Fueling solutions for the small business ecosystem

Partner with Nav to power credit, revenue and lending insights for your small business customers.

More than 1 million small businesses in the U.S. have seen their credit scores and data through Nav. Our partners power the small business economy. We’ve designed a program to streamline and amplify their impact.

SMB data from:

The Nav solution

Nav aligns financing qualifications, predicts needs, and facilitates transations between data providers, lenders, partners, and small businesses.

Nav focuses on three core areas to prepare SMBs:

Business Financing

Credit Health

Credit Data

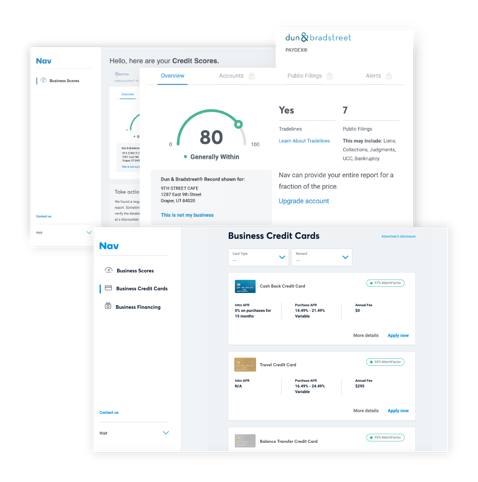

The credit data that matters from the bureaus that matter

Nav’s first and only tri-bureau solution gives our partners and their customers access to all of the major commercial bureaus’ data in one spot.

Summary data

• Business credit grades from Dun & Bradstreet, Experian & Equifax

• API-powered alerts for all three commercial bureaus

• Expert education and insights

Premium data

• Full business credit report & PAYDEX Score from Dun & Bradstreet

• Full business credit report & Intelliscore from Experian

• Full business credit report & Business Deliquency Score from Equifax

• API-powered & custom alerts for all three commercial bureaus

• Identity theft protection & insurance

• Expert education and insights

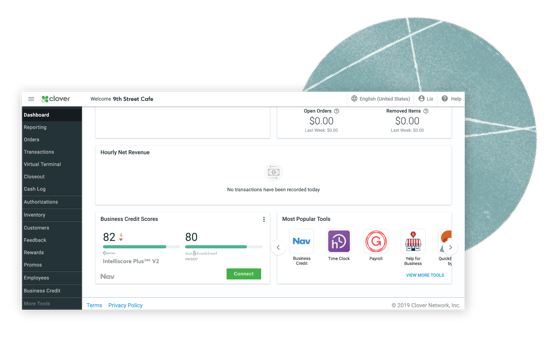

Clover & Nav: A Case Study

Clover’s point-of-sale device and SMB services are connected to hundreds of thousands of merchants across the U.S.

Clover’s Goal

Create more engagement & increase revenue from Clover customers by partnering with complementary business services and tools.

Nav’s Solution

- Free business credit score matching and score updates from Experian and Dun & Bradstreet via an autoprovisioned widget on Clover devices.

- Premium features for Clover merchants who upgrade, including alerts, full reports and score updates.

- A fully configurable & compliant credit card and financing marketplace

- In-app education on business credit and tradelines

- A call-to-action API to serve new and data-driven engagement, conversion opportunities and upsells

- Full marketing support

We strive to empower our merchants with best-in-class business solutions. That’s why it was the natural choice to partner with Nav where our merchants can get their credit data as an easily digestible datapoint to help them make better business decisions, access an extensive marketplace to find financing and credit card options, learn from Nav’s financial education tools, and subscribe to premium solutions to support them in running their business better.”

Daniel Hayes

Product Manager, Clover

Financial Data

Using OAuth technology and connections with more than 50,000 financial institutions across the U.S., Nav is powering cash flow and revenue insights for small business owners. Use this feature to:

- Verify revenues for SMBs

- Understand customer revenue trends

- Target SMBs who need a financing solution

- Increase engagement on your platform

Business Financing Marketplace

Configurable || Customizable || Compliant

A custom financing solution unique to every partner’s needs. Nav’s one-stop-shop financing marketplace can be configured so you:

- Improve customer engagement and retention

- Serve underfinanced SMB customers with no additional risk

- Power new or additional revenue streams

Data

Nav’s proprietary data set and machine learning team are a perfect fit for companies looking to understand the small business ecosystem and use that knowledge to craft new tools, predictions and products.

Learn more about this upcoming product

Become a Nav partner

A member of our account management team will reach out to set up a call.