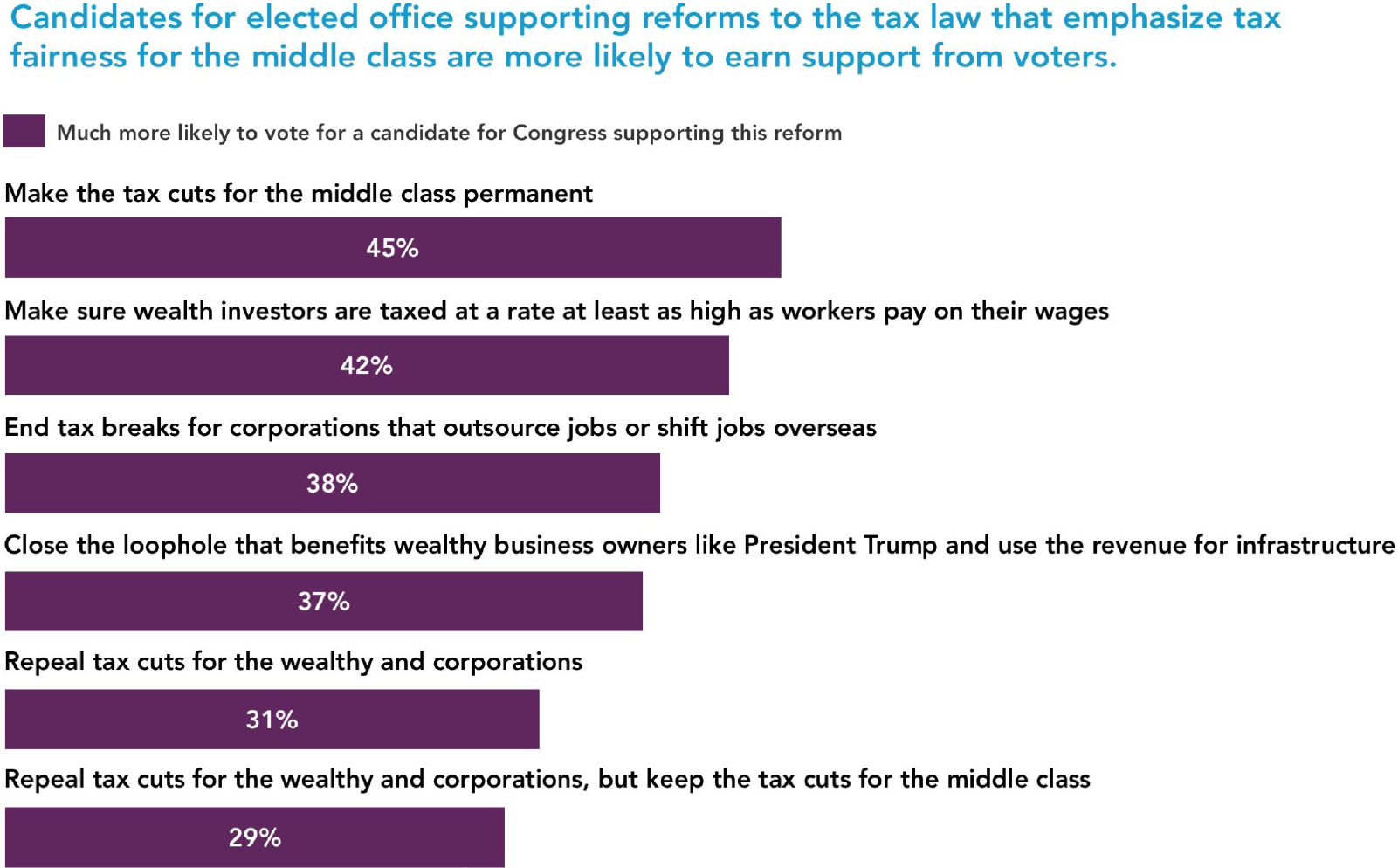

- Voters prefer a candidate who will replace the TCJA with one that taxes corporations and the wealthy, but support keeping their own personal tax cut intact.

Activists and elected officials gathered on Capitol Hill in December 2017 to rally against the proposed GOP tax law and demand not one penny in tax breaks for millionaires, billionaires, and wealthy corporations.

| Introduction: New Tax Cuts, Same Old Reasons

On December 20, 2017, as the first year of Republicans controlling Congress and the White House neared its end, Republicans passed the TCJA – their first and only major legislative achievement of the 115th Congress. The law passed on party lines in both chambers, with all Republicans in the Senate and all but 12 Republicans in the House of Representatives supporting the legislation, and with unanimous Democratic opposition.1 Passing the law was seen as a political necessity for Republicans, with the GOP attempting to prove that they could govern and deliver on what they have long seen as a core, uniting issue: reducing taxes. On the day of House passage, Speaker Paul Ryan declared: “But when we get this done, when people see their withholding improving, when they see the jobs occurring, when they see a simpler tax code, that’s what’s going to produce the results. And results are going to be what makes this popular.”2

An attendee at a rally on Capitol Hill against the proposed GOP tax law holds up a sign proclaiming that corporate wealthcare hurts the middle class, senior citizens, students, teachers, and the deficit.

According to non-partisan analysis, the TCJA was expected to reduce federal government revenues by $1.5 trillion over the next decade, with most of that, $1 trillion, through what The Washington Post called “a massive tax cut for corporations.”3 Tax cuts at the individual level included massive reductions in taxes paid by the wealthiest, as well as smaller reductions in taxes for many others and reduce the number of Americans who pay any income taxes. However, some individual taxpayers are expected to see their taxes increase over the next decade. While the corporate tax cuts are permanent, the law’s cuts for individuals expire after eight years in 2025.4

Republican congressional leaders and political operatives planned to make passage of the TCJA a central focus of their campaigns for re-election in 2018, with CNN reporting in March, “As Republicans gear up for a tough midterm election year, party leaders are pointing to their success in passing the tax overhaul last year as the key to preventing a Democratic wave in November.”5 Speaker Ryan emphasized to his members the importance of campaigning on the tax law, a call that has been echoed by his members.6 Political and business groups that support the tax law have spent millions of dollars on ads bolstering Republican candidates who voted for the law, and will continue to do so through November.7 8

In advocating for its passage, Republicans emphasized the legislation would raise wages, create new jobs, and boost economic growth, with President Trump saying that it would be “rocket fuel for our economy.”9 Celebrating the law’s passage in his 2018 State of the Union address, Trump again asserted that the TCJA was lowering taxes for middle-class families and small businesses, raising wages, and creating jobs.10

Yet, the claims that President Trump made in his State of the Union are the same false claims that Republicans have been making when it comes to taxes for the past four decades. As CBS reported when the Act passed:

The plan reflects the economic philosophy that has dominated the Republican Party since the presidency of Ronald Reagan in the 1980s: That cutting taxes and regulations and shrinking government will spur businesses to invest — in factories, equipment, software, people — and thereby energize the American economy. The benefits of a tax windfall to corporations and the wealthy will trickle down, in time, to ordinary Americans.11

In 1978, two years before Governor Ronald Reagan’s victory in the 1980 presidential election, Proposition 13 was approved in California, decreasing the state’s property taxes and required a two-thirds vote of each chamber of the state legislature for any future tax increases. Coming at a time of “stagflation,” with high inflation and slow economic growth squeezing the middle class, Proposition 13 was championed by its proponents as a call for the “less government and lower taxes” platform Reagan made a centerpiece of his campaigns for president.

In the period after Proposition 13 passed and again in the economic recession of the early 1990s, states around the country enacted limits on taxes and spending. As the Urban Institute summarized in a report, “As of 2015, 28 states had a TEL [Tax and Expenditure Limit]. … In 2015, 23 states limited only spending, although 11 of those required a supermajority to raise revenues. By contrast, only three limited revenue alone. Two states limited both.”12 The report notes only nine of the TELs passed by voter initiative, with the majority instead being enacted by state legislatures.

After Reagan became President, he signed into law in 1981 and 1986 signature tax legislation that cut the highest marginal tax rate from 70 percent to 28 percent. Since 1985, Americans for Tax Reform, an organization started by Grover Norquist, has pushed candidates for office to sign the Taxpayer Protection Pledge, which commits the signer to oppose raising taxes or tax rates. The Pledge currently has the signatures of over 85 percent of currently-serving federally elected officials in Congress.13

The power of that orthodoxy was reinforced when President George H.W. Bush ran for election in 1988 saying, “Read my lips. No new taxes.” But after Bush reached a compromise with the Democratic-controlled Congress to increase some taxes as a way to reduce the budget deficit, he was attacked by both political parties. In the 1992 Republican presidential primary, Pat Buchanan hammered at Bush for this reversal. And in the general election, Democratic nominee Bill Clinton ran an attack ad lambasting Bush for “the second biggest tax increase in American history” raising gas taxes and touting Clinton’s record in Arkansas as having “the second lowest tax burden in the country.” Time put Bush’s comment on a list of the top 10 most “unfortunate political one-liners.”14

As the Clinton ad exemplifies, Democrats assumed cutting taxes was good politics. But the reality was never as simple as that. George H. W. Bush’s agreement to raise taxes to address the federal budget deficit actually followed the example of none other than President Reagan, who signed

two bills that closed loopholes and broadened the tax base as well as other legislation that raised Social Security taxes on upper income individuals. One observer noted that together, they “constituted the biggest tax increase ever enacted during peacetime.”15

An activist holds up a sign with photos of her daughter who has complex medical needs at a rally against the GOP tax law on Capitol Hill.

On April 15, 2017, over 125,000 people took part in demonstrations across the country and in Washington, D.C. as a part of Tax March to demand that Donald Trump release his tax returns and to fight for a fair tax code for all Americans.

As Bloomberg wrote prior to passage of the TCJA, “What is less well-known is that these [1981] cuts were then followed by a series of tax increases that, if you add them all together, were almost as big as or even bigger than the 1981 cuts, depending on the measure you use.”16

The 1993 tax increases were part of legislation supported by President Clinton and the Democratic Congress to address budget deficits, which included raising the top income tax rate on the wealthy. During his presidency, Clinton supported a mix of tax increases and tax reductions for people with higher incomes, reductions for small businesses, payroll tax increases to support funding of Medicare and Social Security, and tax increases on gasoline. Republicans, in the minority, staunchly opposed the Clinton tax increases.

Unlike Republicans, Democrats have not historically made taxes central to their legislative priorities or party identification. Sometimes defensive about being described as “tax and spend liberals,” Democrats have not had clear positioning on taxes. Yet, if there has been any one idea that Democrats have supported with some regularity when budget deficits or spending priorities press the need for more revenues, it is raising taxes on higher-income taxpayers.

Democratic support for raising taxes on the wealthy is not new. For example, in 1983, the Democratic state legislature in New Jersey enacted a 2.5 percent tax increase on those with higher incomes, which was signed by Republican Governor Tom Kean alongside a small increase in sales taxes.17 For years after this, progressive Democrats have made raising taxes on the wealthy and corporations an issue priority.

In 2008, President Obama campaigned on keeping tax rates in place for couples who earned under $250,000, which was his frame for supporting increasing income taxes for those with higher incomes. As President, he focused on this pledge, ultimately agreeing to keep President George W. Bush’s tax cuts for all except couples earning more than $450,000.

Indeed, the idea that raising taxes is political poison has been increasingly refuted in recent years. In 2016, voter initiatives to raise taxes on the wealthy passed in both California and Maine. At the local level, voters have been approving tax hikes for specific needs, including voting for taxes that fund pre-kindergarten programs in two cities in Ohio. In 2017, voters approved seven of eight ballot referenda to raise taxes to fund transit programs.

This year, as The Washington Post reported, “Democratic candidates in several states are campaigning on higher taxes on millionaires to pay for the robust social programs increasingly demanded by the party’s base, such as universal pre-kindergarten, expanded health-care benefits and free community college.”18

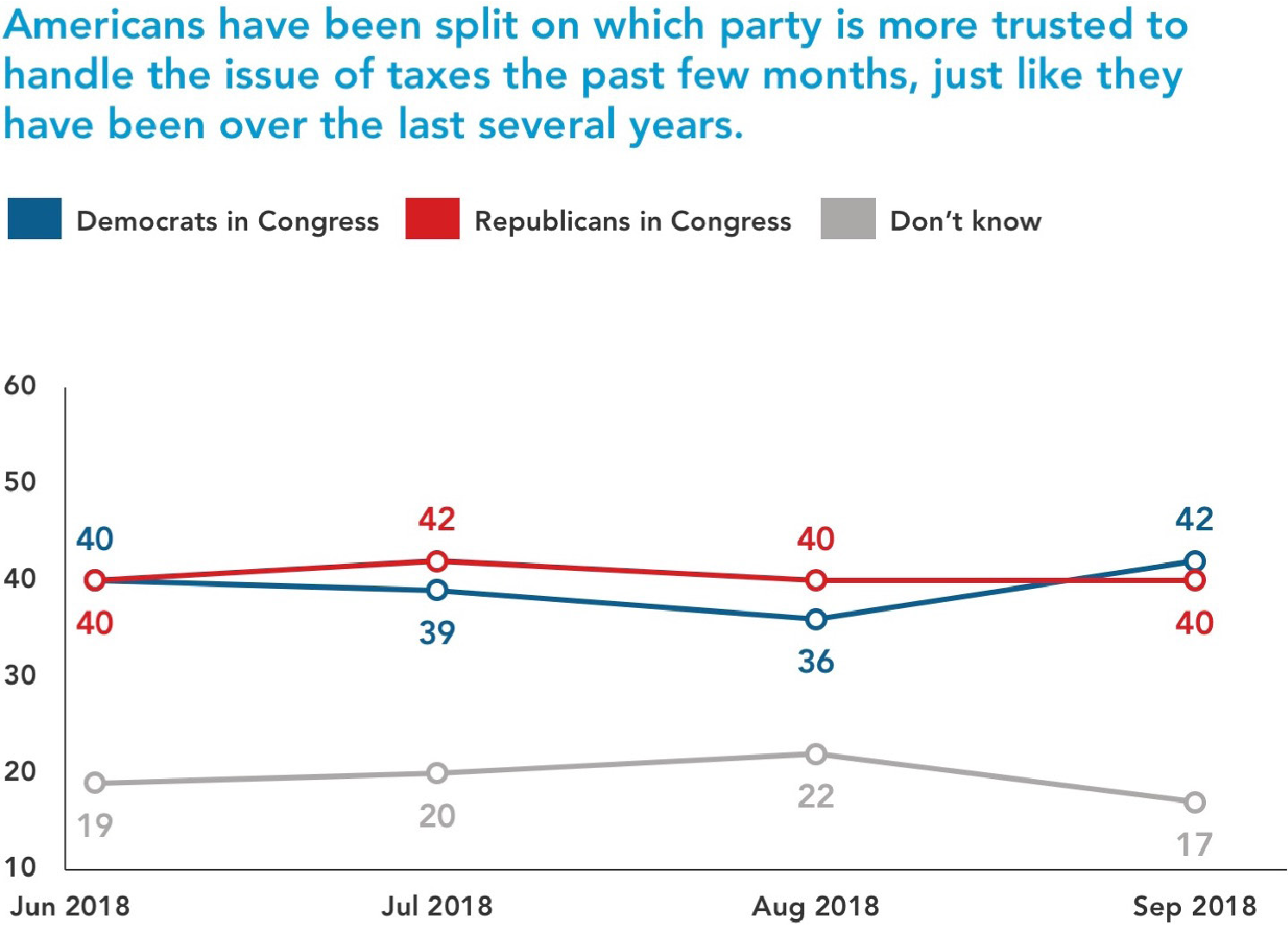

One might expect, given the GOP’s sharp focus on taxes, that the American public would view Republicans as having an advantage on the issue. A review of public polling shows that during most of the 1990s, the public generally rated Republicans better on taxes, but starting in 1998, neither party has a consistent advantage. Democrats even held a sizable advantage from 2005 through 2008 during President George W. Bush’s tumultuous second term that concluded with the onset of the financial crisis. That disappeared in 2009, and Republicans and Democrats have traded positions since then. Take the last two years of the Trump administration, for example: the NBC/Wall Street Journal poll gave Republicans had a 4-point advantage in December 2017,

Democrats a 4-point advantage in December 2017, and Republicans a 5-point advantage in August 2018.19 In Navigator Research’s own tracking over the course of this year on which party is more trusted to handle the issue of taxes, voters have been closely split, registering a range of Republicans leading by 4 to Democrats leading by 2.20

There are good reasons why public opinion of tax policy and politics are so closely contested: The core arguments made by progressives and conservatives both have strong appeal and, even in era of partisan polarization at an all-time high, those appeals cut across party and ideological lines.

These views are well-entrenched and are not likely to be changed by campaign ads or claims by elected officials and candidates. These views may also often surprise the prevailing conventional wisdom about how Americans view taxes, contradicting widely held assumptions about public priorities, views of tax cuts, and the relationship between tax and economic policy.

The evolution of the American people’s perceptions on taxes has evolved in a decidedly more populist and progressive direction, suggesting Democrats and progressives are positioned to benefit from constantly making the case against conservative philosophy on the economy and the new tax law. Republicans, on the other hand, are likely to find themselves in a weaker position than in years past after vigorously defending substantial tax cuts for the wealthy and large corporations.

This report reviews public opinion on tax policy and the tax system in the years leading up to the passage of the TCJA, including underlying attitudes toward who benefitted from the tax system and the relationship of taxation to perceptions of deficits, government spending, and the overall economy. With that baseline established, this report then looks at how Americans view the TCJA and its potential impact on next month’s midterms, including which messages about the law are most persuasive to voters.

This report includes data from over two dozen surveys, including public polling from Navigator Research, academic and media outlets, and research commissioned and released by progressive organizations.

| Who Does the Tax Code Benefit Most?

Particularly in this day of hyper-partisanship, where people’s views and responses to questions are shaped by their partisan alignments, it is important to understand public attitudes towards taxes and tax policy before the passage of the TCJA. This analysis helps us understand well-established views on taxes, which can cut through the partisan lens regarding the new law.

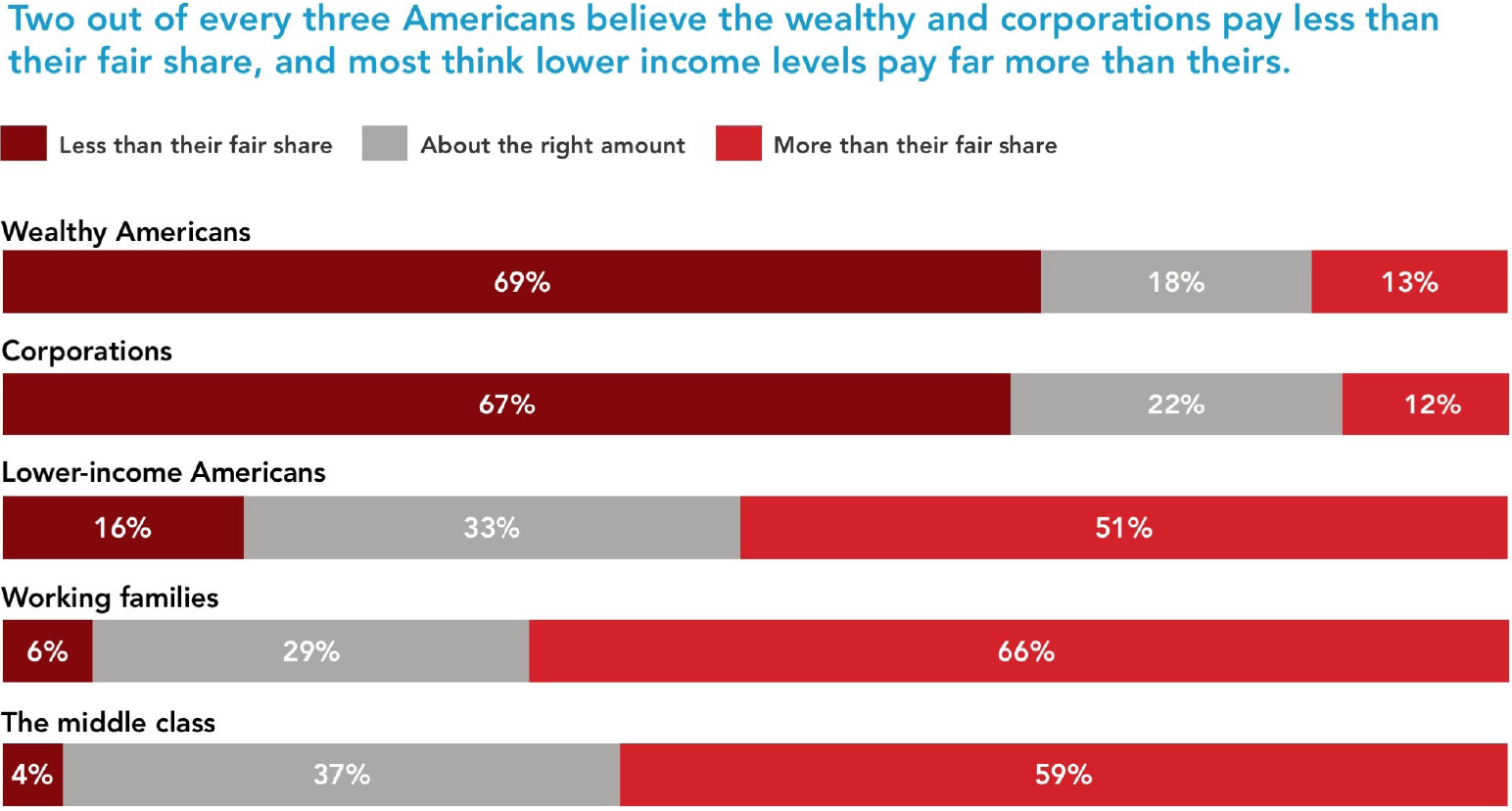

Americans are clear on one thing when it comes to the state of the tax code today: they believe that the tax system favors the wealthiest individuals and corporations over everyone else. Survey after survey shows this sentiment is broad across party and ideology, refuting the theory put forth by conservatives that low-income people are not paying taxes. A majority of the country believes that working families, the middle class, and low-income Americans paid the right amount of taxes, while just about one in ten felt wealthy Americans and corporations did the same.21

These sentiments are long established since polling on perceptions of fairness in the tax code has been conducted in the post-Reagan tax cuts era. When asked by Gallup whether corporations pay their fair share in taxes, those surveyed chose “too little” by 75% in 1992, and still believed to be the case by 67% in 2018.22

In a 2003 survey, a plurality of Americans (44%) said what bothered them most about the tax code was “the feeling that wealthy and corporations don’t pay their fair share,” compared with just 26% who said “the complexity of the tax system” and 15% who said “large amounts you pay in taxes.”23 When asked this question in 2011, the percentage saying some wealthy people get away with not paying their fair share bothered them the most about the tax code rose to 57%.24

The breadth of agreement with progressive views on who the tax code benefits can be seen in the chart to the right from a 2017 survey asking Americans whether they agree or disagree with a set of statements about the federal tax code.25

| What Tax Policies Will Grow the Economy?

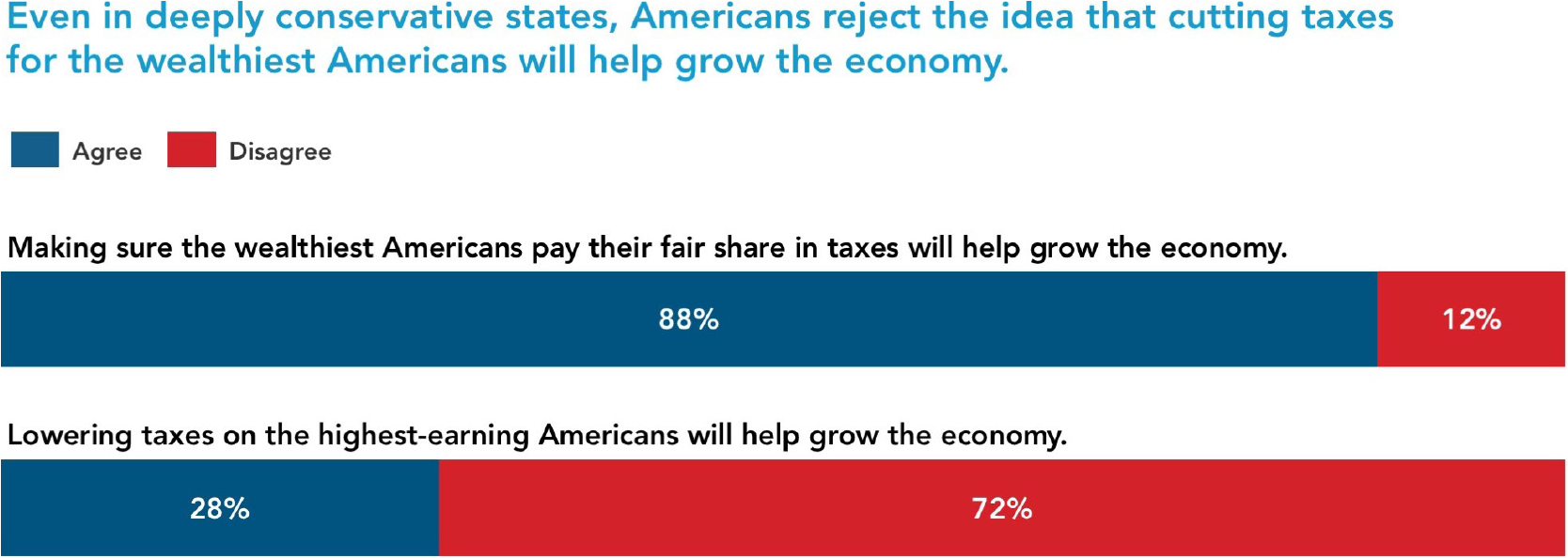

The deep and widespread perception that the American tax system benefits corporations and the wealthy translates into how people view the relationship between the tax code and how to grow the economy. The public widely believes that raising taxes on the wealthy and corporations will boost the economy and strengthen the middle class. That view is much more widely held than the core conservative theory that cutting taxes boosts economic growth.

Americans firmly reject the idea that cutting taxes on the wealthy will grow the economy. Even in a Senate battleground survey with a far more conservative electorate than the nation overall (the sample supported Trump by 12 points in the 2016 election), more than three times as many Americans in these states believe raising taxes on the wealthy will grow the economy than those that agree that lowering taxes on the wealthy will lead to economic growth. And while there is support for cutting taxes on everyone as a means to economic growth – including the wealthy – an even stronger argument is that corporations and the wealthy should pay their fair share. Even 36% of Republicans strongly agreed having corporations and the wealthy pay their fair share will help grow the economy, with 73% overall agreeing.26

Other previous public polling demonstrates Americans’ attitudes toward raising taxes on the wealthy has been moving in this direction for some time. In 2011, 61% of adults said that raising taxes on the wealthy will not cause a loss of jobs, as opposed to just 35% who said it will.27 In 2012, 40% of voters in a Fox News survey agreed that raising taxes on wealthy Americans will help the economy, while 24% said it would hurt the economy.28 And last year, there was strong support for specific proposals to correct the imbalance in the tax system, such as requiring millionaires to pay at least 30% of their income in taxes (86% support; 56% strongly) and raising taxes on the wealthiest one percent of income earners (82% support; 54% strongly).29

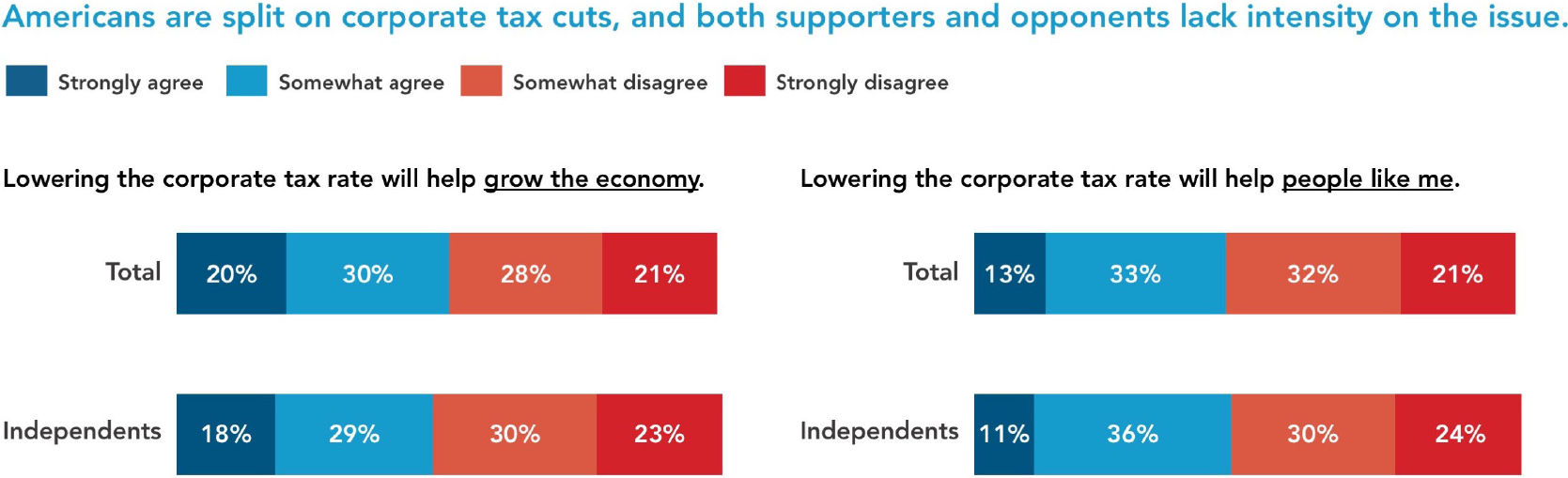

When it comes to tax cuts for corporations, Americans are evenly split on whether such cuts will help grow the economy or “help people like me.” However, when looking beyond the topline numbers, there is a lack of intensity among supporters of corporate tax cuts.

While cutting taxes for “corporations” is contested, 85% of voters do agree with an argument for cutting taxes on small businesses, though wording questions differently can show dramatically different results. For example, tax cuts to small businesses was favored by 85%, but 57%, agreed that wealthy small businesses should not get a tax cut.” Only 47% favored tax cuts for business owners.

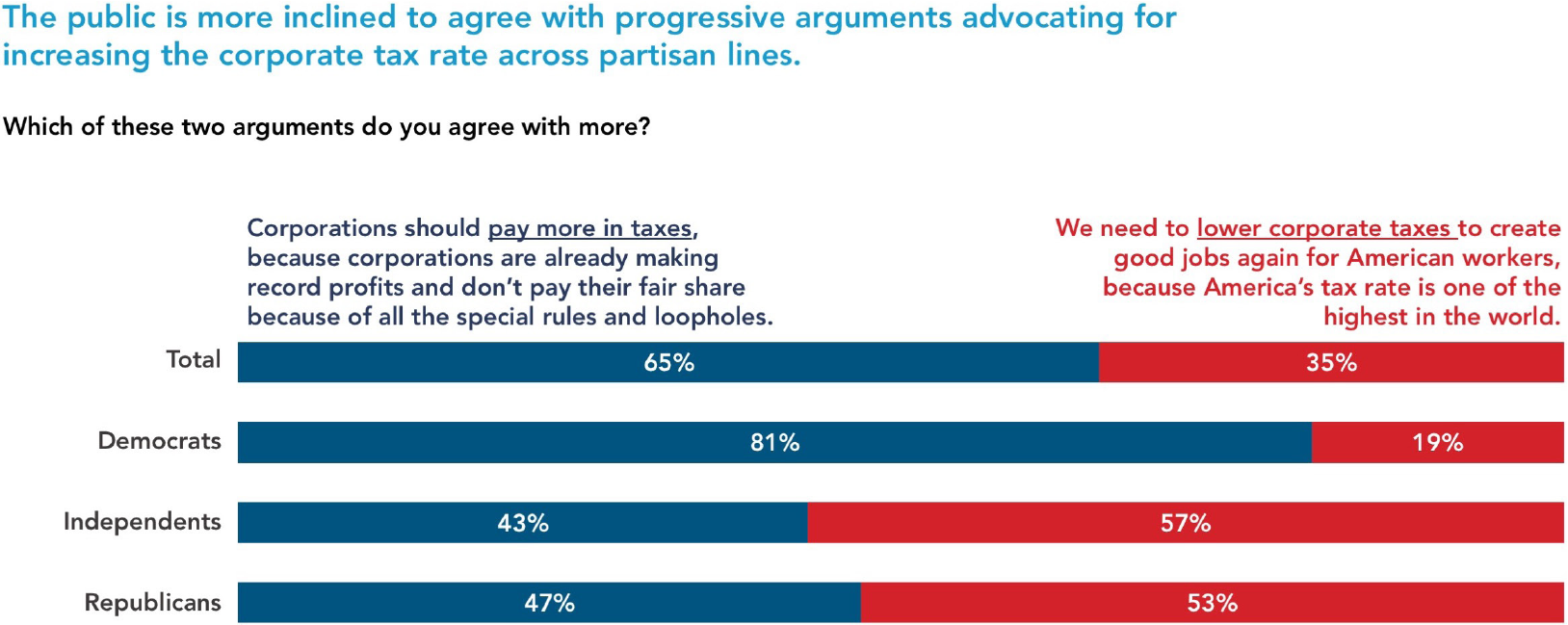

Importantly, in a forced choice test of ideas about corporate taxes, the progressive argument prevails by a 2-to-1 margin.

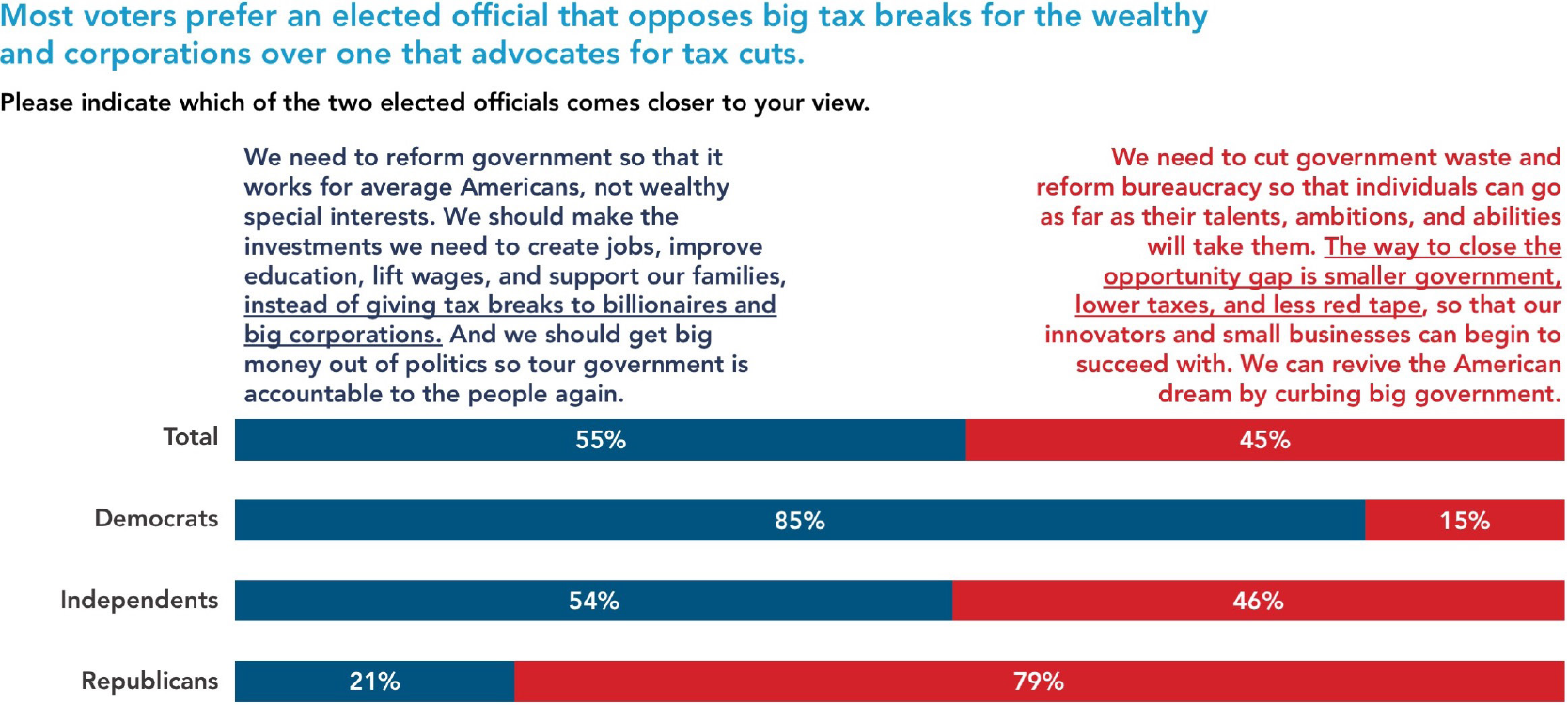

Finally, in a partisan context, voters are inclined to agree with the Democratic position on taxes that calls for tax loopholes that benefit wealthy corporations to be closed and making sure higher-income individuals pay their fair share. For example, a July 2015 survey tested a statement by a Republican candidate against potential statements from a Democratic candidate. The Republican statement had four references to taxes including: “small businesses struggle under the weight of taxes and regulation; … too much government spending, taxes, and borrowing have weakened our economy. …The answer to closing this opportunity gap is smaller government, lower taxes for every American.”

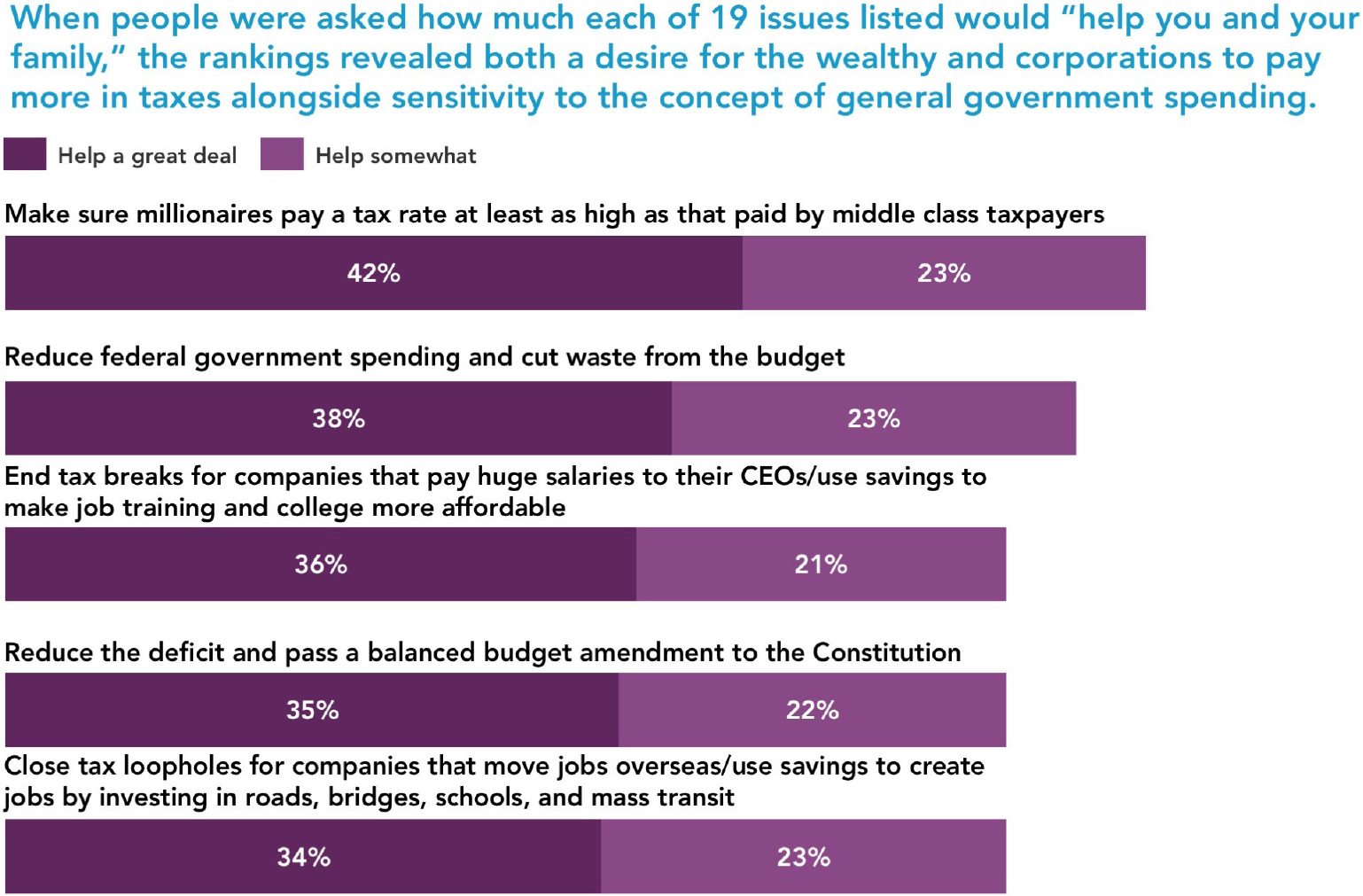

The Democratic statement that performed best by a 12-point margin (56% to 44%) also mentioned taxes six times, including: “Corporate CEOs and billionaires keep getting new tax breaks, while average Americans live paycheck to paycheck…. We should invest in technology, repair our bridges, and create jobs, instead of giving tax breaks to billionaires. … End tax breaks for companies that pay huge salaries to their CEOs and use the savings to make job training and college more affordable so people can get higher-paying jobs; … Make sure millionaires pay a tax rate at least as high as that paid by middle-class taxpayers; … Close tax loopholes for companies that move jobs overseas, and use the savings to create jobs by investing in roads, bridges, schools, and mass transit.”30

| What is the Link Between Taxes and Government Spending?

Another contest for public opinion related to tax policy is about government spending. Overall, Americans tend to be more supportive of cutting government spending in the abstract, but they are very concerned about cutting funding for public programs and support raising taxes on the wealthy and corporations to finance those programs.

In one 2010 survey, when adults were asked which of the following would be the first step you would take to balance the federal budget, 61% chose increasing taxes on the wealthy while the next highest option was cutting military spending at 20%, but only a fraction chose cuts to Medicare (4%) or Social Security (3%).31

In another survey from 2011 during the debt ceiling crisis, when voters were asked whether any agreement to raise the national debt ceiling should only consist of government spending cuts or should also include an increase in taxes for the wealthy and corporations, 67% chose the latter compared to 25% who said spending cuts.32

A year later, Americans were asked what the biggest reason was for large deficits in the coming year. The most popular choice by far (46%) was wealthy Americans not paying enough in taxes, while 24% of those surveyed chose too much government spending on defense and 14% too much government spending on programs for poor people. Even 29% of Republicans put the blame on wealthy Americans, while 42% of independents placed the blame on the wealthy and 11% on spending on poor people.33

Another survey done in September 2015 reinforces the power of these competing narratives on what is best for the economy, but suggests a slight advantage for the progressive argument.34 For example, a progressive message that calls for increasing taxes on the richest one percent to fund investments that will grow the economy in the long term like in public education, scientific research, and infrastructure is considered a more effective approach to growing the economy (72% effective; 44% very) than a conservative message focused on eliminating the $500 billion a year deficit to start paying down (then) $17 trillion debt, meaning every American born in this country begins life $56,000 in debt (64% effective, 37% very). Moreover, in a direct test about taxes and government, a progressive narrative comes out ahead of the conservative argument by 10 points.35

While cutting government spending and reducing the deficit have support in the abstract, cuts to specific social programs are very unpopular. For example, polling during and after the debate in Washington on the TCJA found implementing policies resulting in significant cuts to important public programs raised significant doubts about passing revisions to the tax code. In the aforementioned Senate battleground survey from late 2017, voters are deeply concerned about specific cuts. For example, 74% expressed doubts (49% serious doubts) when told: “Independent analysts say that the tax plan would add trillions of dollars to the national debt, which will then be used to justify deep cuts to Social Security, Medicare, Medicaid and public education.”36

Post-passage, the message continued to resonate. The following message gave voters the most doubts about the new tax law in February 2018: “Because this plan adds so much to the deficit, Medicare and Medicaid will become prime targets for deficit reduction. We’ll end up cutting health care for children and the elderly in order to pay for tax cuts for the richest 1 percent.”37

| How Does The Public View the New Tax Law?

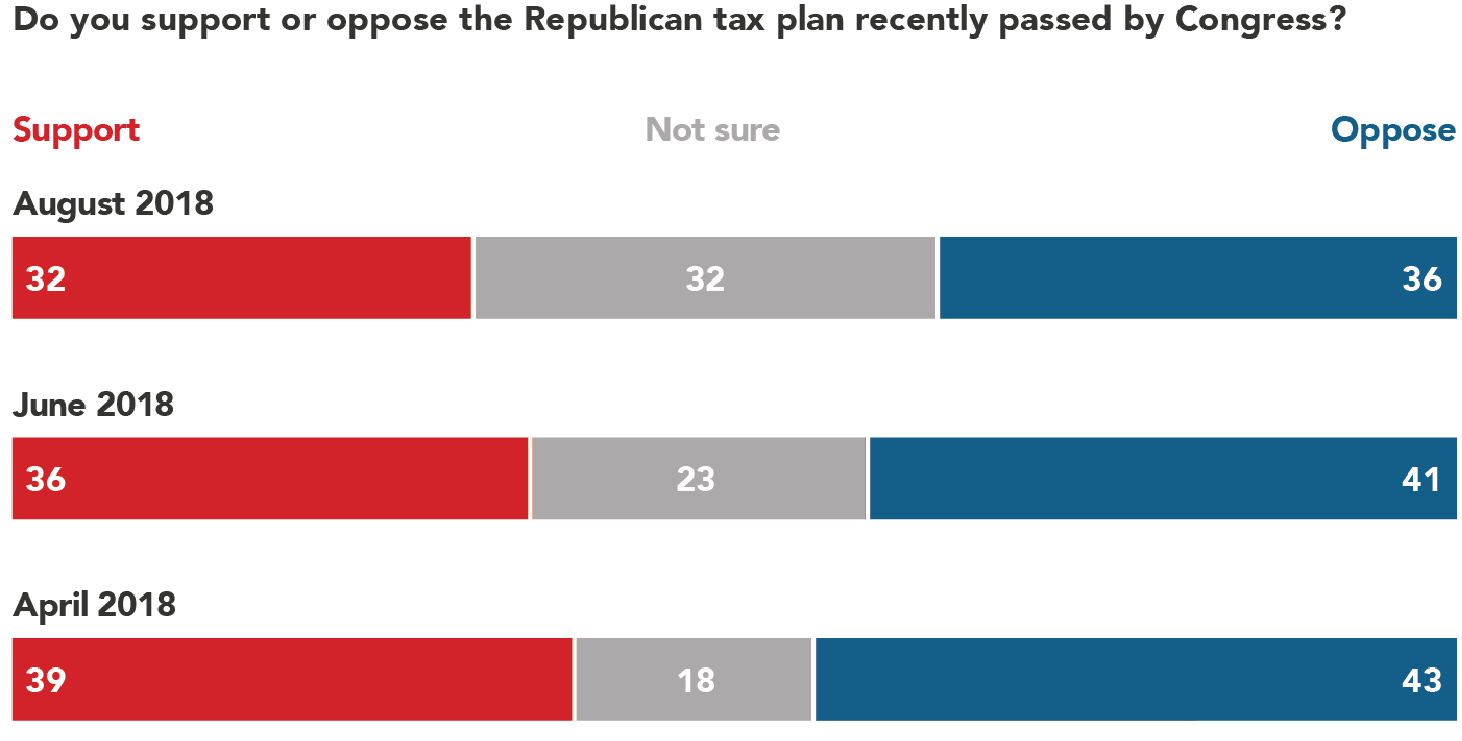

Since the TCJA was passed by Congress and signed into law by President Trump in December 2017, the tax law has largely been overall net unpopular, averaging just under 40 percent support in publicly available polling, with slightly more disapproving. Prior to passage, support for the bill was even worse, averaging just 33 percent support and 52 percent opposition in polls conducted in December.38 After an initial uptick in support immediately following passage, support has stalled throughout the course of 2018.

The first few months post-passage found strong splits along party identification, which have maintained over time. In a poll conducted in February 2018, support for the law at 39% support and 43% oppose – with 81% of Republicans, 36% of independents, and 9% of Democrats supporting the law.39 A June Quinnipiac University poll in June found just 39% approved of the law while 46% opposed, with 78% of Republicans, 39% of independents, and 6% of Democrats approving.40 In August 2018, Monmouth University reported just 37% approval while 45% disapproved – 71% of Republicans, 39% of independents, and 12% of Democrats approving.41

Additionally, Navigator Research has been tracking support for the law over the past few months and has found declining levels of support – and opposition – with Americans becoming less clear what to think about the law. The April 2018 poll found that 39% supported the law while 43% opposed; however, in August 2018, support had dropped to just 32%, with a mirrored 7% decline in opposition (36% opposed). Over the course of those four months, the percentage saying they weren’t sure rose from 18% to 32%.42 Given that Republican leadership was saying that, as voters learned more about the law, it would grow in popularity and help their candidates in the midterms, this data is evidence Republicans are not making the sales pitch on the campaign trail and have abandoned the TCJA as a core electoral issue.

Even as of October 2018, almost a year since the TCJA was passed, Gallup finds that net support for the law remains negative (39 percent support – 46 percent oppose).43

Responses to questions about the law’s impact on personal finances are also driven by partisanship, with significant shares of people in all parties saying that the law will not have any impact. For example, in a March 2018 survey, 53% of Democrats said that their taxes would go up, compared with 19% of Republicans. About one-third (35%) of Republicans expected their taxes to go down, compared with 11% of Democrats. A significant portion said they expect their taxes to say the same: 28% of Democrats, 29% of independents, and 37% of Republicans.44

A similar pattern was found when voters were asked in March about whether the law would have a positive impact on their personal finances: 41% of Democrats, 44% of independents, and 27% of Republicans said it would have no impact. When asked if they had actually had seen their taxes lowered, only 22% said yes, including just 33% of Republicans, 16% of independents, and 14% of Democrats. The same proportion of Republicans (41%) said they got a raise as those that said they did not get a raise. Among Democrats, 58% said they did not get a raise, more than twice the proportion who said they did (27%). Independents were close to Democrats (52% no; 28% yes).45

| What Concerns Americans About the Tax Law?

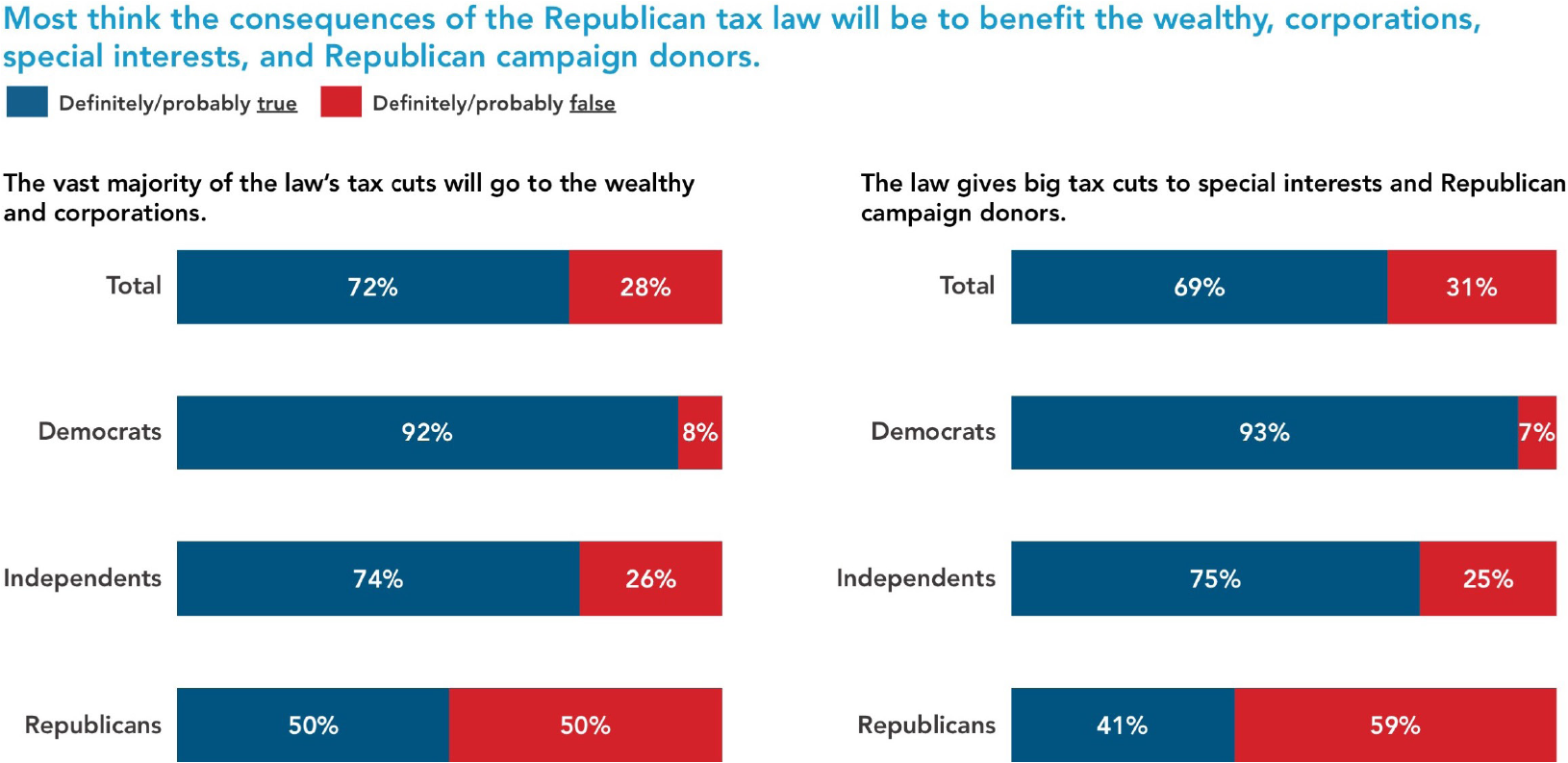

Americans are convinced that the TCJA unfairly benefits wealthy individuals and corporations at the expense of the middle class and worry that the law will raise the deficit and lead to cuts in valued public programs. Americans generally do not believe that the new tax law will have a positive impact on “the fairness of the tax system.” 48% think there will ultimately be a negative impact on tax fairness, while just 31% think it will be positive and 21% think there will be no impact. When asked if the new tax law “will make the tax code more fair,” only 43% thought that was true, and only 9% were certain it was true. Just 38% of swing voters and 19% of low turnout Democrats agreed.46

One aspect Republicans attempted to play up in order to galvanize support for the TCJA was that it would ultimately simplify the tax code. However, voters are divided about whether the tax law makes the tax system less complex and do not rank that as a strong argument for the law: 55% said this was true, including 13% of voters saying that it was definitely true the law makes the tax code simpler. However, this compares to 72 percent who think it is true that the vast majority of the law’s tax cuts will go to the wealthy and large corporations (30% definitely true).47

When asked who will benefit more from the tax cuts created by the law, the wealthy or the middle class, people overwhelmingly chose the wealthy by a 59% to 16% margin (with 25% saying both equally).48 This is almost identical to another survey finding exploring who will benefit more from the tax cuts when the choice is between mainly employees or mainly shareholders and corporate executives, with most overwhelmingly choosing shareholders and executives 58% to 12% (and 30% saying both equally).49

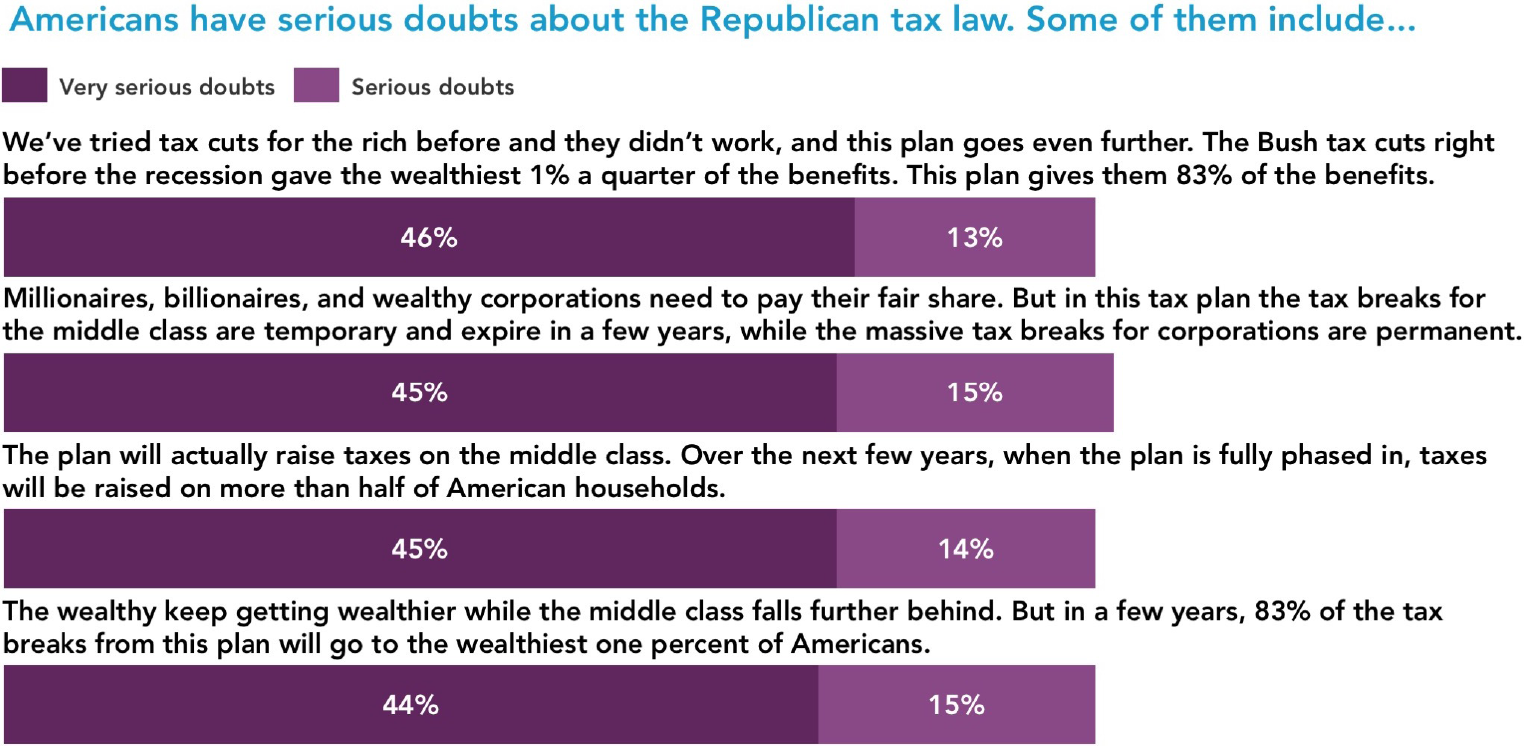

Aside from this being a giveaway to the wealthy and large corporations, the other biggest concern Americans have about the TCJA

is its potential impact on valued public programs. These concerns are further magnified when statements explain that the law’s impact on the deficit is the reason for the possible cuts. For example, 59% of voters think it’s true that the tax law will lead to large cuts in Medicare, Medicaid, and Social Security. However, when linked to the tax law increasing the deficit and thus causing those cuts, that rises to 70% thinking it is true.50

While the typical partisan differences remain, Republicans are far more divided on these budget and deficit questions than on other issues while still reliably giving the law favorable ratings. For example, this same survey finds only 11% more Republicans said the law will have a positive impact (31%) than a negative impact (20%) on Medicare, Medicaid and Social Security, while independents held that it would have a negative impact by a net 43 points (12% to 55%) and Democrats by a net 67 points (6% to 73%). Moreover, only 8% of Republicans said the law will have a positive impact on the deficit. These low positive ratings among Republicans, combined with the very high negative ratings by independents and even higher by Democrats, underscores the strong concern that voters have. Gender and education play significant roles differentiating responses. Women are much more concerned (38% more negative) than men (27% more negative) on cuts to the social programs. In addition, college-educated voters are much more skeptical (46% more negative) than those with less education (13% more negative).

Another survey asked Americans to pick out of a list of six the most concerning reasons why Democrats say they oppose the law. By 10 points more than any other, the following was one of the top two choices of 48% of voters, including 51% of Democrats and 45% of Republicans: “Adds $1.5 trillion to the deficit and now Donald Trump and Republicans say we must pay for it with cuts to Medicare, Medicaid and Social Security.” Focusing on the huge impact to government revenue over the next decade and the implication that this funding could have gone to public schools, health care, or infrastructure, also focused on the relationship between the deficit and public programs, was the second most concerning and cited by 38% of both Democrats and Republicans.51

| How Strong Are Progressive Arguments on Taxes?

There is no question that the public is largely divided on tax policy and leans toward opposing the TCJA for reasons already covered, but what is also clear is that in any fair debate between conservatives defending tax cuts versus progressives’ counterarguments, the opposition prevails. Given the strength of concerns about changes to the tax code that exacerbate income inequality by benefiting the wealthy and corporations more, or that these changes may be financed by deep cuts to popular public programs, it may not be surprising that conservative arguments touting the success of the law do not hold up against progressive attacks on the law.

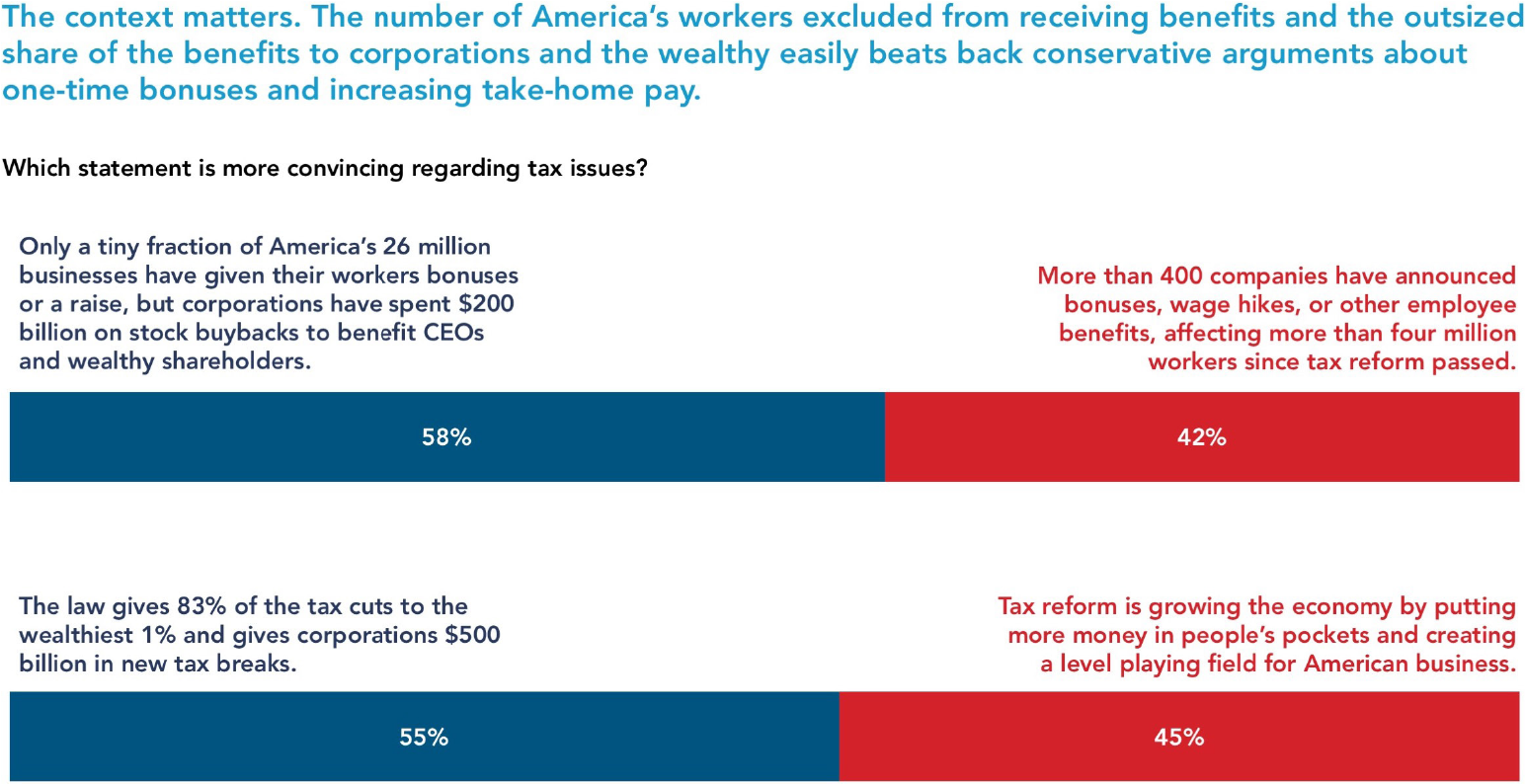

In a test of conservative vs. progressive arguments around the impact of the tax law on wages and jobs, the progressive statements rated to be more convincing. The most effective progressive statements focused on how wealthy individuals and corporations receive far greater benefits from these changes to the tax code than workers or individuals. Importantly, one counter-example where the Republican argument prevailed was one where the Democratic argument tried to link the tax law to outsourcing of jobs when juxtaposed with companies repatriating corporate profits.

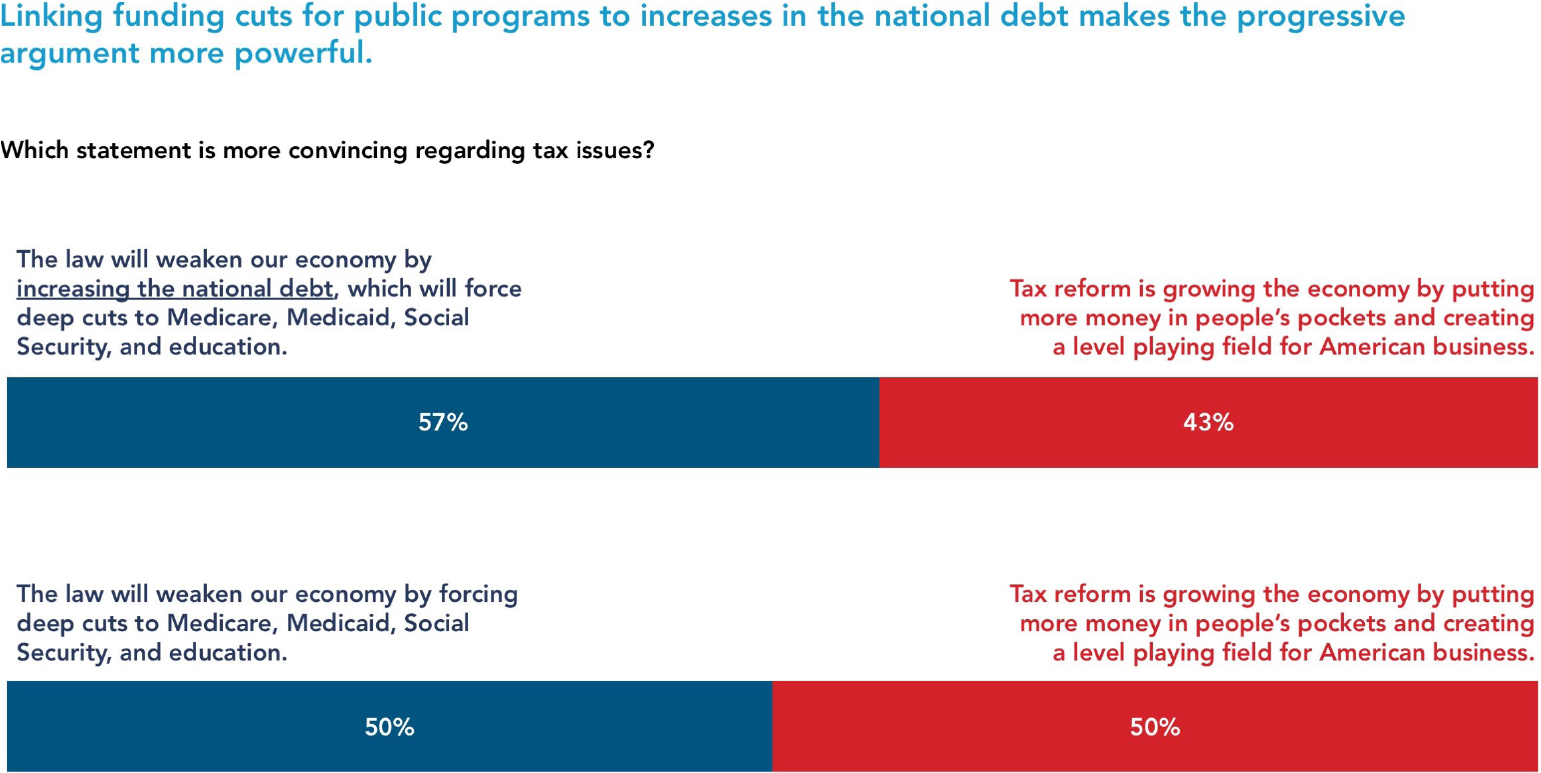

Additionally, an argument focused on how the tax law increases the national debt, which will eventually force funding cuts to public programs like Medicare, Medicaid, and Social Security, performs better. Again, the importance of linking the deficit to program cuts in order to win the economic debate.52

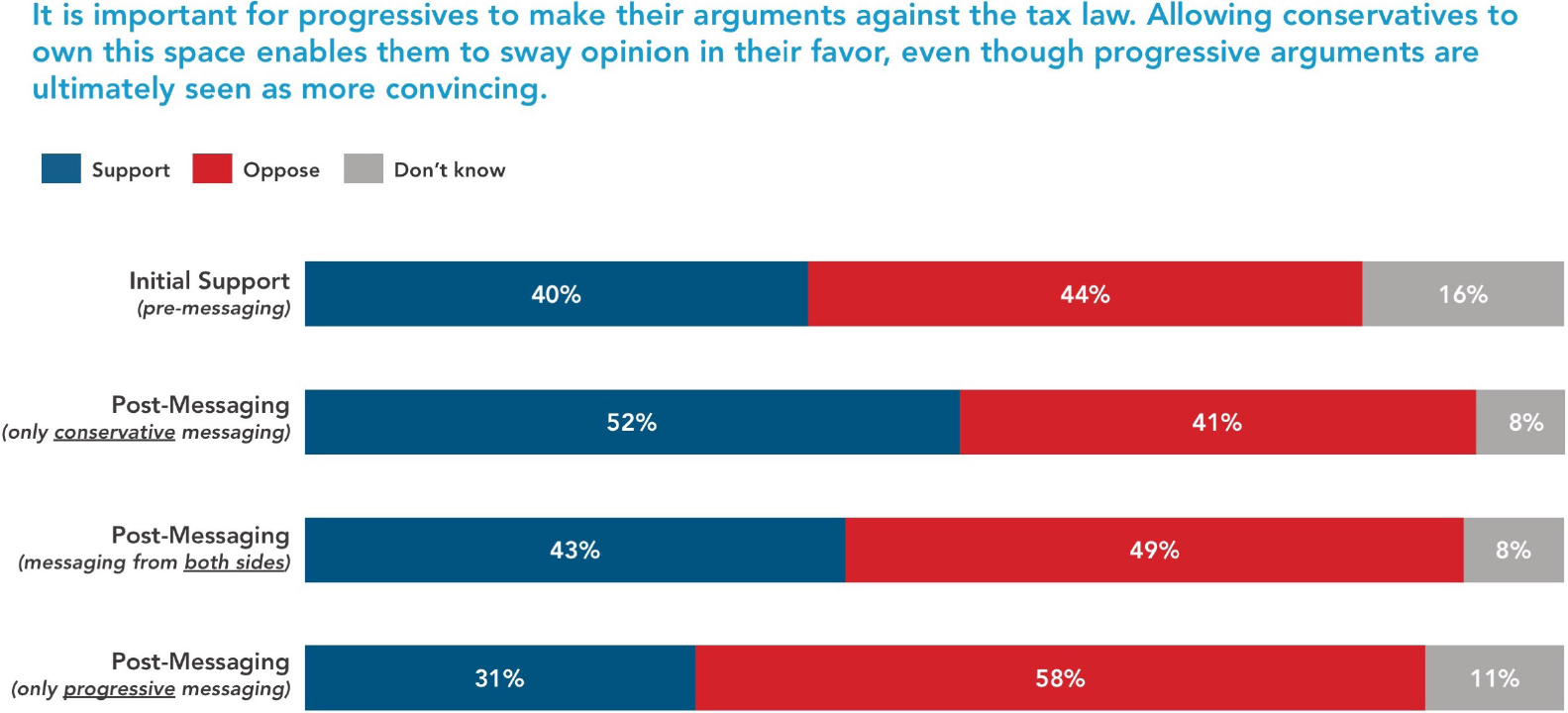

| How Important Is It For Progressives to Make the Argument on Taxes?

In a debate over the tax law, its opponents win. But, in order to win, progressive opponents must be willing to have the debate. In February 2018, a survey was designed to test the impact on opinion of the law based on whether people heard competing arguments about the law. Before any discussion of the law, opinion was slightly negative (40% to 44%), in line with other opinion polls taken throughout the entirety of 2018. When only hearing a positive argument in favor of the law, it’s favorability increased by 12 points, giving it a net 11-point advantage. Conversely, among those who only heard an argument against the law, opposition overwhelmed support by 27 points. But in a balanced debate, opinion remains slightly negative, suggesting a greater rationale for why progressives should continue making the case against the TCJA.

The survey then went on to present multiple arguments by opponents of the bill, with no statements by supporters, after which opposition outpaced support for the tax law by a 20-point margin (56% to 36%). Moreover, among those who had initially only heard an argument in favor of the law, but were then exposed to messaging, they “caught up” in opposing the law at equal levels with those who had heard a balanced debate at the beginning.53

In another poll, a balanced debate also produced significant movement against the law. In a March survey, the law started with slight approval, 47% to 44%. After hearing arguments both in support and opposition to the TCJA, net approval shifted by 10 percentage points (43% to 50%). Approval in House battleground districts dropped from +1% to -11%, while Democratic opposition increased by 10 points and Republican opposition increased by 5 points.

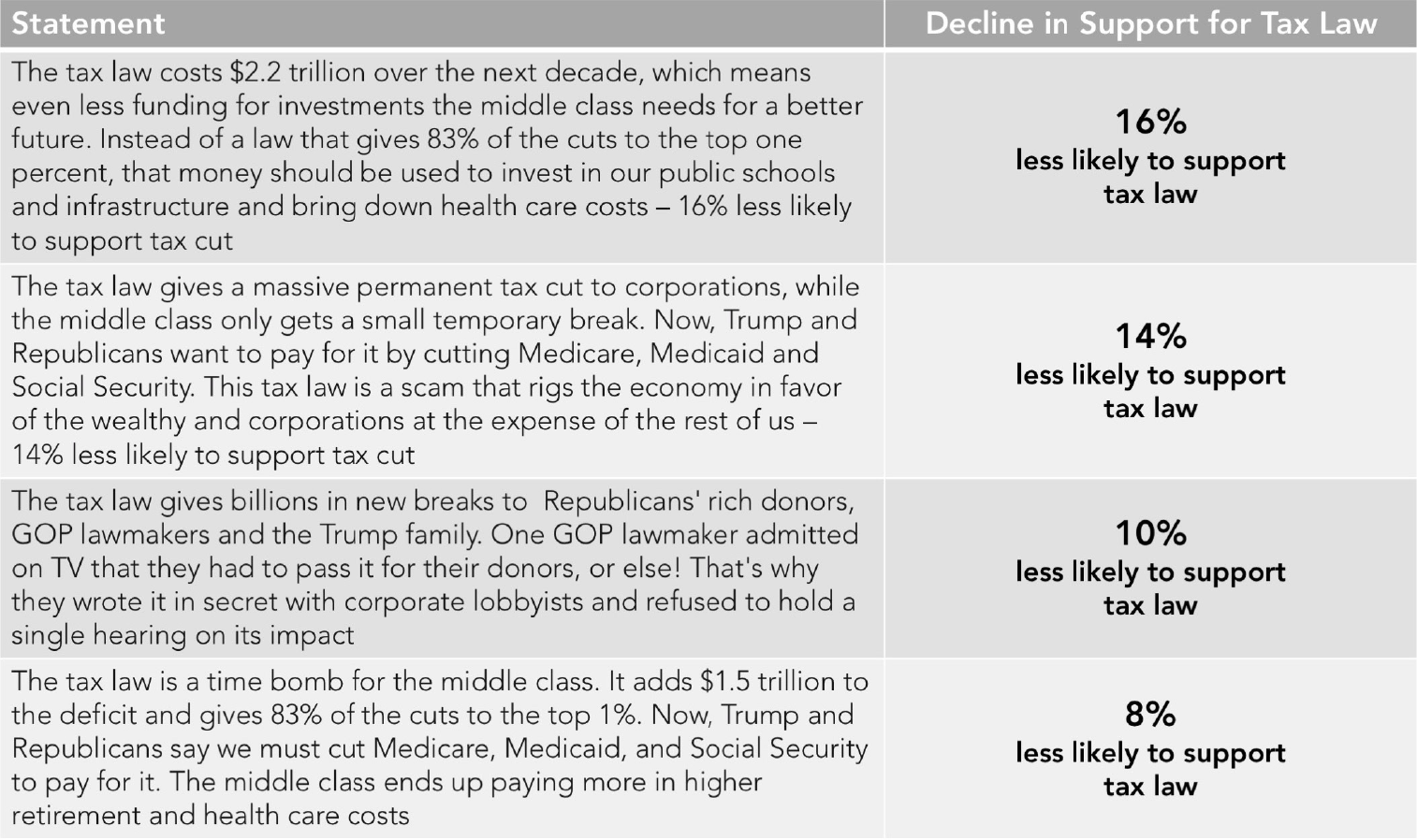

This survey identified the issues that were most likely to move people toward opposition through regression analysis. The following were the top four issues, measured by the mean predicted impact of people shifting from supporting to opposing the tax bill after hearing and equal number of supporting and opposing statements.

| How Will the Tax Debate Impact the Midterms?

Evidence shows that a debate on the tax law has the potential to increase support for Democratic candidates for Congress in the 2018 midterm elections. A significant portion of voters in both political parties say that the tax law will play a major role in their congressional preference and most voters say it will play some role, and there’s a small edge among Democrats. In polls taken earlier this year, with 78% of Democrats, 75% of Republicans, and 67% of independents saying it will play a role in their vote for Congress.54 Another survey from June found that 72% of voters say the tax law will play a role in their vote, with one-third (33%) saying it will be very important. Independents are much less likely to say it will be a very important factor in their vote (18%) than Democrats (41%) or Republicans (45%). A balanced debate on the law increased the highest level of interest in the election by Democrats by 4 points to 61%, while Republican interest stayed the same, 50% at the highest level.55

When it comes to vote preference on the generic congressional ballot, one survey from March found that the debate on the tax law increased the generic congressional preference two points from +7 to +9 in favor of the Democratic candidate. The following groups improved their preferences for Democratic candidates by at least 10 points: swing voters, undecided voters, and Republican women. In addition, white women of all education levels moved towards the Democratic candidate by 5 points. The same poll found that the percentage of voters who said they were less likely to vote for a member of Congress who voted for the law went from 37% to 45% (with only a one point change in the proportion saying more likely, from 28% to 29%).

This survey, which also included oversamples in Senate and House battleground states, also found voters were even more strongly preferring a Democrat who would advocate for repealing the tax law and instead raising taxes on the wealthy and corporations over a Republican who supports the TCJA.56

While this shows a slightly stronger response to the repeal argument that does not include keeping the middle-class tax cuts, there are risks for Democrats should they adopt the approach of full repeal. When asked what specific issue positions would make someone more likely to vote for a candidate for Congress, Americans indicated their strong support for keeping the middle-class tax cuts in addition to raising taxes on the wealthy and corporations.

The Republican experience of pushing to repeal and replace the Affordable Care Act may provide some context for Democrats. While repeal was an attractive call to their base, actual proposals to repeal popular provisions such as the requirement for insurance companies to cover those with pre-existing conditions proved incredibly unpopular. As a result, support for the Affordable Care Act remains near or at all-time highs, and according to last month’s Navigator survey, Democrats now have a 15-point advantage over Republicans on who is more trusted to handle the issue of health care, which grows to 26 points when it comes to protecting pre-existing condition coverage.57 On the other hand, legislation that repealed the tax cuts for the wealthy and corporations would be wildly popular, particular if those revenues were used to invest in education, infrastructure, and reducing health care costs.

| Conclusion

The continued unpopularity of the Republican tax law may be a surprise to the GOP, but it shouldn’t be. The idea that massive tax cuts for the wealthiest Americans and biggest corporations would be accepted by the public as long as individuals also got a small tax cut shows a serious misreading of how the American public thinks about taxes today. Similarly, Republicans are mistaken if they believe that the public will readily buy the idea that more tax cuts for the wealthiest and CEOs will trickle-down to everyone else after decades in which wages stagnated for most people, job security decreased, and the certainty of affordable health care or a good retirement for most working and middle-class families eroded.

Republicans are mired in an orthodoxy around tax cuts that worked for them when the post-World War II boom ended and they successfully shifted blame for diminished family income on government spending and taxation. The GOP have been boosted by campaign donations from the largest beneficiaries of tax cuts, the wealthiest and large corporations, many of whom are their largest donors. As a result, 56% of Americans – including 61% of independents – think the tax law was passed by Republicans because they wanted to help wealthy individuals and corporations who regularly support Republican campaigns rather than because they believe cutting taxes will help the economy.

Rather than having to play defense, taxes offer Democrats and progressives a prime opportunity to proactively tell a very distinct story from Republicans and conservatives about who government works for and how to create broad-based economic prosperity. The public – including Republicans – is convinced that the current tax system benefits the wealthy and big corporations at the expense of working families and the middle-class. At the ballot, voters are backing policies and politicians that raise taxes on the wealthy. And, despite Americans’ skepticism over government effectiveness, voters are regularly raising taxes to support particular government spending, like public transit and pre-kindergarten programs.

We have seen the debate play out in this election cycle. Democratic candidates for governor are campaigning on raising taxes on the wealthy to expand public programs like education, and, in congressional elections, Republicans have largely retreated from using it as a rationale for earning voter support.

Attendees at the Tax March on April 15, 2017 walk past the Washington Monument after marching past the White House.

When progressives engage in the debate, they can win. Progressives have a competing story that is more deeply resonant and popular with more voters. The public believes the tax system is steeply tilted toward the wealthy and corporations and the Republican tax law deepens the imbalance in a deeply unfair system. Americans are convinced the TCJA favors the wealthy and corporations, will increase the deficit, and threaten very popular government programs. Progressives can powerfully broaden the story by linking the Republican attempt to repeal the Affordable Care Act and efforts to take away health care from millions of Americans with deep cuts to Medicaid in order to give tax cuts to the richest. Moreover, broad majorities think that raising taxes on the wealthy and big corporations promotes economic growth than cutting their taxes, or for that matter, cutting taxes on everyone. Instead of the current conservative approach, progressives are well-positioned to advocate that the best economics is to raise taxes on the wealthy and corporations and use those funds to increase investments in the middle class through public education, infrastructure, and other public programs. Until we know the outcome, progressives are positioned to use their multiple advantages with the public on taxes to build and expand upon their own potentially historic wave election.

1. Thomas Kaplan and Alan Rappeport, The New York Times, “Republican Tax Bill Passes Senate in 51-48 Vote,” December 19, 2017.

2. Christina Wilkie, CNBC, “Paul Ryan: ‘Results’ Will Help GOP Tax Bill Win Over Skeptical Voters,” December 19, 2017.

3. Heather Long, The Washington Post, “The Final GOP Tax Bill Is Complete. Here’s What Is in It,” December 15, 2017.

4. Bob Bryan, Business Insider, “Here’s How the Newly Passed GOP Tax Bill Will Impacct the Economy, Businesses, the Deficit, and Your Wallet,” December 20, 2017.

5. David Wright, CNN, “Will Tax Cuts Save Republicans in 2018?,” March 21, 2018.

6. Sahil Kapur, Bloomberg News, “Republicans Struggle to Make Take Cuts a Winning Election Issue,” April 16, 2018.

7. Naomi Jagoda, The Hill, “Tax Law Supporters Rally For Republicans in Tough Races,” May 20, 2018.

8. Alana Abramson, Fortune, “Koch Brothers Continue Tax Reform Push With Ads Targeting Two Senators,” March 14, 2018.

9. Peter Baker, The New York Times, “Trump Pitches Tax Cuts as ‘Rocket Fuel’ for the Economy,” September 29, 2017.

10. The White House, “President Donald J. Trump’s State of the Union Address,” January 30, 2018.

11. Associated Press, “Republicans’ Claim That Their Tax Plan Will Boost the Economy Faces Widespread Doubts,” December 20, 2017.

12. Kim S. Rueben and Megan Randall, The Urban Institute, “Tax and Expenditure Limits: How States Restrict Revenues and Spending,” November 27, 2017.

13. Americans for Tax Reform, Taxpayer Protection Pledge Database. Accessed October 10, 2018.

14. Time Magazine, “Top 10 Unfortunate Political One-Liners,” Accessed October 10, 2018.

15. Jeanne Sahadi, CNN Money, “Taxes: What People Forget About Reagan,” September 12, 2010.

16. Justin Fox, Bloomberg News, “The Mostly Forgotten Tax Increases of 1982-1993,” December 15, 2017.

17. Joseph Sullivan, The New York Times, “Kean Signs Bills Raising Two Taxes to Cut Budget Cap,” January 1, 1983.

18. Jeff Stein, The Washington Post, “N.J. Democrats Loved the Idea of Taxing the Rich – Until They Actually Could Do It,” May 24, 2018.

19. NBC/The Wall Street Journal surveys conducted by Hart Research Associates and Public Opinion Strategies. Surveys conducted August 18-22, 2018 (n = 900 registered voters) and December 13-15, 2017 (n = 900 registered voters).

20. Navigator Research surveys conducted by Global Strategy Group and GBA Strategies. Surveys conducted September 5-9, 2018 (n = 1,250 registered voters) and August 2-5, 2018 (n = 1,128 registered voters).

21. MoveOn survey conducted by Global Strategy Group. Survey conducted April 5-9, 2017 (n = 1,211 registered voters).

22. Surveys conducted by Gallup Organization. 2018 survey conducted April 2-11, 2018 (n = 1,015 adults); 1992 survey conducted March 26-29, 1992 (n = 1,004 adults).

23. Government and the Obligation of Citizens Survey conducted by Greenberg Quinlan Rosner Research. Survey conducted October 21-26, 2003 (n = 1,000 likely 2004

voters).

24. Pew Research Center, “Tax System Seen as Unfair, in Need of Overhaul.” Survey conducted December 7-11, 2011 (n = 1,521 adults).

25. MoveOn Survey conducted by Global Strategy Group, April 2017.

26. Not One Penny survey conducted by Global Strategy Group. Survey conducted October 17-25, 2017 in 15 Senate battleground states (n = 1,500 likely 2018 voters).

27. New Models National Brand Poll conducted by The Winston Group. Survey conducted September 12-13, 2011 (n = 1000 registered voters).

28. Fox News Poll conducted by Anderson Robbins Research and Shaw & Company. Survey conducted April 22-24, 2012 (n = 915 registered voters).

29. MoveOn Survey conducted by Global Strategy Group, April 2017.

30. Americans United survey conducted by Hart Research Associates. Survey conducted July 15-20, 2015 (n = 1,600 registered voters).

31. 60 Minutes/Vanity Fair survey conducted by CBS News. Survey conducted November 29-December 2, 2010 (n = 1,067 adults).

32. Quinnipiac University Polling Institute. Survey conducted July 5-11, 2011 (n = 2,311 registered voters).

33. United Technologies/National Journal survey conducted by Princeton Survey Research Associates. Survey conducted February 9-12, 2012 (n = 1,000 adults).

34. Roosevelt Institute survey conducted by Greenberg Quinlan Rosner Research. Survey conducted September 12-16, 2015 (n = 900 likely 2016 voters).

35. Center for American Progress survey conducted by Hart Research Associates. Survey conducted July 31-August 6, 2015 (n = 2,000 registered voters).

36. Not One Penny survey conducted by Global Strategy Group. Conducted October 2017.

37. Not One Penny survey conducted by GBA Strategies. Survey conducted February 9-16, 2018 (n = 2,000 registered voters).

38. Harry Enten, FiveThirtyEight, “Will Passing the Tax Bill Help the GOP in 2018? Probably Not.,” December 18, 2017.

39. Not One Penny survey conducted by GBA Strategies. Conducted February 2018.

40. Quinnipiac University Polling Institute. Survey conducted June 14-17, 2018 (n = 905 registered voters).

41. Monmouth University. Survey conducted August 15-19, 2018 (n = 805 adults).

42. Navigator Research surveys conducted by Global Strategy Group and GBA Strategies. Surveys conducted August 2-5, 2018 (n = 1,128 registered voters), June 12-17, 2018 (n = 1,429 registered voters), and April 3-5, 2018 (n = 1,009 registered voters).

43. Gallup Organization. Survey conducted September 24-30, 2018 (n = 1,462 adults).

44. Monmouth University. Survey conducted March 2-5, 2018 (n = 803 adults).

45. Americans for Tax Fairness/Not One Penny/Priorities USA/Unidos US/Center for American Progress Action Fund survey conducted by Hart Research Associates and

Global Strategy Group. Survey conducted March 3-15, 2018 (n = 2,065 likely 2018 voters).

46. Americans for Tax Fairness/Not One Penny/Priorities USA/Unidos US/CAPAF survey. Conducted March 2018.

47. Americans for Tax Fairness/Not One Penny/Priorities USA/Unidos US/CAPAF survey. Conducted March 2018.

48. Not One Penny survey conducted by Global Strategy Group. Conducted October 2017.

49. Americans for Tax Fairness/Not One Penny/Priorities USA/Unidos US/CAPAF survey. Conducted March 2018.

50. Americans for Tax Fairness/Not One Penny/Priorities USA/Unidos US/CAPAF survey. Conducted March 2018.

51. Not One Penny survey conducted by Global Strategy Group. Conducted October 2017.

52. Americans for Tax Fairness/Not One Penny/Priorities USA/Unidos US/CAPAF survey. Conducted March 2018.

53. Not One Penny survey conducted by GBA Strategies. Survey conducted February 9-16, 2018 (n = 2,000 registered voters).

54. Not One Penny survey conducted by GBA Strategies. Survey conducted February 9-16, 2018 (n = 2,000 registered voters).

55. American Federation of Teachers survey conducted by Greenberg Quinlan Rosner Research. Survey June 1-5, 2018 (n = 1,400 likely 2018 voters).

56. Americans for Tax Fairness/Not One Penny/Priorities USA/Unidos US/CAPAF survey. Conducted March 2018.

57. Navigator Research. Conducted September 2018.

About The Study

This edition is a special report reviewing a large body of public opinion research among Americans on the issue of taxes. This includes a review of over two dozen surveys conducted and publicly released from the early 1990s through this year.