Bull market for stocks is turning 9. Could it become the longest?

Adam Shell

Adam ShellWhen it comes to longevity, Wall Street's current bull has some really good genes.

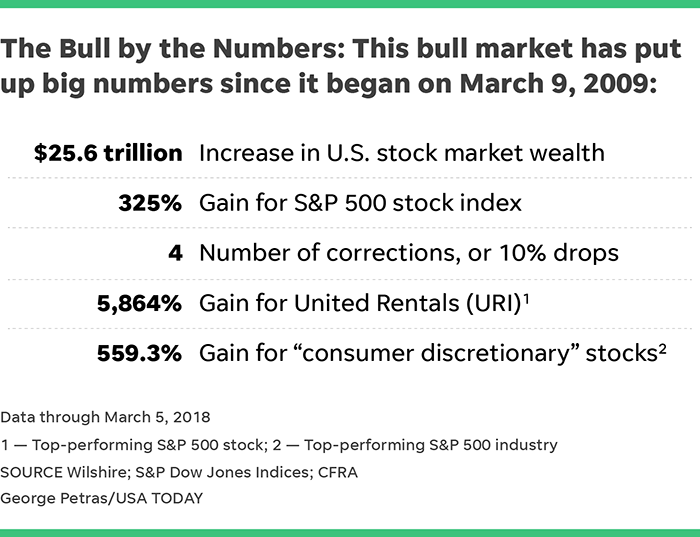

This bull market for stocks turns 9 on Friday. It began March 9, 2009, the day U.S. stocks finally stopped falling after the worst market rout since the Great Depression.

It's now the second-longest bull in history, having survived all sorts of fears and shocks, from wars and hurricanes to a government shutdown, a European debt crisis, terrorism and threats of nuclear war.

Protect your assets: Best high-yield savings accounts of 2023

And after all that, it has a shot at overtaking the longest bull ever, the famed 1990s rally that finally died when the tech bubble burst in 2000.

But for the current bull to outlive that beast, the stock market must avoid for the next six months a 20% drop from its all-time high on Jan. 26. And that means shrugging off the recent worries that can trigger a severe stock swoon, like the return of wild price swings, a potential trade war between the U.S. and its trading partners and fears that borrowing costs are headed sharply higher.

"This bull might be old, but remember bull markets don't die of old age, they die of excesses," says John Lynch, chief investment strategist at LPL Financial.

And, for now, Lynch hasn't spotted any danger signs, such as "overspending, overborrowing and overconfidence" by shoppers, investors and businesses that are often seen at "major tipping points" for a stock market tumble.

So how has this bull, which has had more doubters than believers during its long rise and gain of 325%, done it?

Its success, Wall Street pros say, has a lot to do with how loathed it's been — a pessimistic mind-set among Main Street investors who were scared off by the Great Recession. That trauma kept them from getting overly optimistic and paying too much for stocks in the bull years that followed.

But staying out of the market turned out to be a missed opportunity. Investors who were savvy enough to invest $100,000 in a broad index fund at the start of the bull run and held it the whole time would have seen their money more than quadruple in value to $425,000.

Those who jumped in benefited from a decade of record-low borrowing costs, engineered by the Federal Reserve to provide a lift to a hard-hit economy during the Great Recession. The fact that the U.S. economy, despite being nearly nine years into its recovery, has grown at a sub-par rate for a long time also worked in the stock market's favor. The reason: Economic growth was strong enough to lift corporate profits but not quite robust enough to overheat the economy and force the nation's central bank to cool it off with too many interest rate hikes.

More:401(k) investors stock market "correction" survival guide

More:Warren Buffett letter: 3 tips for stock investors

More:Trump Bump is down but not out after stock rout

What will propel the bull to No. 1?

The bull — despite last month's scare over rising inflation and interest rates, and now worries over tariffs — still has a lot of good things working in its favor, says Dan Suzuki, senior U.S. equity strategist at Bank of America Merrill Lynch.

While Suzuki acknowledges that the bull is in its later stages and risks are rising, the stock market will continue to be supported by the profit boost companies will get from paying lower taxes under the new tax law, as well as a push from continued global economic growth, he says.

"The bull market is still intact," Suzuki tells USA TODAY. "We still think there is further upside for the market."

The current bull's chances of becoming the longest ever later this year are also good because few bear markets — or drops of 20% from a high — occur without a recession, and there are scant signs of that sort of economic contraction in the next six months, adds Ed Yardeni, chief investment strategist at Yardeni Research.

"I'm hard-pressed to find reasons for a bear," Yardeni says. "Recessions in the past were caused by busts that followed booms, but we're not quite in a boom phase."

What could derail the bull?

The biggest risk to the stock market is if President Trump ratchets up his protectionist talk to the point that it causes a trade war with the rest of the world, causing harm to the global economy, says Liz Ann Sonders, chief investment strategist at Charles Schwab. The president's decision last week to slap tariffs, or taxes, on foreign-made steel and aluminum entering the U.S. could be bad news.

"It would be a bull market killer," she says.

As for rate hikes from the Fed, Sonders says the market would be comfortable with three or four quarter-point increases from the central bank this year — if it is due to accelerating growth rather than out-of-control inflation.

But skeptics like Woody Dorsey, a behavioral finance expert and head of Market Semiotics, says the shift to an era of higher borrowing costs is a big enough change and obstacle that it could diminish the power of the bull market.

For now, Sonders sees the bull continuing but with the caveat that "it is getting late" in the game and that investors should expect more scary drops like the 10% plunge in February that brought fear back into the market.

"We are still in an ongoing bull," Sonders says, "but we are entering a more treacherous era."